Whether you are coming to the end of your Company's first year of trading or have been trading for longer, at the end of each year you need to file a Corporation Tax Return with HMRC and pay any corporation tax due. If you’re not already familiar with this process, you need to complete a form CT600 (corporation tax return) and attach a set of IXBRL tagged company accounts.

No need to worry if that all sounds a bit technical, Easy Digital Filing’s innovative corporation tax software creates and files CT600 tax returns and iXBRL tags for you, along with iXBRL company accounts! Read on to find out how to file with us.

Filing a Corporation Tax Return

Once your accounting period has finished, you have 12 months to file your Corporation Tax Return to HMRC, and if you have any corporation tax to pay, it must be paid within 9 months and one day of your account period ending. You also need to file your accounts with Companies House within 9 months of the end of your company year. Note that the accounts can be submitted to both Companies House and HMRC or just HMRC.

File a Company Tax Return to HMRC

An annual corporation tax return to HMRC is made up of 3 parts:

- A CT600 - this used to be a paper form that was posted to HMRC. Now each company must file the information contained in a CT600 electronically. See 'What is a CT600 Return' for more information.

- Computations - these show how your figures in the CT600 are calculated. We take the information you input into your CT600 to create and IXBRL tag your computations.

- Company Accounts - these are a standard set of accounts, with a Profit and Loss (income) Statement and a Balance Sheet. The accounting standards applied depend on whether your company is a micro or small entity. These are also tagged with IXBRL, our article company accounts explains in more depth how to create these.

To file a Corporation Tax return using Easy Digital Filing you will need your Unique Tax Reference - UTR and your HMRC Gateway login details.

If you have not already registered with HMRC please see their website. If you are already VAT registered or registered for PAYE you will be able to use your existing login details. You must also ensure that you have activated the Corporation Tax Service in your Gateway Account.

How does Easy Digital File A Corporation Tax Return?

Our user-friendly templates enable you to easily create the CT600 and the associated computations and the IXBRL tagged accounts, directly within the online platform. The CT600 asks you to fill in your income information in a way that allows us to create the computations in the background. There are additional pages if you need to report on items such as Capital Allowances, How to File a Research and Development Claim, additional income, and loans to participants.

We have also made the accounts templates easy and straightforward to use. For Micro Companies there are just four forms:

- Company information - comprising of return dates, address, directors and employee number.

- Profit and Loss statement - your income and expenditure figures.

- Balance Sheet

- Declaration

- Optional notes

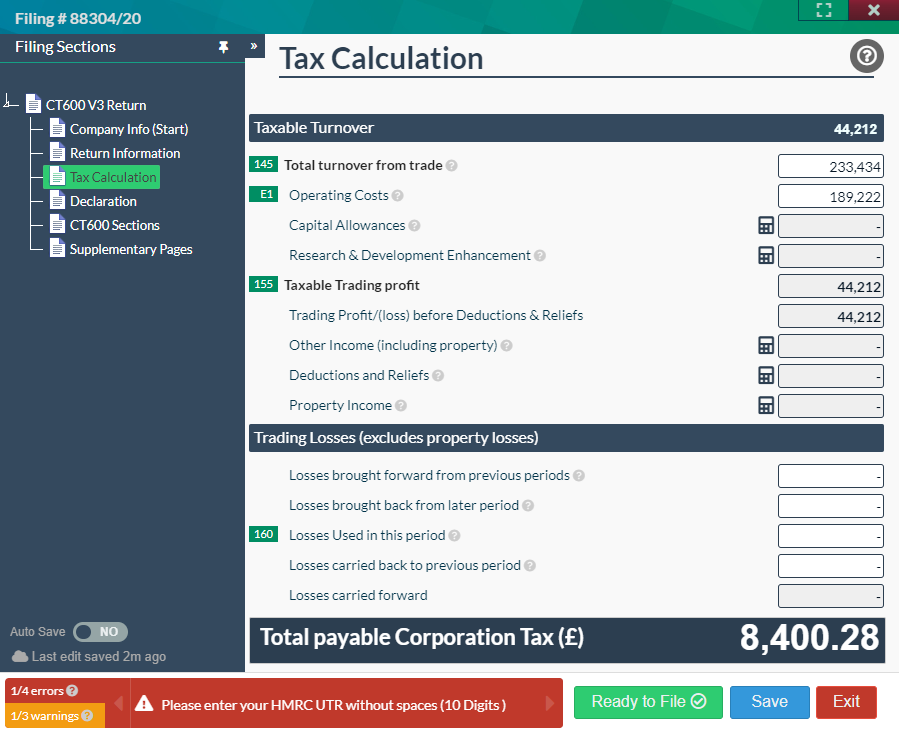

Once you have filled in your details, we format the accounts with IXBRL tags, ready for submission to HMRC. The Easy Digital Filing Platform has a built-in tax calculation engine, so all you need to do is enter your figures and let our software do the rest.

(Example below shows the tax calculation screen)

We Store Your Company Information Safely

We appreciate that creating your corporation tax return can take time, especially when juggling the commitments of running a company, so you can safely log off and your templates will be stored in the system, even if you don’t come back to it for several months! Your data is continually saved across multiple UK servers, so you do not need to worry about losing your progress.

If you do accidentally delete a filing, we can recover it for you within 48 hours. Just log into your account and send us a message in our live chat.

Try Before you Buy

You only need to pay when you have completed the forms, so you can use the software for free up until you are ready to file. While you’re using the system, you’ll notice item context tooltips, and inline help pages for guidance. We also offer additional support and information via email, and our online chat.

Get Ready to File

When you are ready to submit to HMRC, click the submit button and your company accounts and encoded IXBRL tagged files are automatically attached to the CT600 and transmitted through to the HMRC Gateway. You will instantly receive a message to let you know if you have filed successfully, and you can correct any errors and resubmit as many times as required.

Further guidance can also be found within articles on our Knowledge Base but if you’re stuck don’t hesitate to contact us and we’ll be happy to help.

CH & HMRC Filing in One

You can also file to Companies House at the same time as HMRC by creating a Companies House submission and entering your company authentication code. Our software will take the information you have entered into the company accounts template and file the balance sheet and statutory declarations to Companies House.

If you are only filing to Companies House, please see our article on Filing Company Accounts to Companies House.

Remember, Companies House require you to file your accounts to them within 9 months after the end of your accounting period

File Your Taxes Easily with Us

At Easy Digital Filing, we specialise in helping small and micro companies file their taxes and accounts with Companies House and HMRC, ensuring that they meet their legal obligations and file on time using our simple, intuitive software. Try for free on Easy Digital Filing or send us a message and we will be happy to assist you.