What is R&D (Research and Development?)

Research and Development, most commonly abbreviated to R&D, refers to the process of investigation, experimentation and innovation aimed at creating or improving products, services or processes.

A R&D Intensive Company is an organisation that commits itself and its resources towards investigation and innovation. Research and Development is a great way to keep your business relevant by adapting to customer needs and keeping up with competitors. R&D intensive companies are often found in industries such as technology, pharmaceuticals, automotive, etc., where innovation is crucial for staying competitive and meeting evolving customer needs.

Governments often provide incentives, such as the R&D Tax Relief Scheme in the United Kingdom, to encourage innovation and stimulate economic growth. These incentives may include tax credits, grants, subsidies, or other financial support aimed at reducing the costs associated with research and development activities.

What is the R&D Tax Relief Scheme?

There are two types of R&D tax relief schemes – the SME R&D Tax Relief Scheme and the RDEC Scheme.

SME R&D Tax Relief Scheme

The SME R&D Tax Relief Scheme was created for micro, small and medium sized companies. This scheme offers organisations an 86% enhancement on their qualifying R&D expenditure. This means that it would increase the company’s costs during the accounting period, which would then offset against any tax due, therefore reducing their corporation tax liability. However, if your company was already loss-making, you can claim an R&D payable tax credit, where you would get a repayment from HMRC instead. This is the same if your company was profit-making but became loss-making after the R&D enhanced expenditure has been added.

RDEC Scheme

The other R&D Tax Relief Scheme is the Research and Development Expenditure Credit (RDEC). This claim was originally for larger companies, however, the two R&D tax relief schemes are currently being phased into one - the RDEC scheme. This will be in effect for companies whose accounting period starts on or after 1st April 2024.

What are the R&D tax credit rates?

The standard tax credit rate for the SME R&D tax relief scheme is 10%. This means that you can claim a payable tax credit which is 10% of either the adjusted loss for your company, or the qualifying enhancement (the claim is based on the lesser amount of the two). The tax credit rate was reduced to 10% from 14.5%, and came into effect on 1st April 2023, for the Financial Year 2023/2024.

If a company’s accounting period falls across 1st April 2023, then the tax credit claim must be apportioned across the two financial years. This means that if your accounting period is from 1st January 2023 to 31st December 2023, then from 1st January 2023 to 31st March 2023, the payable tax credit will be calculated at 14.5%, and then from 1st April 2023 to 31st December 2023, the payable tax credit will be calculated at 10%. This may sound confusing, but don’t worry – our software will automatically calculate your claim and apportion based on your company’s accounting period.

Recently, however, HMRC introduced a new type of claim for the R&D tax credit, which is for R&D intensive companies. This means that R&D intensive companies can actually claim a payable tax credit which is at a rate of 14.5%.

What is an R&D intensive company?

R&D intensive companies were established to provide micro, small, and medium-sized enterprises with a heightened payable tax credit rate, if the majority of their business expenses are put towards research and development endeavours. A company qualifies as an R&D intensive company if 40% or more of their total expenditure is spent on R&D. This change primarily impacts loss-making companies, as they stand to gain from the elevated pay-out, whereas profit-making companies remain unaffected since the enhanced expenditure does not change regardless of intensive company status. The introduction of the intensive R&D claim was created to further encourage companies to invest in research and development, which, in turn, drives innovation, benefiting both the economy and society.

How do I file an R&D intensive claim?

Filing an R&D tax credit claim through our software is super simple and easy, but please read on for a detailed breakdown.

Filing as an R&D intensive company is very similar to how you would file a standard R&D claim – the only difference is that you would need to notify HMRC that you are filing as an R&D intensive company - our software will do the rest for you!

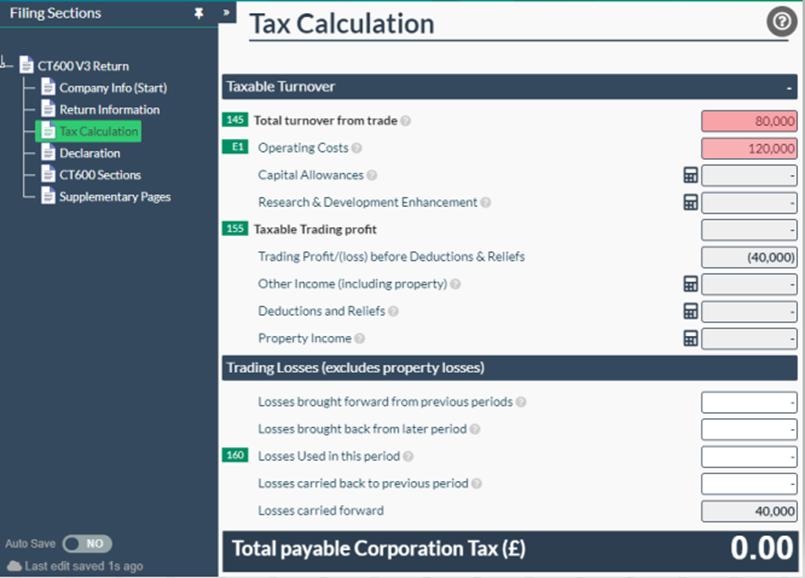

To start, you will just need to open up your CT600 return filing and enter your income and expenses in the appropriate boxes. For this example, we will assume that there is £80,000 of sales from trade, £120,000 of expenses which includes £65,000 of qualifying R&D expenses.

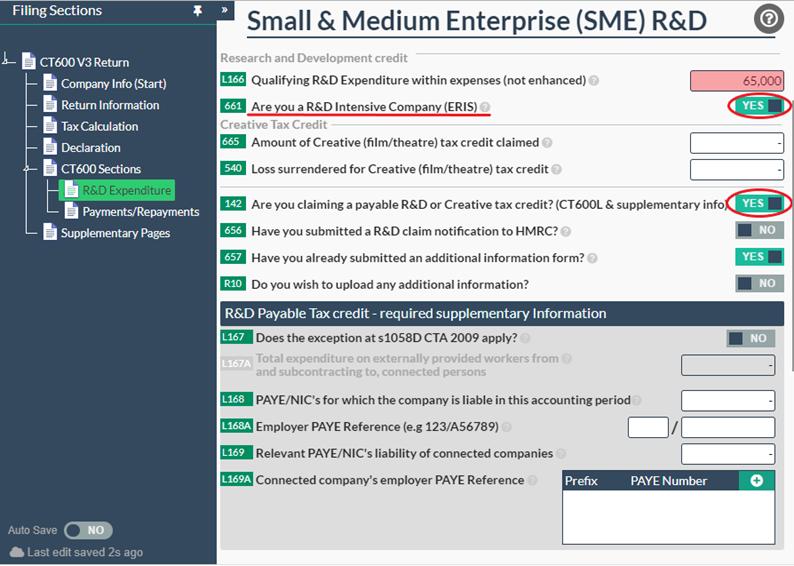

It is important to remember that you must include the qualifying R&D expenditure in your total expenses. Then, you need to input the qualifying R&D expenses separately on the ‘R&D Expenditure’ tab in box 660. Here is where you would also notify HMRC that your company is R&D intensive:

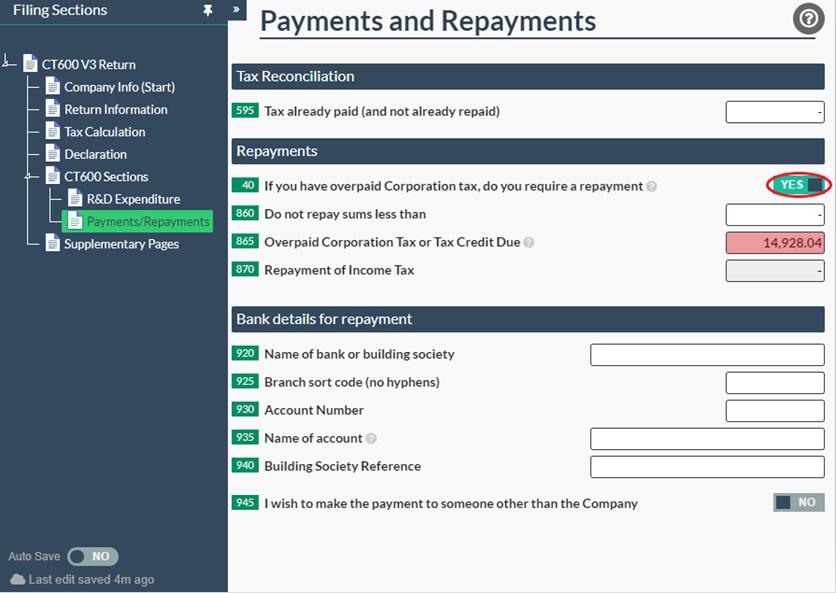

Box 661 must be switched to ‘Yes’ if your company qualifies as an R&D intensive company in order to make a tax credit claim at the higher rate. Please also remember to switch box 142 to ‘Yes’ if you are also claiming the payable tax credit, rather than just the enhanced expenditure (if your company is loss-making). This will turn on the ‘Payments and Repayments’ page, which is where you can view the total tax credit payable to your company:

Our software will automatically calculate the R&D tax credit due to be paid at either 10% or 14.5%, depending on whether box 661 has been turned on to signify if the company is R&D intensive. As this company above is R&D intensive, the software has calculated the payable tax credit at a rate of 14.5%.

What happens if I filed my claim but didn’t inform HMRC that my company is R&D intensive?

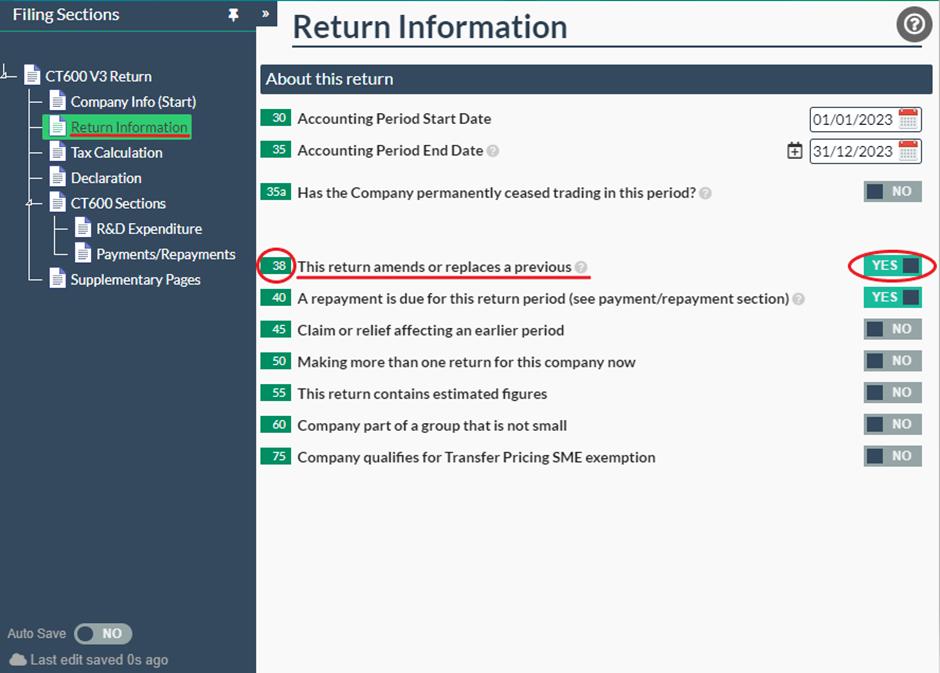

Not to worry! You can file amended CT600 returns to HMRC through our software. Additionally, if you previously filed the original return through us, there is no extra cost for filing an amendment. To submit your amended return, simply click ‘Unlock and Amend’ on your previous return, switch box 38 to ‘Yes’ to notify HMRC that you are submitting an amended return, and proceed with your changes before submitting again. If you did not submit the original return through us, just remember to switch box 38 to ‘Yes’ before submitting.

It is crucial to remember if you're submitting an amended CT600 return for your company’s first accounting period, you will also need to call HMRC and ask them to unlog your submission before you can submit the amendment. You can call HMRC on

0300 200 3410 (if calling from within UK) or on

+44 151 268 0571 (if calling from outside UK). You will not need to do this for future amended filings, as it only applies for first year companies.

What’s next?

That’s it! Once you have submitted your amended return with box 661 switched to ‘Yes’, if the company is an R&D intensive company, your claim will be adjusted and you will receive the rest of the R&D tax credit due to your company. For more information about how to make R&D claims, please take a look at our article ‘

How To File a R&D (Research and Development) Tax Credit Claim’.

This article is information only and has been prepared for general guidance on matters of interest only, and does not constitute legal, accounting, tax, investment or other professional advice or services. You should not act upon the information contained in this article without obtaining specific professional or legal advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this article, and, to the extent permitted by law, Comdal Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.