Deductions and reliefs are a section within the CT600 that allows comapnies to claim addtional costs associated with the running of the business that do not fall within the main trading

expenses within the business. They also allow you to use losses that are either moved into the period or a trading loss of the period against other income.

Overall they have the effect of reducing the taxable profit of the company.

What are Deductions and Reliefs

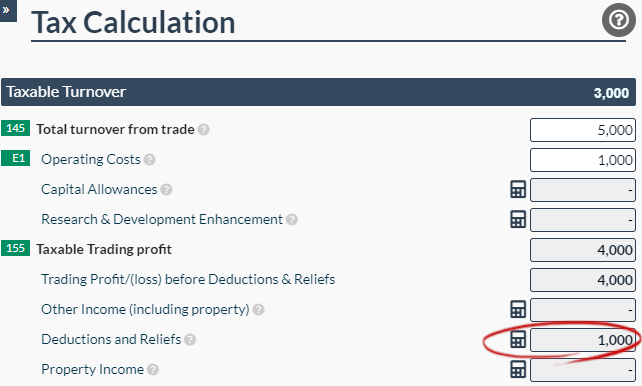

Corporation tax relief and deductions work together to help reduce the amount of corporation tax you pay. This is done by reducing your taxable income. For example, if your total turnover from an accounting period was £5,000 and your operating costs were £1,000, this would leave you with £4,000 taxable income. If you then include deductions and reliefs of £1,000 your taxable income would reduce by £1,000 to £3,000.

It is important to remember your deductions and reliefs can never be more than your total profit, in this case £4,000. If you enter an amount that is greated than your total taxable profit, you will see a warning within our software to allert you. If you are unsure whether an item qualifies as a deduction or relief, it is always best to double check as HMRC can investigate your tax return and ask for evidence. This is why it is advisable to keep detailed records of your business transactions.

What can you claim Deductions and Reliefs on?

Deductions and reliefs work to reduce the profit you pay tax on by deducting specific costs or losses from the business from your taxable profit. This includes:

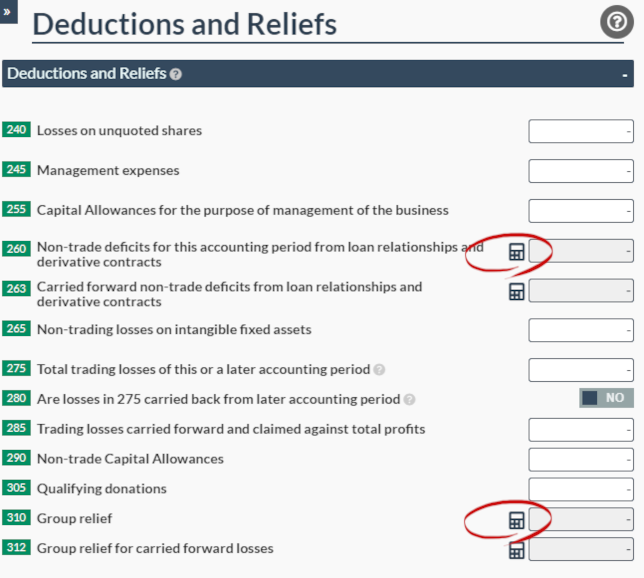

- Management expenses - This applies to investment and certain life insurance companies only.

- Trading losses -Trading losses are those which come about from your business activities. These can either be trading losses within the period or losses moved from either an earlier or later period.

- Non trade capital allowances - Capital allowances arising from non-trading activities.

- Losses on unquoted shares - Losses on shares not traded on a stock exchange.

- Non- trade deficits - When a company’s non- trading loan relationships create a surplus of non-trading debits.

- Group relief - If your company is part of a group relationship then you are able to transfer losses between the companies. You will also need to complete the CT600C to do this.

- Qualifying donations - Charitable donations made by the company.

How to claim

To enter the deductions and reliefs page with Easy Digital Filing you can either enter by clicking on the calculator button, on the main tax calculation page:

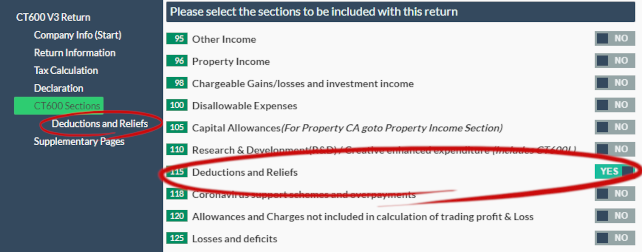

Alternatively, you can enter by going to the CT600 sections page:

Once you enter the page, you can enter your deductions and reliefs, any tax reductions will be automatically calculated for you and reflected in your tax calculation.

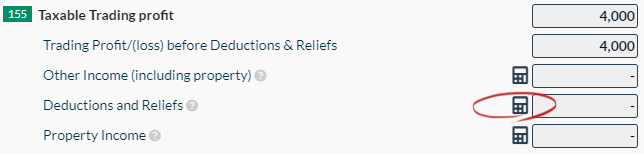

Some Deductions and Reliefs require more information than just an initial input figure. You can access all the input boxes by clicking on the calculator icon

opposite the individual heading which will allow you to enter all the required figures. These include claiming non-trade deficits and group relief.

You can add the addional information by clicking on the calcualtor symbol on the page:

How to claim losses on the Deductions and Reliefs page?

Trading losses that you wish to offset against other income are recorded in the Deductions and Reliefs page, CT600 box 275. Remember to Switch box 280 to yes if the losses entered in box 275 are carried back from a later accounting period.

CT600 Box 285 should be used if you have made a loss in previous accounting periods and wish use the loss against your total profits, this includes other income. For further information about using losses and moving losses between periods, please see our Losses article.

CT600 Box 265 should be used for losses on intangible fixed assets - these are long life assets that cannot be seen or touched- that have arisen from non-trading activities e.g. licences.

If you have losses from the period you are reporting on, please remember to add the loss into the losses and deficits page, CT600 boxes 780 - 835.