Learn How to File your CT600 for your Property Company

Property rental companies with an annual income of more than £5,200 per year are required to file thier corporation tax using commercial software. Luckily, our filing software at Easy Digital Filing makes it simple with a step-by-step guide.

Start with the property income

Once you’re on the Easy Digital Filing platform, head to the Supplementary Section and click box 96 property income to "yes". You will notice that as well as an additional page for entering your property income, another income page also appears. This is where your property income will be reported on the CT600. As part of the CT600, HMRC requires a set of computations. When you fill in the property forms, the information you provide will be tagged in iXBRL to create these computations.

Next, open up the property income page. The first few boxes are about income and expenditure. Enter your figures into boxes 1 and 2, and your net profit/loss will be calculated.

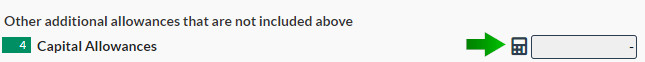

Add Any Capital Allowances

If you have any capital allowances you need to report, click on the calculator button next to box 4.

This will launch the capital allowances page. Please see our article on capital allowances

if you require any further information about filling in this section.

If you have any other expense not included in box 2, such as wear and tear or have replacement domestic items for your property business, please enter them into box 5 and 6.

Check your Disallowable Expenses

If you have any disallowable expenses such as depreciation or entertainment, enter them into boxes 7 & 8.

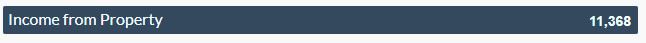

As you enter your data into the different sections you will see your net income from property is calculated at the top of the page.

If however, you have made a loss, the loss will be shown in the losses section.

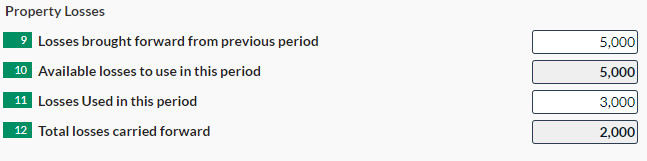

Calculate any Property Losses

If you have property losses, either from the current accounting period or from a previous accounting period, they can be use to offset profits thus reducing your corporation tax liability. Please note that unlike certain other losses you can not carry property losses back to an earlier period.

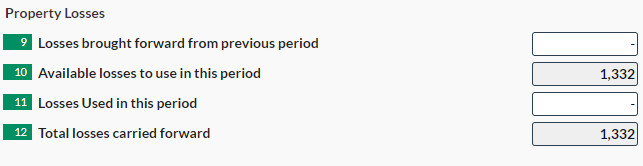

Property losses in current period

If you have incurred property losses in your current period and have other income that is liable for corporation tax, you can use the loss to off-set the Corporation Tax

on the other income.

Enter the amount of loss you wish to use in box 11.

The losses used cannot be greater than your total other income.

If you have not used all your losses against your other income, then you will see the remainder in the carried forward box 12.

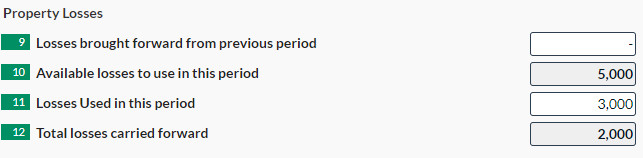

Property Losses brought forward from previous periods

If you have made a property loss in a previous year, you can use it against profits as long as the company is still carrying on its property business which can affect tax on property income. To use the losses from a previous period, enter the losses carried forward into box 9 and then enter the amount of loss you wish to use into box 11.

If you have made a property profit in the year you are reporting on, these losses will be used to reduce your property income. If you have other income they will be used against your other income.

Once you have completed all the applicable sections, you will be able to review your entries by opening up your computations and CT600 by saving and closing down your input screen and going to the review icon.