If your Company cannot use the HMRC website to file its annual Corporation Tax CT600 return, and let's face it there are only a small number of Companies now that can, what do you do? You could engage an accountant, but if your profits are small this can turn out to be another cost you just don't need, maybe you love tax or perhaps as the director of your business, you just want to do it yourself. So how do you complete a CT600? First this is what you will need:

- Your Company will need your Company UTR (Unique Tax Reference), HMRC Gateway account username and password and have Corporation Tax activated. (You can register with HMRC here).

- Have details of your income and expenditure for your accounting period

- Create an account with Easy Digital Filing who are validated HMRC Corporation Tax Software provider.

- Your return will need to include a CT600, computations and IXBRL Company Accounts.

How to get started

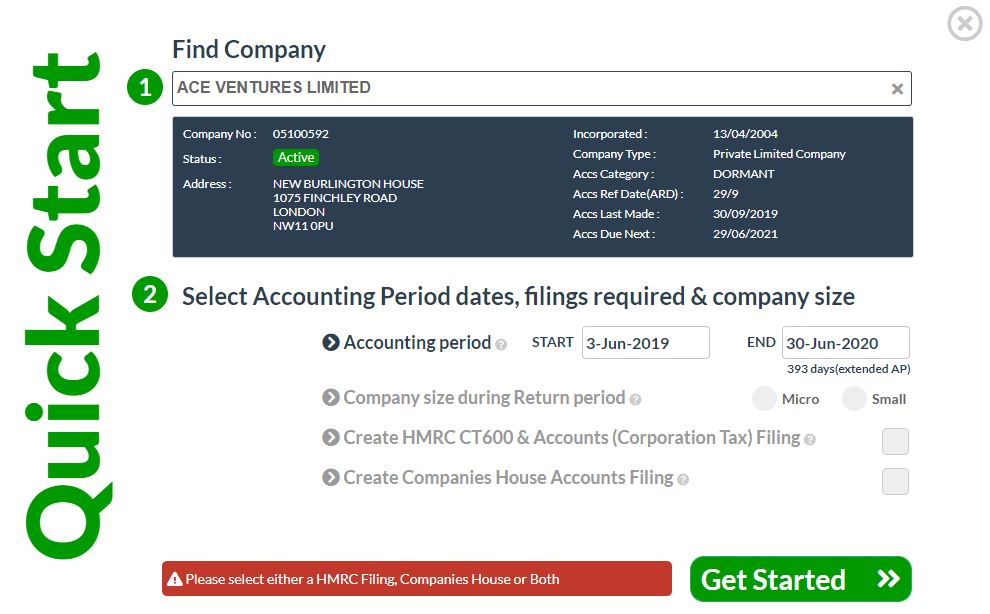

Once logged on, you will encounter the QuickStart this allows you to:

- Find your company, using either company name or number, with our realtime company look up

- Enter your accounting period start date

- Select whether your Limited Company is a Small or Micro entity (there is a help to aid your choice)

- Select to file a CT600 along with IXBRL accounts

- Select if you would like to file filleted accounts to Companies House

So far so good, what next?

Once you hit next, you will be launched into the Filing home page and the template for the CT600 will be launched.

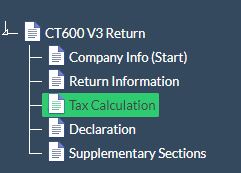

This consists of 5 sections, for a very simple tax return you will only need to fill in the first 4.

Company Information

- If you have used the QuickStart your company name and number will be prepopulated.

- Enter your Company's UTR (Unique Tax Reference); you should have received this from HMRC, approximately 2 weeks after registering with Companies House.

- Select your Company Type, generally a "Trading Company" (0 on the paper CT600).

Next step - Return Information

Your accounting period dates will be automatically populated. You can edit them if required. However please note that your account period can not be longer than a 12 month period (it can be shorter). If your accounting period is longer than 12 months please see our guide on filing a CT600 for an extended period.

For the remaining boxes click any to yes if they apply. If you are due a refund please make sure you click box 40 to yes.

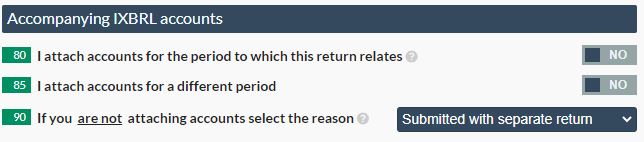

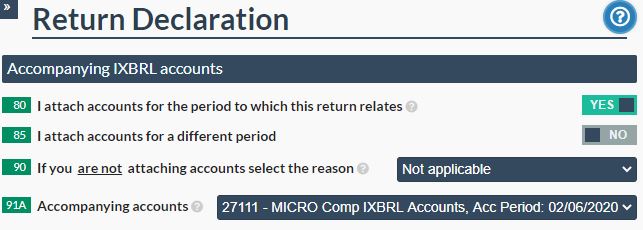

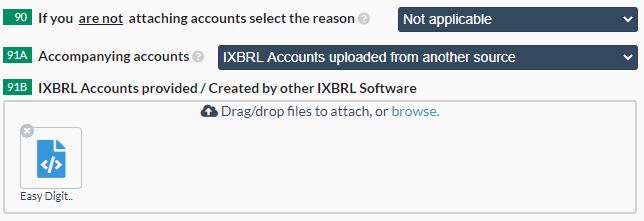

Declaration and Accompanying Accounts

If you are making a return with no accounts set both Box 80 and 85 to No and choose the appropriate reason from the list in Box 90.

If you are attaching accounts created from within our system then set either box 80 or box 85 to yes, which ever is applicable. Then select the accounts in the drop down list.

If you are attaching accounts from a different source in box 91A select "iXBRL Accounts from a different source" and then drag and drop your accounts into the box. Your accounts must be pre-tagged and saved in .htm .html or .xhtml format. pdf accounts can not be uploaded in this section.

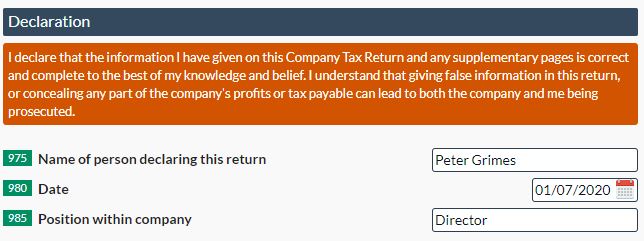

In the Declaration enter the name of the person signing the return, the date the return is signed and the person's position within the company.

Tax Calculation

Now to the taxing part!

Enter your total turnover from trade in box 145.

Your operating costs are next, enter them into the next box and this will give you your taxable turnover.

We will calculate how much tax you need to pay.

If you have any capital allowances, research and development,

other income or any of the other supplementary sections please see the relevant guides.

If you have a loss from a previous year to bring forward, or bought back from a later period please enter in the relevant box.

If you wish to use any of these losses to offset against tax in the current year, enter in the amount in the losses used in this period box.

Your tax will be recalculated accordingly.

Nearly There...

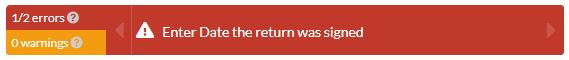

If you have any errors or warnings at the bottom of the template, please click on them and they will take you to the relevant section.

RED warnings will prevent you from filing with HMRC and must be addressed before you complete your filing.

AMBER warnings are there to help you with your filings. If they do not apply just accept the warnings when

you are ready to file.

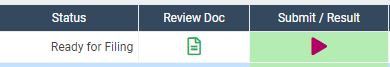

Once you have checked all your entries and are ready to file click the Ready to file button at the bottom of the page.

At this point you will need to pay, see our pricing page for details. Your green submission arrow will then appear:

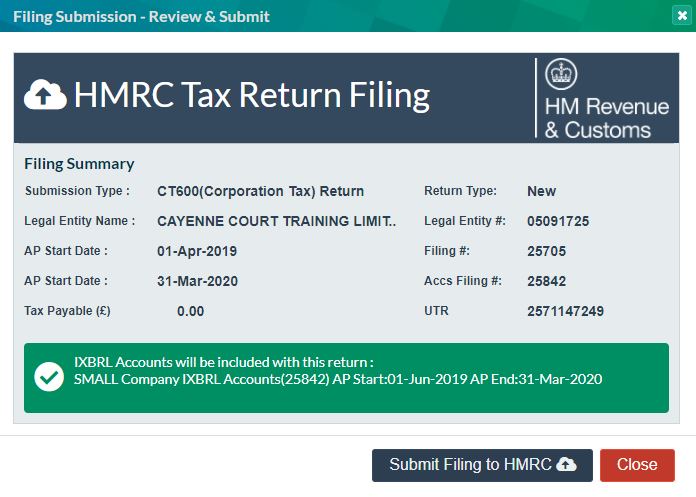

Click the green arrow, this will launch the submission dialogue box, check your details for the final time and click submit to file to HMRC.

Once you hit submit in the background we create an XML message that transmits your CT600, computations and accounts (if included) to HMRC.

The Computations are iXBRL tagged representation of the information you have included in your CT600, showing how we calculated your tax liability. They are available to download along with the CT600

and accounts you have created. It is a good idea to download a copy for your records, however, they are saved and backed up on our system, if you need to access them.

If your filling is successful you will receive an email from us and your status will be updated to accepted by HMRC.

Don't worry, if your filing is rejected, these are often down to invalid user credentials, please see

our how to resolve guide.

Once you have resolved the issue, set both the accounts and CT600 back to ready for filing and try again.

If your issues persist please contact us via the online chat for further support and guidance.