To be able to submit your company tax return successfully, you will need to ensure that you have activated Corporation Tax Service in your Government Gateway account. Setting up your corporation tax service in advance will help ensure you can file your CT600 returns and make your Corporation Tax payments to HMRC on time, avoiding any fines and penalties. It is a good idea to set up your Government gateway account as soon after incorporation as possible but if you haven't done this already, you can still do this now. You will also need a gateway account to register for VAT and PAYE.

If you have previously used an accountant to file and you would now like to self-file, you will have to set up your company's very own HMRC online business account (Government gateway account) and register for Corporation Tax Service. This is because your accountant would have previously submitted your previous tax return using their agent credentials. If this is the case, please remember to contact HMRC so that they can unlog the agent credentials from the company's UTR allowing you to self-file going forward.

To set up your HMRC Government Gateway business account

(If you have not set this up already, please follow the steps outlined below. Otherwise, please skip to the next section).

1. Please follow this link to get started on setting up the account.

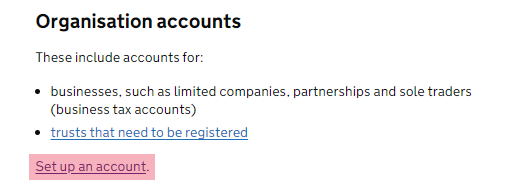

2. Scroll down to Organisation accounts and select 'set up an account', where you will then be able to 'create sign in details' as a new user of Government Gateway. You will need your company UTR (Unique Tax Reference) to create a gateway account. This should have been sent to you just after incorporation but if you can't find it you can ask for a reminder on the HMRC page.

3. Create your 12 digit User ID and Password to your Gateway account and keep this safe!

How to register for Corporation Tax Service

Once you have your gateway account, you can start to add HMRC services that you need to run your business. To add corporation tax, please follow these steps:

1. Log into your business tax account by using your Gateway User ID and Password here.

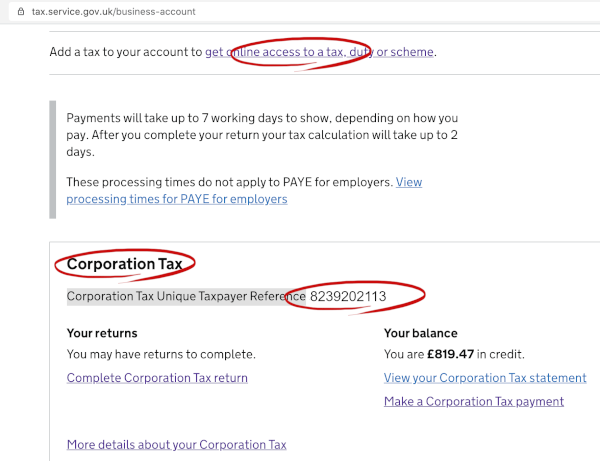

2. Select 'add a tax, duty or scheme now' and then select 'corporation tax'. Please enter the company's 10 digit UTR number. For more information on the UTR, please visit our article.

3. You can either enter the company registration number, or the registered office postcode.

4. HMRC will post an activation code with instructions on how to activate the service in your account. Generally, the code should arrive within 7- 10 working days.

How to activate the Corporation Tax Service

Once you have received the activation code through the post, to activate your corporation tax service you will then need to:

1. Sign back into your business tax account and select 'services you can add' in the menu.

2. Locate Corporation Tax in the list and then select 'activate service'.

3. Enter the activation code from the letter.

Please remember to activate the service as soon as soon as you can once the code has been received. If it is not activated within 28 days, the code will expire and you will have to request a new online code.

You can also add other tax services to your business account. There are 3 main ones that can added: Corporation Tax (as discussed), PAYE for employers and VAT. Adding the relevant taxes to your account will help you manage it online.

After you have set up your corporation tax services in your account, HMRC should send you a notice to pay Corporation Tax with the deadline. If Corporation Tax is due for the period, please remember to note the 17 character payment reference number. It can also be viewed in your business account; please select 'view period', 'accounting period' and then select the relevant period you are paying for.

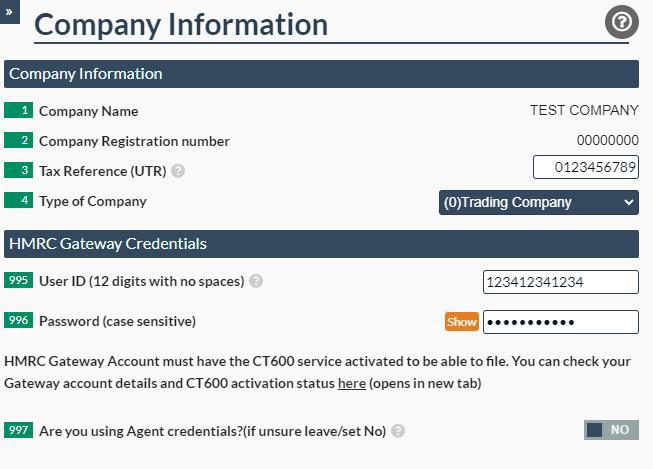

Please note that to successfully file your tax return with HMRC using Easy Digital Filing, you will need the 10 digit UTR number, User ID and Password that is used to log into your HMRC gateway account and also ensure that your Corporation Tax Service has been activated.

Your business account, upon logging in, should look like this:

1046 Error

If you have received a 1046 rejection error upon submission of your CT600 return, it might be the case that the Corporation Tax service has not been activated. However, if you are still receiving this 1046 error, please read our 1046 error article, as it discusses other steps that you can take to ensure your company tax return will be successfully submitted.

Once you have activated your Corporation Tax, you can enter your tax into the Company Information page in the CT600 return.

Our team are always happy to help you so please do not hesitate to contact us, if you have any queries or require any assistance.