In order to understand what non-trade loan deficits are, we will need to start by looking at the distinction between trade and non-trade loan relationships.

Trading and non-trading loan relationships - what is the difference?

HMRC's definition of trading and non-trading loan relationships is as follows:

A company will have a trading loan relationship if it entered into the loan relationship because of its trade. As an example - a company taking a loan in order to finance the purchase of an asset that will help expand the company's trading activities. Put simply, for any loan to which a company is a party for trading purposes.

Contrarily, a company will have a non-trading loan relationship if it is not a party to that loan relationship for the purposes of its trade. For instance, an investment company will not have trading activities, so this will not be related to trade - it will be a non-trade loan relationship.

Loan relationships profits - if the credits from loan relationships exceed the debits from those sources the excess is a loan relationship credit and this is subject to corporation tax.

Loan relationships deficits - if the debits from loan relationships exceed the credits from loan relationships the excess is called a loan relationship deficit and will be available to relieve against other profits.

How to account for non-trading loan deficits or profits in your company's accounts?

HMRC requires companies to submit full accounts (Income statement and Balance sheet) accompanying the CT600 Return, so it is important to reflect the profits from non-trade loan relationships as well as the deficits on non-trade loan relationships accordingly in your company's accounts.

Profit from non-trade loan relationship - as there is not a specific section for that, such profits can be placed in 'Other income'.

Deficit from non-trade loan relationship - typically these appear within the 'Other expenses' section - 'Interest Payable and similar expenses'

How to report non-trading loan relationships in your company's CT600 Return?

Accounting for non-trading loan relationships in the CT600 return is easier than it sounds! We will look at a few examples of both the Non-trade loan profits and Non-trade loan deficits.

Profits from non-trading loan relationships

Accounting for profits from non-trading loan relationships in the company's CT600 Return is simple - it can be done in a few steps, so let's summarize them below:

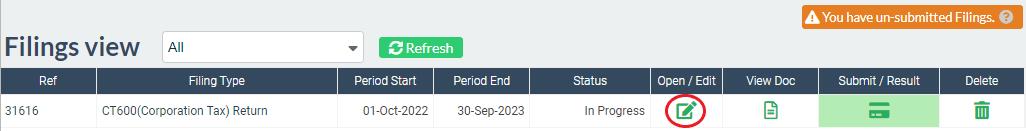

1. Open the CT600 Return template you created in your account

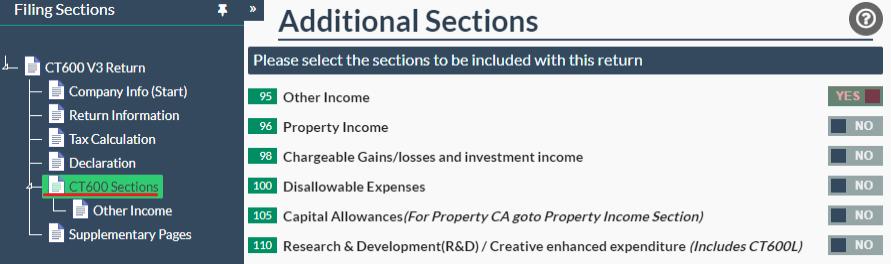

2. Navigate to the 'CT600 Sections' page and switch the 'Other Income' box 95 to 'YES' (this will then open a new tab at the left side of your screen).

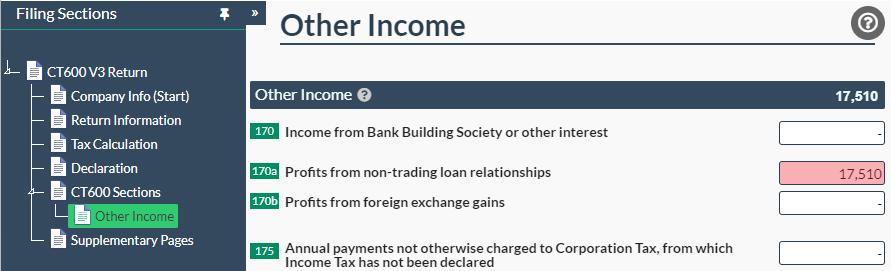

3. Lastly, you can now complete box '170a' with the Profits from non-trading loan relationships

Non-trade loan relationship Deficits (NTLDs)

Case 1 In order to illustrate how to reflect NTLDs let's assume your company has only non-trading loan deficits of £2,430 in its accounting period.

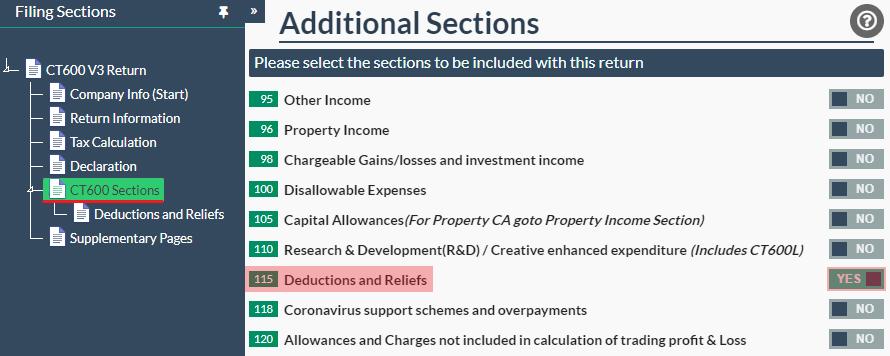

The first step is to create a CT600 return in your account. Then, you will need to navigate to 'CT600 sections' and switch box 115 'Deductions and Reliefs' to 'YES'.

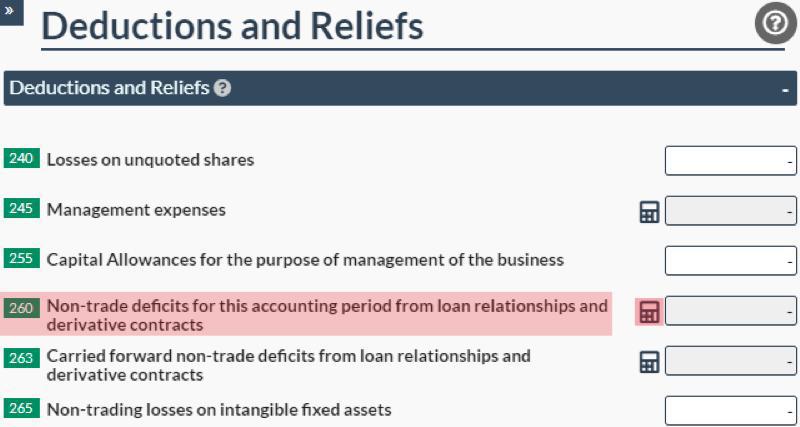

Once this is done the 'Deductions and Reliefs' section will appear and you will be able to see the 'Non-trade deficits from this accounting period from loan relationships and derivative contracts' section - box 260. In order to enter the NTLDs for the period, you will need to click on the calculator icon.

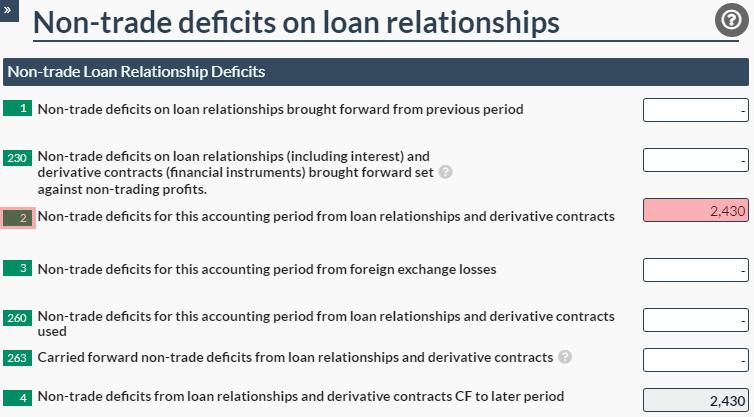

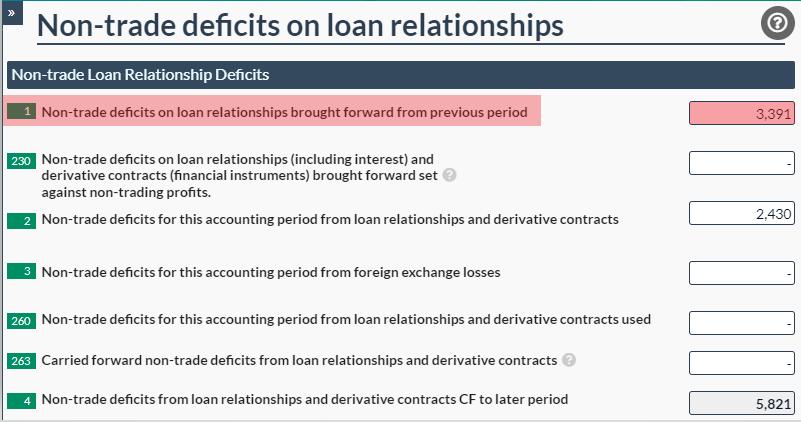

Once on the 'Deductions and Reliefs' page you will be able to enter the NTLDs for the accounting period you are reporting on in box 2.

As your company do not have any taxable income in the period, the £2,430 deficits cannot be used to offset against it. Therefore, the deficits of £2,430 are being carried forward to future accounting periods and appear in box 4.

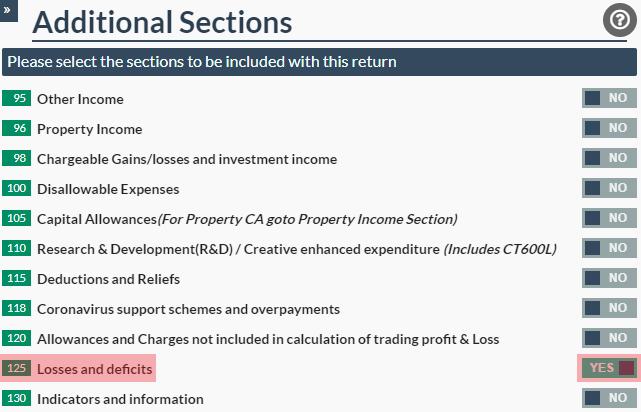

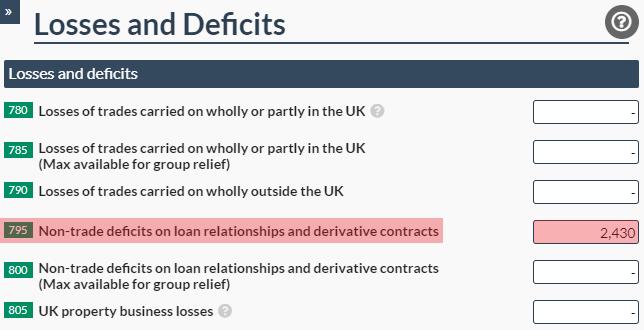

Once the deficits are accounted for on the 'Deductions and Reliefs' page you will need to show the amount in the 'Losses and Deficits' page too. Again, in order to get this additional page you will need to navigate to 'CT600 Sections' and switch box 125 to 'Yes'.

Then, the NTLDs can be reflected in box 795 - 'Non-trade deficits on loan relationship and derivative contracts'.

Please ensure that you are only recording the loss for the accounting period you are preparing your CT600 Return for. If you have NTLDs to bring forward from previous accounting periods you will need to account for those in the 'NTLD' page only.

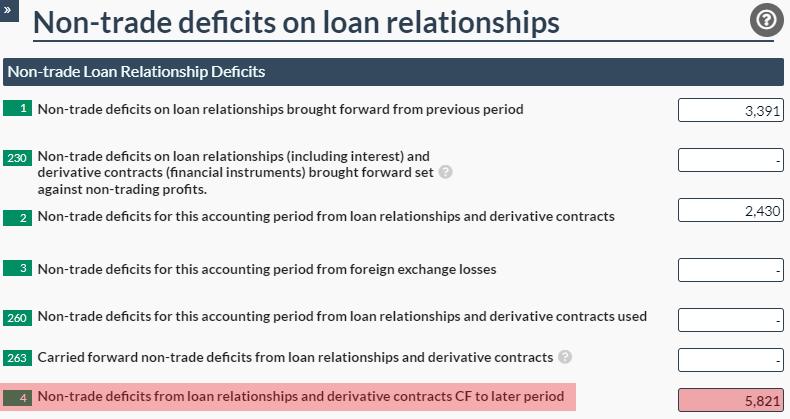

Case 2 Now, let's presume that you are bringing forward £3,391 of NTLDs but you also had £2,430 of NTLDs arising in the period. The brought forward deficits should be recorded in box 1 - 'Non-trade deficits on loan relationships brought forward from previous period'.

If NTLDs are not used in the accounting period to offset against taxable income, these will be carried forward to future periods and the total of box 1 (amount brought forward) and box 2 (amount arising in period) will appear in box 4.

Box 263 should be used if there is income that the non-trading loan deficits can be used to offset against.

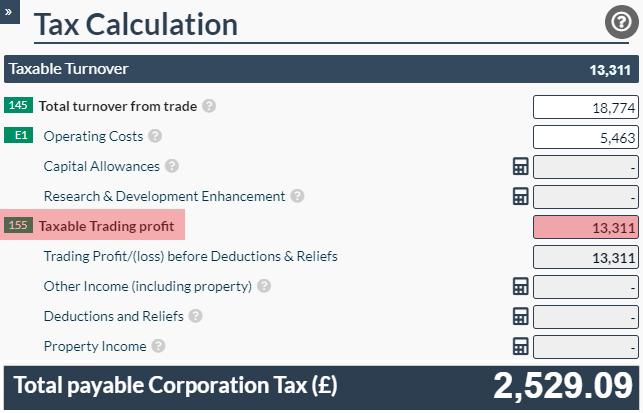

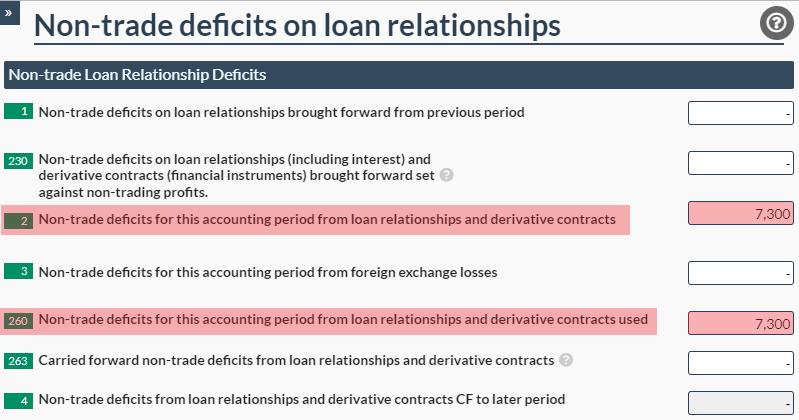

Case 3 In the next example, we will explore a situation in which your company has taxable trading income of £13,311 and non-trade deficits on loan relationships arising in the period of £7,300.

How to use the deficits of £7,300 against the taxable income so that we get reduction in taxable income?

It is important to note that if you have trading expenses in the period the non-trade deficits should not be included in the 'Operating costs' - they will only appear on the 'NTLD' page.

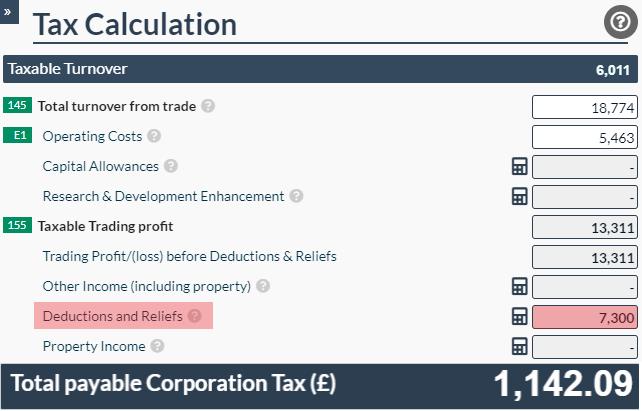

We can see that for £13,311 taxable income the corporation tax payable is £2,529.09, however now let's account for the £7,300 of NTLDs.

The amount of NTLDs for the period are reflected in box 2, and as the amount used is for the accounting period we are filing for - those should appear in box 260.

Then, going back to the 'Tax calculation' page we can see that the corporation tax has reduced to £1,142.09 because the NTLDs were used to offset against the arising taxable income.

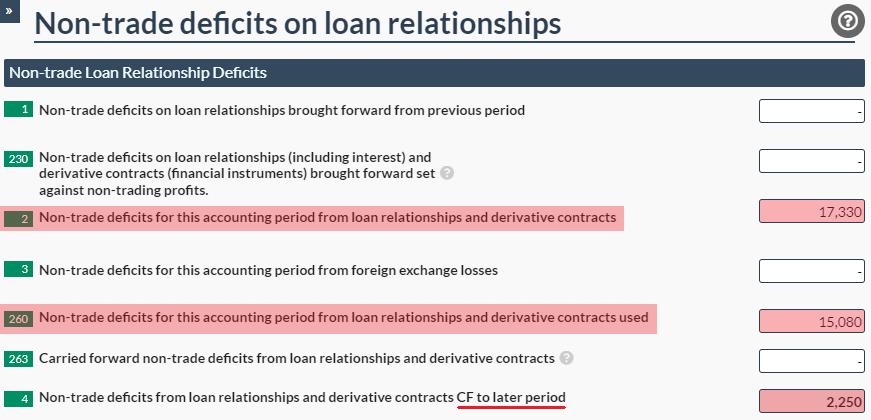

Can you offset NTLDs against non-trading taxable profits?

Yes, you can! If a company has a property business which has taxable property income, the NTLDs can be used in the same way as if the taxable income was income from trade. It is important to note that the amount of NTLDs used should be lower or equal to the actual taxable profits.

For example, if a company has taxable property income of £15,080 and apart from the property related expenses the company has £17,330 of NTLDs in the period - the taxable profit arising (£15,080) is lower than the total NTLDs of £17,330 in the period. Therefore, the deficits of £2,050 that are not utilized in the period (this is the difference between £17,330 and £15,080) are carried forward to future periods.

To sum up - what are the two main aspects to remember when accounting for Non-trade loan relationships in your company's filings:

- If the company has made a profit on non-trade relationships - show it as 'Other income' in the company's Accounts, as well as 'Other income' in the CT600 Return template (box '170a').

- If the company has a non-trade loan deficit in its period - this is shown as an expense within the 'Other expenses' section of the accounts, and in the 'Deductions and Reliefs' (NTLD's section) of the CT600 Return. Last but not least, if NTLD's are used in the period to offset against taxable income - the amount utilized should not be higher than the actual taxable amount.

We hope this guide helped you complete your company's CT600 Return and accounts, however if you still need assistance - please feel free to get in contact with one of our team here.