With the ease of buying and selling on the internet, more and more small and micro businesses are accepting and making payments in foreign currencies. When it comes to your annual Corporation Tax CT600 return and accounts, how do you report them?

You may have already checked on the HMRC website and found that if you need to report foreign currency transactions, you are not able to use their CATO service. In this article we look at what you need to do to report your Foreign exchange gains/(losses) in your corporation tax return and the taxation treatment of Forex gains and losses.

1. What are Foreign exchange gains and losses?

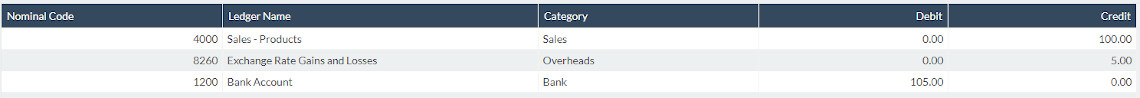

Being a UK company, you report your accounts in GBP, (base currency). When you create an invoice for your customer in a foreign currency, you need to record it in your bookkeeping software in GBP. For example, you sell an item for £100.00 to a customer in Europe ane you invoice them in Euros , on the day you issue the invoice the exchange rate is £1 to €1.12. This is called the spot rate. The invoice total is €112.00

A month later, your customer pays you. However the exchange rate has changed and now £1 to €1.07. Your customer pays you €112.00, when you convert it in GBP you receive £105.00 into your bank account. This means you have made a £5.00 foreign exchange gain.

The reverse is true i.e you make a Foreign exchange loss if the currency moves in the opposite direction and you get less money for your goods or services than you were expecting.

2. Reporting Gains and Losses

To keep in simple, I will divide the reporting up in to 2 categories depending on whether you have just a GBP business bank account where all your income/expenses are paid into and out of or whether you have foreign currency bank account(s), which you use for buying and selling goods.

2.1 Sterling Bank Account only

If you have a UK sterling bank account and use this for all your income and expenditure with all your foreign currency transactions being paid directly from or

to this account. Then any Foreign exchange trading gains and losses should be totalled up at the end of the accounting period. Inline with the government finance manuals these

exchange gains and losses are taxable or allowable in accordance with the tax rules that apply to the income, expenditure, asset or liability on which those differences arise.

Therefore, within the CT600, if you have a gain, you should report it as an income, If you made a loss it should be reported as a cost to the business.

If however, the invoice was not paid on time, the debt/credit would be classed under the loan relationship rules (see below).

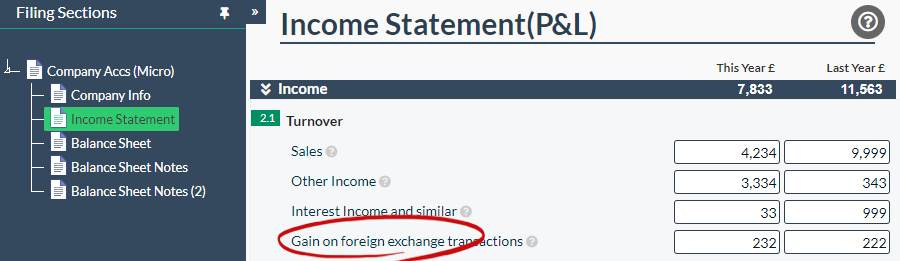

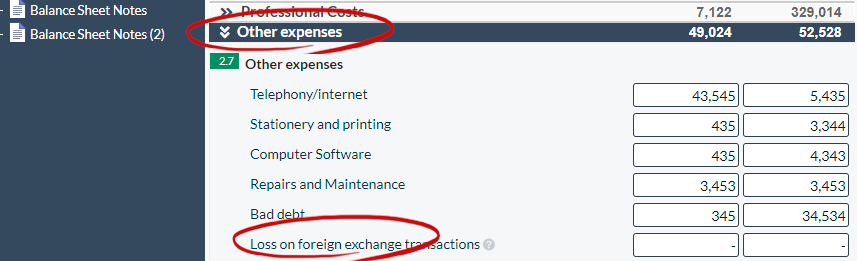

With the accounts any exchange gain and loss can be reported in the Forex gain/loss boxes within the income statement. (Examples below from our Micro Accounts Template)

2.2 Currency held in a Foreign Currency Bank Account

This follows the question "are unrealised gains taxable in uk?" An unrealised foreign exchange gain tax treatment is a more complex area of foreign exchange. This area falls under the loan relationship rules. Therefore at the end of your period, you need to translate your closing Foreign Currency balances into GBP as unrealised fx gains are taxable. This will then give you a foreign exchange gain or loss over the reporting period. This needs to be shown in your accounts and will either be a credit or debit under the loan relationship rules.

If, once you have calculated the gain/loss, you find you have a exchange gain, for the CT600 you should report it in the other income section in box 170.

If you have a exchange loss, please enter the loss in the deductions and reliefs page, into box 260, non trade deficits for this accounting period.

Please note that your total deficits and returns cannot exceed your total taxable income. If your do not have sufficient taxable profit to use your deficits against,

you will need to carry forward the exchange loss, to your next profitable period.

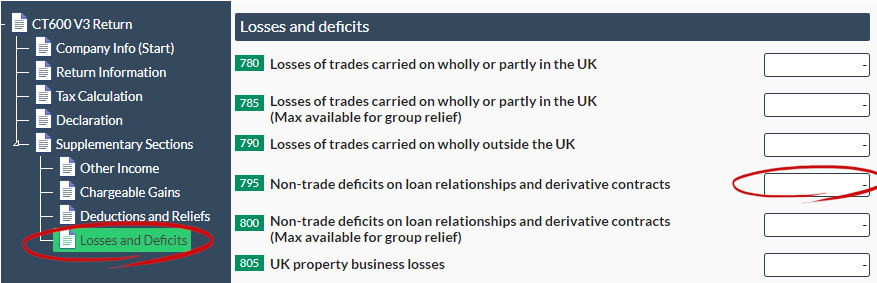

Also remember to enter any exchange losses into the losses and deficits page in box 795.

If you need to carry forward an exchange loss, to a future period, in the period you are carrying forward the loss to, the amount should be

entered into box 230 in the gains/losses supplementary section.

If you are carrying forward an exchange deficit in this period, it should also be entered into box 230.

Please note that your exchange losses can not be greater than your total taxable profit.

To report any exchange gains or losses in you accounts please enter in the relevant Foreign exchange gains/losses sections in the income statement.

Please note that if you make foreign currency gains or losses from anything other than buying and selling of goods, we recommend you seek the advice of a specialist.