A CT600 return is the name of the filing that UK Incorporated companies must file with HMRC after the end of their accounting period. Currently this is stipulated to be no later than 12 months after the end of the company's Accounting period, with any Corporation Tax payable due after 9 months and a day following the accounting period end. A CT600 can only report up to 12 months, so if the accounting period is longer (an extended accounting period), two CT600's would need to be filed.

The CT600 return is now required to be filed digitally with HMRC, with the original CT600 paper form now obsolete and now only used for the compilers reference. Along with the CT600 return HMRC also require that full company accounts are also provided in a format known as IXBRL, where key information is tagged so that the document can be both machine read and viewed as a normal document. Unlike the CT600 the accompanying Company accounts can cover accounting periods greater than 12 months, that is the full duration of the Accounting period.

What information does a CT600 cover?

The CT600 return is divided into sections which relate to the different activities of the company.

The main sections are:

- Company & Return Information - Name, Company Type UTR and Accounting Period.

- The Tax Calculation - Turnover, Income, Expenses, Reliefs, Losses, profits and Tax Payable.

- The Declaration - Accounts that are being submitted with return and the name of the person legally declaring/making the return.

Other sections include:

- Capital Allowances - (e.g capital items purchased that have a lifespan greater than a year)

- Enhanced Expenditure - Creative and Research & Development

- Losses and Deficits

- Other non-trading income (e.g Bank interest)

- Disallowable expenses - (e.g advertising costs, entertainment)

- Income from property - also includes property Capital expenses which are treated differently to above

- Payments and repayments - Bank details to where refunds should be paid

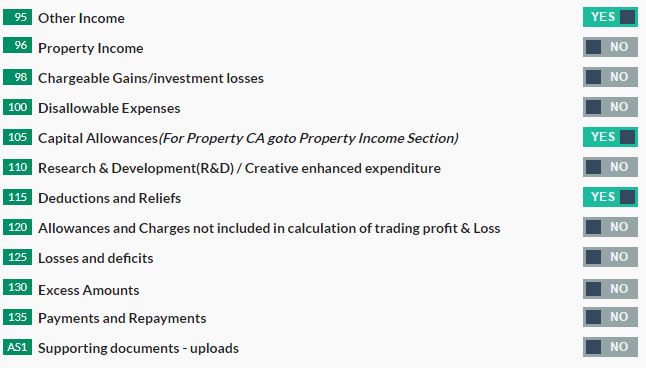

Additional sections that are not initially dispalayed can be accessed by going to the CT600 Sections and turning on the relevant pages:

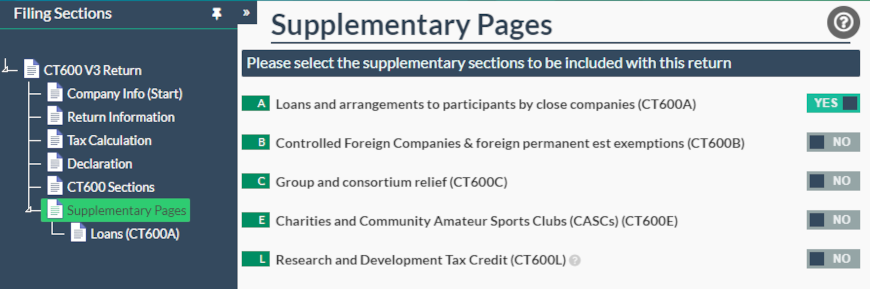

CT600 supplementary pages can be accessed here:

We support the sections most commonly used by small and micro companies. These include the CT600A for Directors' Loans and CT600L if you are claiming an R&D tax credit.

How is a CT600 return filed with HMRC?

As mentioned above HMRC require the CT600 return to be filed electronically(or digitally in new terms), through the HMRC Gateway which is basically a service which enables software platforms like Easy Digital Filings to connect to and transmit the filing.

When using the Easy Digital Filing Service, the end of year amounts are entered

into capture templates which in some ways mimics the old paper CT600 Form. Although with the advantage of a real time

Calculation Engine calculating the Tax position on the go.

Once the Filings (the Accounts and CT600) are set Ready for Filing, the Corporation Tax Submission engine takes all of the inputs and creates the Digital representation of the CT600

in an XML structure and then creates an accompanying IXBRL Tagged Computations and Company Accounts.

These supporting documents are inserted into the CT600 XML structure and cryptographically hashed (the IRMark) for transmission to HMRC.

To be able to make the submission, the filer/Company needs to have a HMRC gateway account (username and password) for its respective

Unique Tax Reference (UTR) and also have the CT600/Corporation Tax service Activated for the

Gateway Account. If the username, password, UTR are incorrect and/or CT600 service has not been activated, then any submission will

be rejected with the (very common) 1046 Error Message.

A simple company that has a very basic set of returnable items may in some cases be able to use the HMRC CATO (Company Accounts and Tax Online) system to make the digital filing. However due to the narrow set of circumstances that the CATO system provides for most companies will need to file using another service (e.g EasyDigitalFiling).

Examples of companies that have to File using a service like Easy Digital Filing are:

- Small Sized companies - (£632K or greater in Turnover)

- Extended Accounting period - Where its greater than 12 months

- Most entities with property - Where Turnover is greater than £5,200 or a loss has been made

- Foreign currency(Forex) transactions - HMRC want to see any currency Gains or Losses shown/tagged in the Accounts

- Adjustments for something reported in a previous years

- Chargeable gains or losses

- Financial instruments - e.g shares held

- Non-trading income (except interest received)

- Research and development costs

- Complex loan-relationship entries

- Capital allowances