A business is likely to encounter many types of income across its life-time, the origins of each of these types of income could differ drastically. In this article we discuss the most common types of income that businesses encounter, how the business income may arise and where they can be included in the company's accounts for submission to HMRC.

Examples of the most common types of income

Of the many types of business income that a company can receive throughout its life-time here are the most common incomes:

Revenue

Revenue, also referred to as sales, turnover, top line and trading income, it is simply the money received from the businesses primary activities.

Revenue can be calculated by taking the sale price of a chosen item and multiplying it by the number of units of that particular item that have been sold, this will then calculate the revenue generated by that specific item.

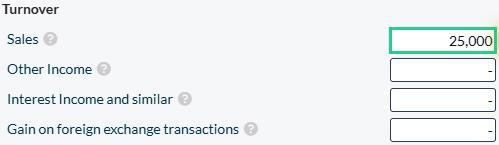

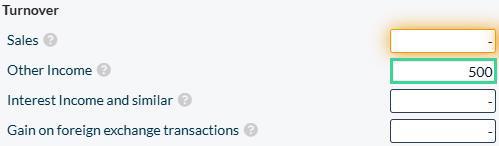

Revenue, being the most common type of business income, can be entered in the 'Sales' box within our profit and loss statement template.

Property Income

A business can generate property income when it has purchased a property and proceeds to rent that property out to other parties through the business. A popular business which is widely operated in the UK is Buy-to-Let. The main source of business income for these companies is property income which would be generated through renting out the owned property.

Although it is important to note that property income is not exclusive to Buy-to-Let businesses. Any business which owns a property can generate property income. For example, a local farmer with an empty shed on their land may they decide to rent it out as storage space for a local retailer, therefore generating a property income for his business.

Foreign Exchange Gain

Its becoming significantly easier for business to both buy and sell goods and/or services online with more businesses accepting payment as well as purchasing goods and/or services in foreign currencies. When exchanging the transactions paid for or received in a foreign currency back into GBP (£) for reporting the company's accounts to HMRC, there may be a difference between the exchange rate on the day an invoice was issued in the foreign currency and exchange rate on the day the invoice was paid.

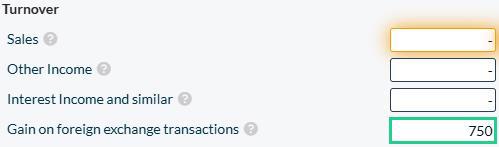

Sometimes this difference can lead to an gain in the amount of money that the company received from the transaction, in this case this income would be classified as a foreign exchange gain which can be included in our profit and loss templates as shown below:

Interest Income

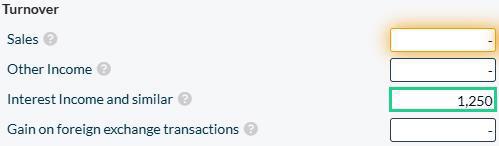

When a business has spare cash, it may decide to put these reserves into an interest bearing business account, instead of leaving the funds in a current account where they generate no income stream for the business. The interest that is paid on the reserves stored within the interest bearing account would then be categorised as interest income which can be included in our Micro IXBRL Accounts template.

Interest income could also be generated if a business loans its available funds to another company and charges interest on the loan. When this occurs, the interest paid by the loan recipient can also be categorised as interest income.

Investment Income

Another type of income for business is investment income. When a company has purchased investments (common examples of investments are stocks and real estate but could also be any other assets purchased) with the aim to generate income, typically deriving from the growth of the value of the investment, this would be classified as Investment Income.

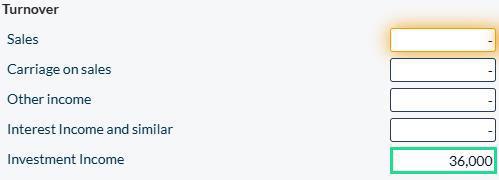

If the investment grew in value from the date that it was purchased then the gain between the purchase price and the sale price of the investment would be the investment income (also referred to as Capital Gain). This amount is then entered into the accounts either as 'Other Income' if filing as a Micro company where as if you are filing as a Small company this can be entered into the 'Investment Income' box as shown below:

Other Income

If a company receives a type of business income which does not fall under any of the headings above then these incomes can be disclosed as an 'Other Income' within the accounts.

Some examples of the most common types of other income are:

- Cashback from a business card's cashback scheme

- Rebates paid by a supplier

- Loyalty rewards from the businesses activity

- Refunds paid to the business on refunded purchases

- Proceeds from the sale of an asset (when filing as a Micro Company)

- Money received from an insurance pay-out (such as compensation for business interruption or damages)

- Grant funding received (these could be local or government grants)

There are often occasions when the types of income received will not fall under one of the applicable headings. When this is the case the income can be entered into the profit and loss statement under the 'Other Income' box as shown below:

Conclusion

Within this article we have discussed the most common types of income that your business may encounter. Most of the types of business income received by a limited company are subject to Corporation Tax, which is payable to HMRC at the end of each accounting period. Although there are some exceptions so when completing your Corporation Tax Return through our software we recommend looking through our extensive Knowledge Base to help with any additional queries that you may have about your businesses returns.