Filing your corporation tax return isn’t always an easy chore. To ensure your CT600 return is filled out accurately as possible, it’s important to understand what allowable and disallowable expenses are.

You must keep a record of your business reports, such as revenue and receipts, to calculate the total amount of corporation tax liable due to HMRC. The good news is that there are allowable expenses, which can be deducted from the taxable income, consequently reducing the amount of tax liability. Unfortunately, there are also disallowable expenses, also referred to as expenses to be added back, and they do not act as tax reducer. So, let's distinguish between these two kinds of expenses.

What expenses are allowable?

Expenses which incurred “wholly and exclusively” for the purposes of running the business are allowable for tax purposes, meaning that those costs must be incurred while performing the business. Also called business expenses, they are ‘allowable’ because the tax rules allow these particular costs to be deducted from trading income when calculating the business’ profits – on which Corporation tax has to be paid.

What expenses are treated as disallowable?

A disallowed expense is an expense that is not deducted from a company’s profits, meaning it will not reduce the amount of tax due, compared to the allowable expenses. Therefore, disallowed expenses are not incurred wholly and exclusively for the purpose of trade.

- Depreciation and amortization

- Client entertainment, also staff entertainment that is not 100% related to business purposes.

- Fines and penalties

- General provisions for bad debts

- Clothing, however, if it is wholly, exclusively and necessary for the performance of your work, for example – a uniform, protective clothing, costumes (for actors or entertainers) then it is allowable.

- Legal expenses on the formation of a company

- Legal expenses related to buying premises or equipment

- Fuel expenses for non-business use of vehicles

- Travel between your home and work

- Payments to political parties

- Most donations and fees made to clubs, charities, GAD

How to Manage Your Disallowable Expenses

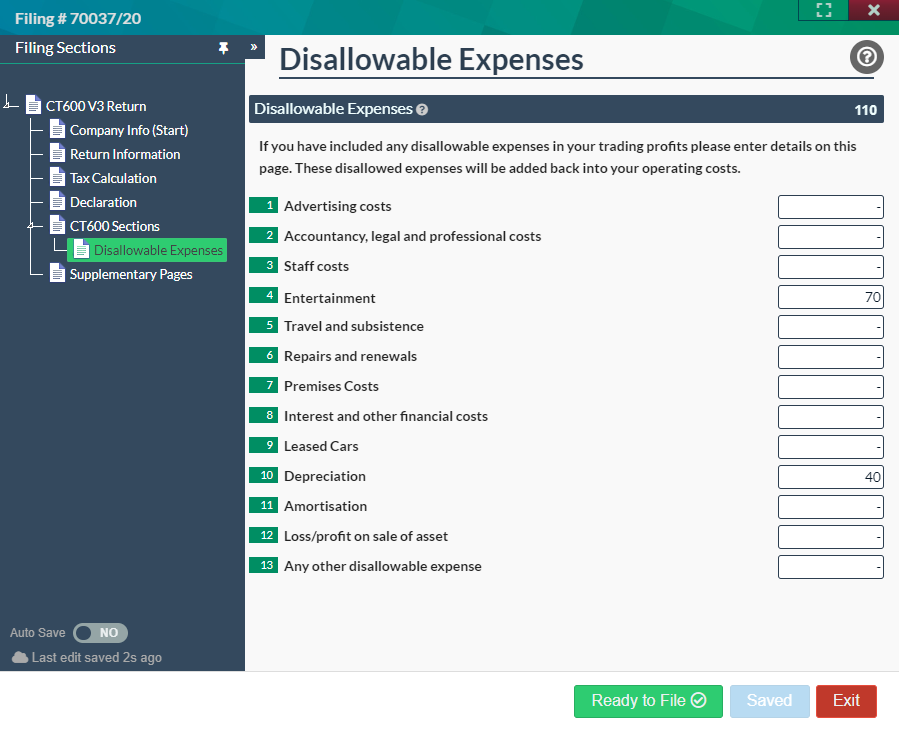

Although it might seem complicated, in Easy Digital Filing we have simplified the process of adding disallowable expenses. In the CT600 return there is a clearly defined section for disallowable expenses. Find below guidance to assist you through the process.

Firstly, you should keep a note of all your expenses – what they are and also their cost

Secondly, make a CT600 return and include all your disallowable expenses in your operating costs

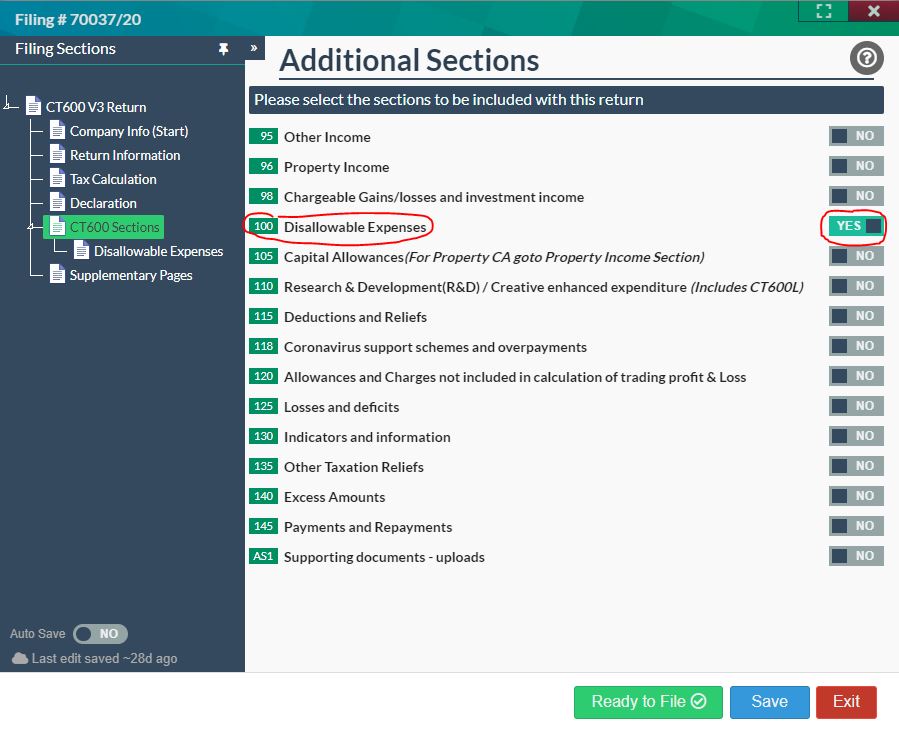

Finally, when your accounting period has finished and you are ready to file, you can simply create and open your CT600 Filing and then set the section in box 100 ‘Disallowable expenses’ to ‘yes’. Once you have done this, the supplementary section will be visible in the section navigator.

From this point you can enter all your disallowable costs, from this figure software will add them back to your taxable profits.