What is Group Relief?

Group Relief is a useful instrument for companies which are members of a group. The use of group relief allows a loss-making company within a group to transfer its losses and other eligible amounts to another company within the group. Transferred losses in a group, can either be carried forwards or losses incurred in the current accounting period. These losses are then moved to a profit making company within the group, this allows the transferred losses to be claimed as their own, effectively reducing its taxable income within its Corporation Tax Return.

What is a Group?

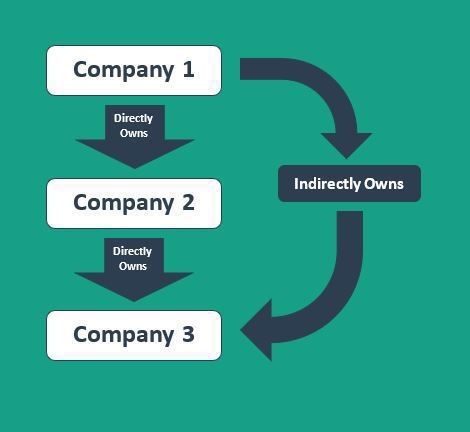

A group is formed when a singular company owns one or more other companies and therefore has control over them. These companies within the group can be owned Directly or Indirectly. Please find examples of direct and indirect ownership of companies below:

Direct ownership occurs when Company 1 owns Company 2, therefore Company 1 would directly own company 2.

Indirect ownership occurs when Company 2 directly owns another company which we shall call Company 3, thereby by Company 1 would indirectly own Company 3. This is because Company 1 directly owns Company 2.

A singular company that owns one or more other companies may be referred to as a Parent or Holding company. Company 1 from the diagram above is an example of a Parent/Holding company.

When a company is owned by another company, either directly or indirectly, it may be referred to as a subsidiary. For example, both Company 2 and 3 would be subsidiaries of Company 1 (Parent Company).

In order for a company to be part of a group and eligible to surrender and claim group relief, the company would need to be:

- A singular company which is a 75% subsidiary of another company, or,

- Both companies are 75% subsidiaries of a third company.

As stated above, group relief allows the members within the group to transfer losses between each other as though the group is one economic unit. Although this does not mean that the group is treated as a singular company for corporation tax purposes. All the companies within the group are still treated as distinct legal entities and should file their own CT600s.

How do I file Group Relief?

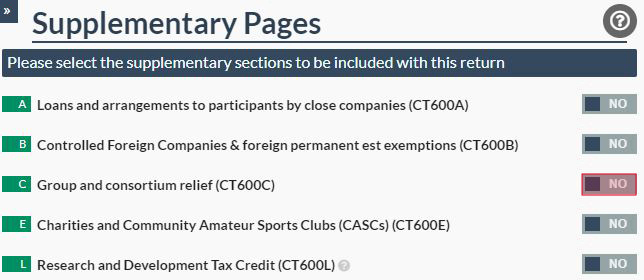

If a company wishes to use group relief they would need to complete a supplementary page CT600C within the CT600 (Corporation Tax Return). There are several supplementary pages which are available as part of the CT600. Within the image below are examples of the supplementary pages available within the Corporation Tax Template that we provide through Easy Digital Filing these include the CT600C which you will need to use if you are in operate in a group structure and wish to transfer losses between the companies.

If a group company wants to transfer losses by either surrendering its losses or claim losses as part of a group relief claim within their CT600 they would need to complete the CT600C, which is the Group and Consortium Relief supplementary page. HMRC require both the company surrendering its losses and the company Within the CT600C companies can transfer losses or claim amounts between the companies within the group.

If you want to file for group relief using all you would need to do is tick the box next to the CT600C to ‘Yes’ then you will be able to access the CT600C form and begin filing for group relief between the companies within the group.

What Losses and Other Amounts can a Group Surrender?

A group can surrender and use different types of losses and other amounts when claiming or surrendering group relief. The most commonly transferred losses and amounts which can be surrendered in full when making a group relief claim are:

- Trading Losses

- Capital Allowances Excess

- Non-trading deficit on loan relationship

A group can also transfer losses from other amounts such as; qualifying charitable donations, UK property business losses, management expenses and non-trading losses on intangible fixed assets. Each of these amounts can be used to reduce down the claiming company's taxable income.

What is a Simplified Arrangement?

Within the CT600C, the company receiving the transferred losses will need to complete either section 1 of the CT600C or section 3 if the transferred losses are carried forward loses. The company will then need to complete the claim authorisation, they can either choose simplified arrangements or upload a pdf with details of the claim authorisation.

A Simplified Arrangement is when one company, which would typically be the parent or a holding company, would become the groups 'Authorised Company'. The simplified arrangement allows the authorised company to make claims and surrender losses and other amounts on behalf of the other companies within the group. In its most basic form, a simplified arrangement allows the authorised company to make a singular statement on behalf of all the company's within the group, rather than requiring multiple Notices of Consent to be written by each company when surrendering losses and making group relief claims.

If a group wishes to set up a simplified arrangement, the authorised company must send an application in writing to the relevant tax office on behalf of itself and the companies within the group. These companies may be referred to as the 'Authorising Companies'.

The application that the authorised company must submit should provide certain details of the authorising companies. Please find below the information which is expected to be provided within the application for a simplified arrangement:

- The Names and Unique Taxpayer Reference (UTR) number of all companies which will be members of the simplified arrangement.

- An explanation of the relationships of the companies which will be a part of the simplified arrangement. This information should illustrate with sufficient detail that the authorising companies are either: a member of the same group or a company owned by a consortium of which one of the companies in the group is a member of.

- A statement made by each company within the group confirming that they agree to be covered by the arrangement and to be bound by claims, surrenders and withdrawals made under the arrangement.

- A specimen copy of the written statement that the authorised company intends to use within the simplified arrangement must also accompany the application.

- Lastly, the application should be signed by an officer from each company within the simplified arrangement, this would typically be done by the company secretary.

Though it is not required, it can be helpful to provide a diagram showing the group structure within the application to provide clarity on the companies within the group.

What is a Notice of Consent to Surrender?

If a group has decided not to set up a Simplified Arrangement but still wish to transfer losses from one company to another, then the company surrendering its losses must provide written consent to surrender their losses to the company making the group relief claim. This should be provided in the form of a Notice of Consent to Surrender. When completing a notice of consent, the surrendering company must provide the following information (as required by the Finance Act 1998):

- The Name of the company surrendering its loss

- The Name of the company to which the relief is being surrendered to

- The Amount of relief being surrendered

- The Accounting Period of the surrendering company to which the surrender relates

- The Tax district references of the surrendering company and the company which relief is being surrendered

If you wish to continue reading, you can find a range articles on our Knowledge Base with articles about Recording a Directors Loan to a helpful Guide to the SA800 Return. If you are ready to file your company's corporation tax return, you can get started here!