Filing annual accounts for your property company doesn’t need to be complicated. Whilst running a property company is an effective way to manage your property portfolio, it does involve extra reporting obligations to HMRC and Companies House.

Using Third Party Software To Prepare Accounts

It is important to remember that HMRC’s own filing software cannot be used by property companies with property income exceeding £5,200. However, Easy Digital Filing is equipped to handle filings for property companies earning above this threshold. As a result, many property companies choose to file with us.

Additionally, with the recent announcement of the CATO closure, property companies will now be required to file using approved third-party software such as Easy Digital to file their annual accounts and their CT600 tax return.

Below, we will guide you through the process of preparing your iXBRL annual accounts and submitting them to both HMRC and Companies House as a property company.

Annual Accounts (iXBRL Tagged)

Both HMRC and Companies House require your property companies annual and abridged accounts (just the balance sheet) to be submitted in iXBRL format. iXBRL, or inline eXtensible Business Reporting Language, is the format HMRC and Companies House use to read and process the businesses financial data.

How To Create iXBRL Accounts For Your Property Company

Firstly, you will need to sign into your Easy Digital account, or create an account if you don't already have one.

Once you have logged into your Easy Digital account, you will need to add either a Micro Company iXBRL template or a Small Company iXBRL template. In this example, we will use a set of Micro iXBRL accounts.

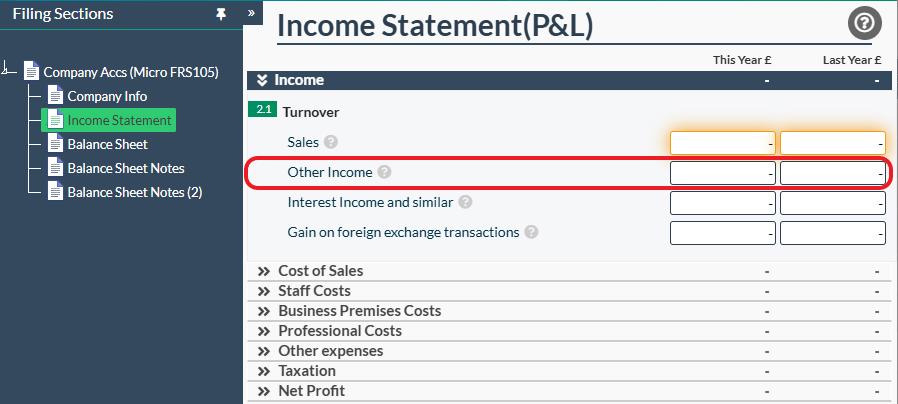

Now that the accounts have been added to your account, it’s time to begin completing the income statement. For property companies, any property related income is typically entered under the 'other income' section of the income statement. This area is highlighted in red below.

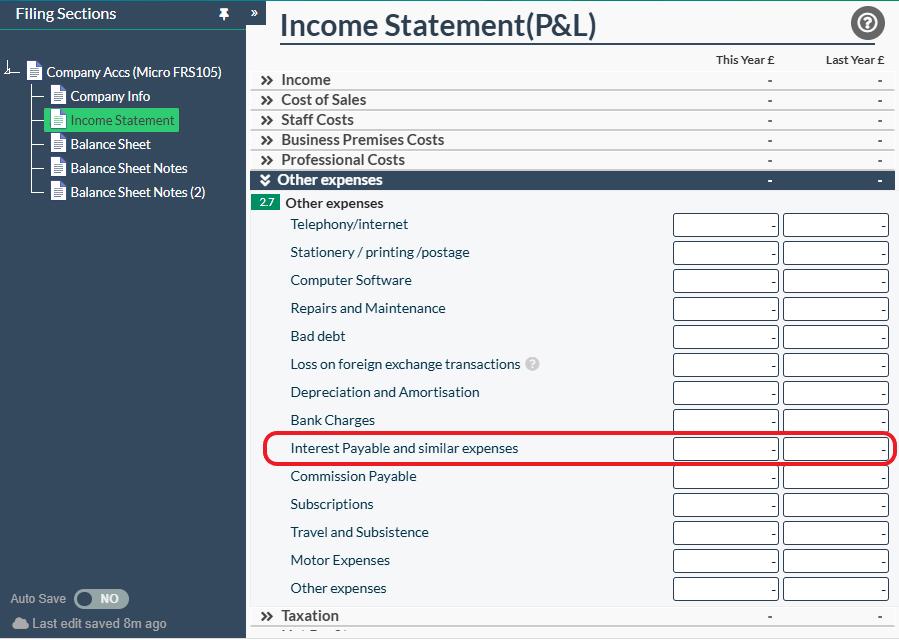

Once your property income has been accounted for, it is equally important to consider how to report any associated expenses. These may include items such as mortgage interest payments, utility bills, subcontractor fees, legal expenses, insurance costs, maintenance and repairs and more. In this example we will focus specifically on the mortgage repayment costs.

It is important to establish how much of your property companies monthly mortgage repayments go towards interest and how much goes towards the repayment of capital. This distinction matters because capital repayments and interest payments are treated differently in your accounts. Capital repayments impact the Balance Sheet, whereas interest payments are recorded in the income statement under 'interest payable and similar expenses' (as highlighted below).

If your property company has interest only mortgages, the entire repayment amount is recorded under the section circled below.

Any additional property related expenses should also be recorded in your income statement. Once all income and expenses have been entered, you can move onto preparing the Balance Sheet!

Companies House Filing (Abridged Accounts)

As mentioned earlier, abridged accounts must be filed with Companies House in iXBRL format. You can access the Balance Sheet directly within the Accounts template.

What Do I Include In My Balance Sheet As A Property Company?

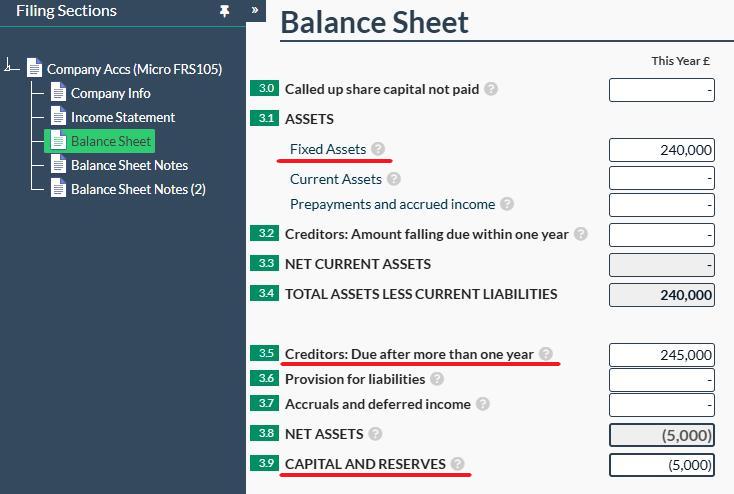

In most cases with property companies, the director(s) acquire the property through the company, meaning the property is in the companies name. This is usually funded using the directors personal money, which can be recorded as a directors loan if repayment is expected or it maybe through a mortgage or bank loan to the Company.

It is important to note that expenses related to the purchase of a property can be included on the Balance Sheet. These associated costs may include items such as stamp duty, legal fees, and surveyor fees. To provide better clarity on how to account for these costs, we have provided an example below.

Example: Director A bought a property worth £200,000 through the company, with associated purchase costs totalling £40,000. Director A also lent the company £5,000 for general expenses unrelated to the property. Director A expects to be repaid the full £245,000 investment.

Fixed Assets: The fixed assets consist of the £200,000 purchase of the property and £40,000 worth of associated costs.

Creditors: This includes the £200,000 used to purchase the property and £40,000 in related purchase costs. Keep in mind, the director also loaned the company £5,000 for expenses not directly linked to the property purchase. Therefore, the £5,000 should not be recorded as part of the fixed assets but instead listed under creditors (any other expenses that the additional £5000, was used for would be included in the income statement).

Net Assets: This is then calculated by subtracting the creditors (money owed) from the fixed assets.

Capital and Reserves: This is calculated using this formula:

= Retained profit (Brought forward from earlier years) + Net profit from this year + any share capital issued in the period - dividends paid

HMRC Filing - Corporation Tax Return (CT600)

When submitting your CT600 return to HMRC, it must be filed in iXBRL format. The iXBRL accounts generated within your Easy Digital account will be attached to your CT600 return and submitted directly to HMRC.

What Can I Include In The CT600 Return For My Property Company?

- Property Income

- Property Expenses

- Capital Allowances

- Disallowable Expenses

- Losses brought forward / Losses you wish to use in the period

We have created a complete guide on how to file the CT600 return for your property company. It covers what a property company can claim on the CT600 and provides a step-by-step guide for submitting the return using our user friendly software.

Still Struggling To File For Your Property Company?

We also offer a Managed Filing service designed to take the stress out of your annual filings. You'll be assigned an accounts specialist who will handle your Annual Accounts, CT600 return, and Companies House submission on your behalf. If you are interested in this service, feel free to contact us or create a free account to get started. For more information about small and micro property companies, be sure to visit our Knowledge Base.