A Unique Taxpayer Reference or UTR, is a number that is unique to you (the legal entity) Assigned by HM Revenue and Customs to charge Tax (either Income Tax or in the case of a company, Corporation Tax - it is also used for VAT). The number has a check digit within it so that transposition errors are reduced (i.e you don't accidentally switch 2 numbers around and end up with someone else's!).

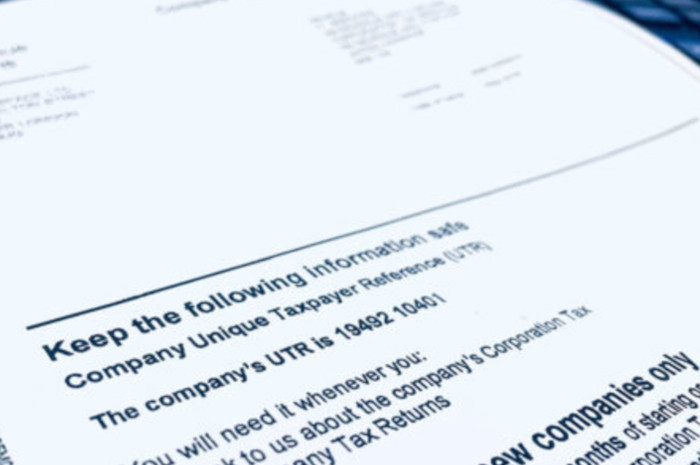

You will usually receive your UTR from HMRC within 14 days of your company being registered at Companies House.

If you did not receive one you can request one from the HMRC website.

The number is made up with three digits being a Tax District code with the next six being the unique assessment or filing number for the individual, company or Legal entity. The check digit prefixes the number and is a modulus check against the Tax district and unique Tax Reference codes.

How do I check to make sure a UTR is valid?

If you have a letter from HMRC in relation to your Tax return, is will almost certainly have the UTR number printed on it - normally the number has a space to make it more readable. It may be described as "Tax Reference", UTR or Unique Tax Reference.

If you need to validate a UTR you can do so

using the Validator below:

(this only confirms that the number is correctly formed - not that its a registered UTR)

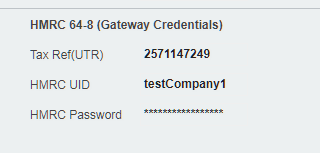

Where do I enter a UTR in Easy Digital Filing?