SA800 Partnership Tax Return basics

In simple terms, the SA800 is a tax return summarising the income and disposals by partnerships. All Limited Liability Partnership (LLP) members are responsible for filing their own self-assessment returns, as well as pay National Insurance contributions and Income Tax on their individual profits. This is in addition to the SA800.As you may already know, Private Limited Companies (denoted by 'LTD') are separate legal entities from their owners, therefore can enter into contracts, sue, be sued and are also liable to pay corporation tax on the taxable income arising. The tax payable is called 'Corporation Tax', and it is declared through filing of a CT600 return, which highlights the income and expenditure of the business entity.

Differences in the business structures of LLPs and private limited companies

Limited Liability Partnerships and Private Limited Companies are two types of business structures. There are a number of differences between the two structures which must be considered before incorporation, and in this article we will explore some of those.

Tax treatment

For tax purposes the business of Limited Liability Partnerships is treated as a partnership between individuals, who are liable to pay Income Tax - hence the LLP itself is not taxable, which is the case with Limited Companies. Partnerships are not expected to pay corporation tax, which is why they are not required to submit CT600 (corporation tax) returns to HMRC. Instead, each of the member's share of profits or gains on the sale of assets are taxable as an individual income (income from self-employment), and the amount of member's share of profit is determined by agreement between members. Members of an LLP are treated as self-employed and are liable to pay income tax - which is declared when completing a self-assessment return - SA100.

A key point to consider is that the SA800 return itself does not show the tax payable (if applicable). Therefore, in addition to filing of SA800 each of the partners must also file a personal self-assessment return SA100 and the SA104 supplementary pages in order to declare their share of profit. This then determines how much tax the individual partners are due to pay.

Number of partners

In order to register an LLP there should be a minimum of two partners, however there is not a requirement in terms of the number of directors or shareholders when incorporating a Limited Company.

How to register a business partnership?

Registering a partnership with HMRC is quite straightforward. In order to complete a SA800 return, partnerships will need to have their own UTR number which can be applied for when completing the registration process. If by the time of LLP's registration partners are not yet registered for self-assessment, they will have to do so by 5 October, as they will be expected to also submit self-assessment returns. Partnerships can be made up of members, some of whom are liable to Income tax and some of whom are liable to Corporation tax. When a partnership is made up of members only liable to Corporation tax - this type of partnership is called a CT partnership.

Who can file the Partnership (SA800) tax return?

The partnership tax SA800 return must be filled in and signed by one of the following:

- The partner nominated by the other partners who were members of the partnership during the return period

- The partner declaring the return

- The manager of a European Economic Interest Grouping (EEIG) registered in the UK

- The member to whom the Partnership tax return is addressed for other EEIGs

The nominated partner will have to register the partnership for self-assessment with HMRC, as they will be the partner responsible for tax and filing the partnership tax return. Each partners will have to register separately as partners with HMRC for self-assessment. The nominated partner is typically chosen when the partnership is set up, however, if nobody has been selected HMRC will choose and send an SA800 return notice in the name of the chosen partner, who will be then required by law to complete and file it.

What is included on a SA800 return and what are the supplementary pages?

All members of partnerships are required to complete and submit an SA100 return individually, in which they return the partnership's income and disposals of chargeable assets. As highlighted by HMRC, every partner gets the first eight pages (the SA800 return) which covers the trading and professional income, interest or alternative receipts. All pages must be completed if at any time in the tax year the partnership carried out a trade or profession. In some cases, some partnerships will have to complete more than one set of the 'Partnership trading' pages. The SA800 consists of the following sections:

- Partnership business and investment income

- Trading and professional income

- Partnership Statement (Short)

- Other information

If, however, the partnership had sources of income outside of the scope of the aforementioned (therefore fewer common types of income), then additional Supplementary pages can accompany the SA800 return, and the page will depend on the type of income.

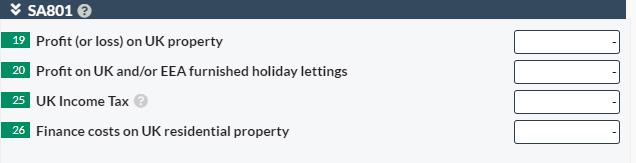

- SA801 Partnership UK Property income - it has to be completed if the partnership received any rental income, other receipts from land and property in the UK, or chargeable premiums arising from leases of land in the UK, holiday lettings in the UK, or a reverse premium.

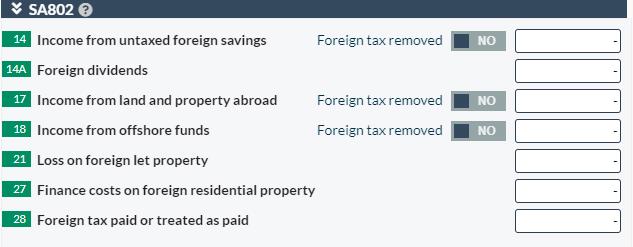

- SA802 Partnership Foreign Income - applicable when the partnership had received interest, dividends or other income from land and property abroad or any other income from sources outside the UK

- SA803 Partnership disposal of chargeable assets - applicable when the partnership disposed of any chargeable assets

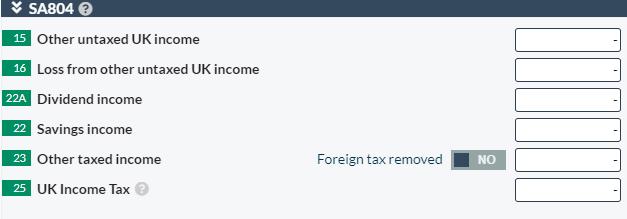

- SA804 Partnership savings and investments and other income - it has to be completed if there was income from interest, dividends, other distributions or other trade.

Partnership statement (Short) and Partnership statement (Full) versions and differences

The Partnership Statement is part of the SA800 return and it summarises the profits, losses and income allocated to partners, and it comes in two formats - a short version and a full version. Which should be completed will depend on the number of partners as well as the type of income the partnership had. Partnership Statement (Short) is an abridged version for up to 3 partners that only have trading and professional income, interest or alternative finance receipts from banks, building societies or other deposits. Otherwise, if there were other types of income or the partnership had up to 6 partners, then 'Partnership Statement (Full)' must be completed as it caters for all possible sources of partnership income. Each partner will then need a copy of their allocation of income to fill in their personal self-assessment tax return SA100.

Filing and tax payment due dates

As with any other tax returns there are due dates set by HMRC for Partnership returns too, and those deadlines will depend on the way the return is submitted. If you are filing the SA800 online the due date is 31 January, however, if you are sending it on paper the due date is 31 October. For paying the tax bill - if there is tax you owe for the previous tax year (balancing payment) or you are making the first payment on account the date is 31 January. For second payment on account, the due date is 31 July.

I hope you found this article helpful. If you would like to continue learning about the SA800, have a look at the following video from our YouTube channel: