What is Corporation Tax?

Corporation tax is the tax that all UK limited companies are obligated to pay as long as they are profit making. These profits can be made from a company's trading activities from trade, gains on the sale of assets (Chargeable Gains) or investments. Companies that break-even or are loss making at the end of their accounting period will have no corporation tax due, but there are many different factors which should be taken into account when calculating corporation tax.

How is Corporation Tax Calculated?

Corporation tax calculation can be rather confusing but there is a simplified formula which can be used to better understand what is typically included when calculating the corporation tax due for a limited company:

Taxable Income (Total Income - Total Expenditure + Disallowable Expenses - Claimed Capital Allowances - Losses Brought Forwards) x Applicable Corporation Tax Rate

This formula should not be used to calculate the company's actual corporation tax due for its accounting period and does not constitute legal , accounting, tax, investment or other professional services nor advice. This formula is for knowledge and guidance purposes only and does not take into account all sections of the corporation tax return.

As you can see in the formula above, there are several categories of the corporation tax calculation that could cause confusion when calculating your company's corporation tax. To prevent that confusion I shall explain and provide examples of how each individual category of the formula is calculated and how they effect the corporation tax calculation.

Taxable Income

This is the most important figure when calculating corporation tax due at the end of a company's accounting period as it is the final figure after any disallowable expenses, capital allowances, reliefs and losses have been included. This leaves you with the taxable income which is then multiplied by the applicable tax rate used in calculating corporation tax due for the company.

Total Income

The first step to calculating corporation tax is to work out company's taxable income. Start by totalling the turnover generated from the company's main trade. Then add any additional income that was generated from sources other than the company's main trade, these can include interest from a business bank account, gains on foreign exchange or any other income into the company that was not generated from its main trade.

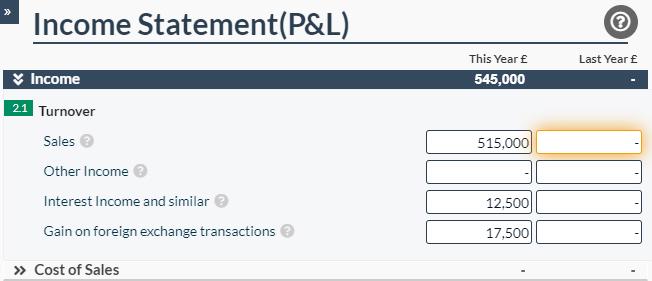

For example: A company had a turnover of £515,000 , it also earned £12,500 of interest on a its business savings account and it has realised gains on foreign exchange which totalled £17,500. This would mean the company has a total trading turnover of £515,000 and other income of £30,000. Therefore the company's total income for the accounting period is £545,000. Please see the image below showing how the figures from the example would be input into our Micro IXBRL accounts Template.

Total Expenditure

The next step in calculating corporation tax due, you will need to know the total expenditure incurred by the company during the accounting period. This can easily be done in by adding all the company's expenditure together (including any disallowable expenses as these are added back in the CT600 later). Within our micro IXBRL accounts template you can easily total the company's expenditure by using the calculated totals for each category of expenditure in the template.

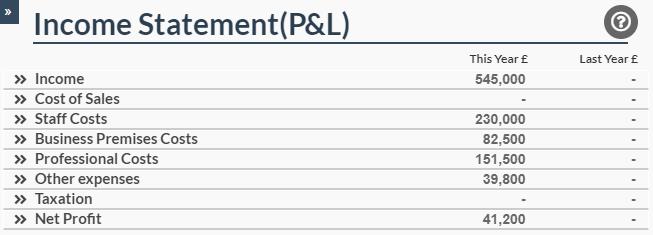

In the example below you can see that the company had the following expenses (£230,000 Staff Costs + £82,500 Business Premises Cost + £151,500 Professional Costs + £39,800 Other Expenses = £503,800 Total Operating Expenses)

Disallowable Expenses & Depreciation

After you have totalled the expenses for the accounting period you should then check whether there were any disallowable expense that need to be added back into the taxable income. Disallowable expense are specific expenses that are not tax deductible and therefore should be added back into the taxable income for the accounting period.

There are many expenses that qualify as a disallowable expense such as fines, penalties and entertaining costs for example. The most common disallowable expense that you are likely to have in your company is Depreciation. When a company owns any fixed assets (items used by the company for longer than 12 Months) they will slowly lose their value over the years that they are used and therefore should be depreciated over their useful life. Depreciation is a disallowable expense as most companies claim capital allowances on fixed assets in the year of purchase.

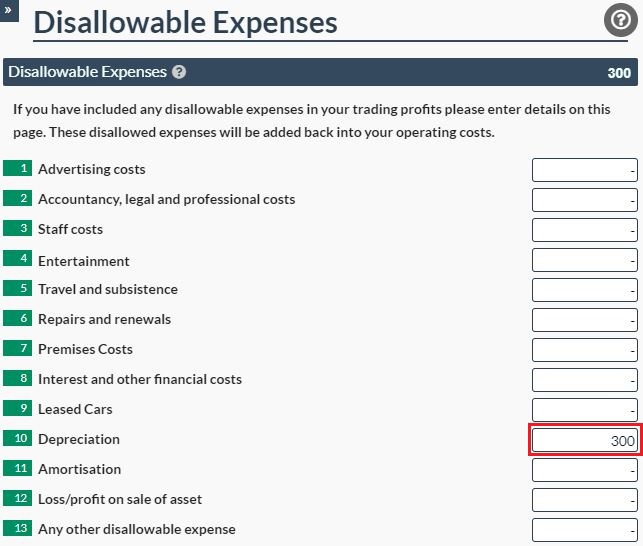

For example: A Limited Company has purchased a brand new and unused laptop for £1,500. This laptop then has an assumed useful life of 5 Years, therefore it should be depreciated at 20% over the 5 years. This is then calculated as £1,500 x 20% = £300 depreciation charge for the year (Straight-Line Method).

As this depreciation charge of £500 is a disallowable expense it will be added back to the taxable income for the accounting period. Within the image below you can see how the depreciation charge from the example would be input as a disallowable expense within our CT600 filing template in our software.

If you wish to learn more about Disallowable Expenses you can read about them in more detail in our Knowledge Base.

Capital Allowances

As a simple explanation of capital allowances, they are a tax relief given to businesses when calculating corporation tax allowing them to deduct some or all of the cost of the item from the company's profit before tax. Capital allowances can be claimed when a company purchases any qualifying plant and machinery during its accounting period. The type of capital allowance that a company should claim depends on the specific item that has been purchased. You can find HMRC's guide for capital allowances for further explanations for each type of capital allowance.

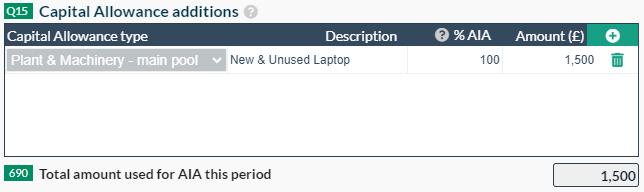

For this example I shall use Annual Investment Allowance: As stated in the disallowable expense section our company has purchased a brand new and unused laptop for £1,500. As this item qualifies for Annual Investment Allowance it means that I can deduct 100% of the laptops value in my corporation tax return. Therefore, when I calculate the corporation tax due I can deduct £1,500 from the taxable income as I have claimed Annual Investment Allowance on my qualifying expenditure of my laptop. In the image below is an example of how this would be claimed within our CT600 template

Losses Brought Forwards

If a company has been loss making in previous accounting periods then these losses can be carried forwards in its corporation tax returns until the company wishes to use the losses in calculating corporation tax. They can do this by offsetting some or all of its losses carried forward against taxable income within its current accounting period.

For example: A company has £25,000 of losses carried forwards and it has a taxable income in this accounting period of £40,000. It can use all of its losses carried forwards to reduce its taxable income (Taxable Income - Losses Carried Forwards). Therefore when calculating corporation tax the taxable income for the accounting period after the losses have been used (£40,000 - £25,000) will be £15,000.

If you wish to find the steps that you would follow to use your losses when filing your company's corporation tax return I would recommend reading our article about How to use losses in a corporation tax return. This article provides the steps and screen shots for you to successfully use losses to reduce your company's taxable income.

Applicable Corporation Tax Rate

Once you have calculated the Taxable Income for the accounting period, your last step in calculating corporation tax is to multiply it by the applicable corporation tax rate to find out how much corporation tax the company would pay for the accounting period. Although the exact corporation tax rate that a should be used to calculate the corporation tax due will change depending on the company's profit. Within the table below are the different tax rates and how they differ depending on the taxable income:

Taxable Income | Applicable Corporation Tax Rate |

Less than £50,000 | Any company with a Taxable Income of less than £50,000 are taxed at the Small Profits Rate of 19% |

Between £50,000 and £250,000(Marginal Rate Relief) | When a company has a Taxable Income between £50,000 and £250,000 it is eligible for Marginal Rate Relief. This is where the company is taxed at the Main Rate of 25% but this is then reduced by Marginal Relief.Please do not threat! Our corporation tax filing software will calculate the Marginal Relief for you to ensure you don't miss out on any tax reliefs due to your company or you can learn more about calculating marginal rate relief. |

Over £250,000 | All companies with Taxable Income of over £250,000 are taxed at the Main Rate of 25% and all overseas companies that need to pay corporation tax |