You will no doubt be aware of the rise of the corporation tax rate to 25% and know that companies with less than £50K profit still get taxed at 19%, companies with over £250K get taxed at the full 25% - but what about the ones that fall in the middle of these 2 figures? Well, these are subject a newly introduce tax relief scheme called Marginal Rate Relief. This means that the rate that you are charged corporation tax on can range anywhere from 19% to 25%.

If you have done any amount of googling, you will no doubt found a very complicated looking corporation tax calculation for marginal rate relief of:

Marginal relief = F x (U-A) x (N/A).

Hmmm not much help!

As a small business owner, you need a practical guide of how this is applied.

How to calculate your Marginal Rate relief:

The marginal rate relief is actually calculated first by dividing your accounting period over the financial years it falls across - it is important to note that a financial year for HMRC purposes runs from 1st April to 31st March each year for corporation tax.

Your taxable profits are then apportioned according to the number of days in each financial year. Any days that fall into the financial period ending on or before 31st March 2023 will still be taxed at 19%.

For any profit that falls after the 1st April 2023, it will be taxed according to the amount of taxable profits that your company has made (once all your expenses and other allowances have been taken into consideration).

Different corporation tax rates:

If we now look at the 3 different levels of taxation:

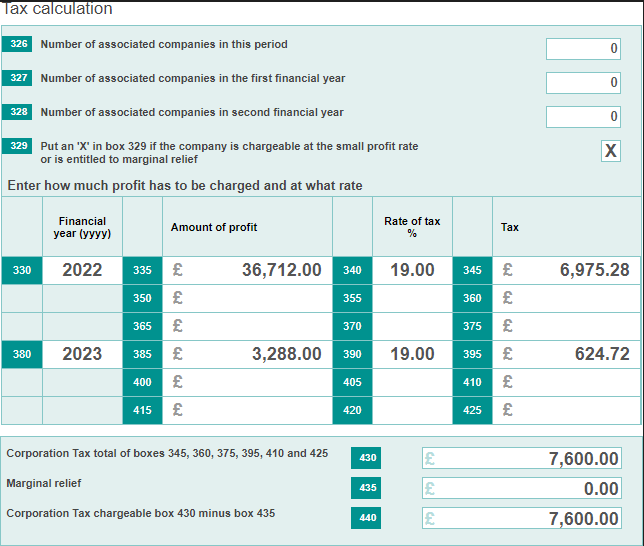

After the 1st April 2023, if your taxable profits are £50K or less, you will be taxed at the small profit rate of 19%. In your CT600 the corporation tax calculation of your small profit rate will be displayed (the example below is based on profits of £40K):

As you can see the corporation tax calculation is unchanged from the calculation pre April 2023. It calculated by taking the taxable profits and multiplying them by 19%: £40,000 x 19% = £7,600 total tax due.

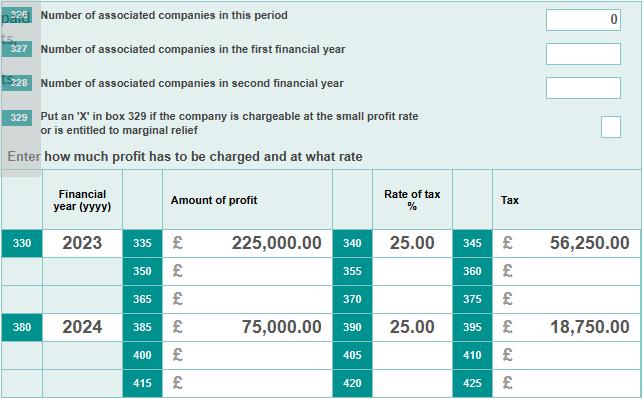

Once again, after the 1st April 2023, if your profits are above £250K, then you will be taxed at 25%. As your taxable profits are above the threshold, the small profits rate of 19% will not be applied and there will be no marginal rate relief either. Your corporation tax calculation will look like this (based on profits of £300K):

You will notice that box 329 of the CT600 is not checked in this example, as neither Marginal Rate Relief or Small Company rate is applicable. So in this case, the corporation tax due is calculated by taking the total taxable profits and multiplying them by 25% instead: £300,000 x 25% = £75,000 total corporation tax due.

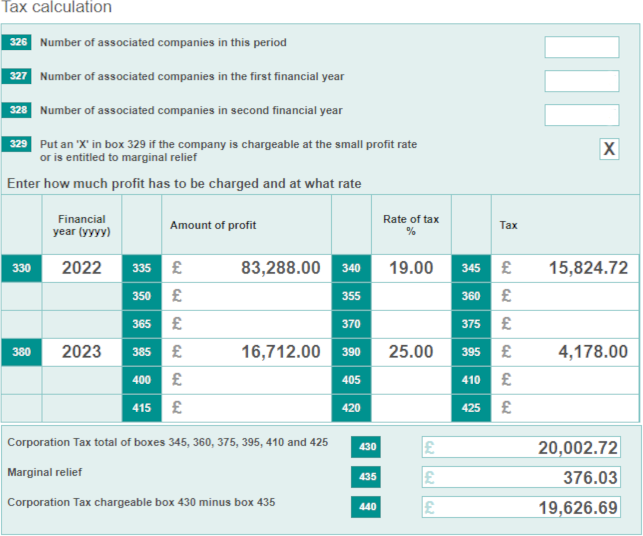

After the 1st April 2023, if your taxable profits are greater than £50K, but less than £250K, then the Marginal Rate Relief will be applied. The effect will be on a sliding scale where the percentage of corporation tax gradually increases.

Marginal Rate Relief is calculated according to the number of days in the period after 1st April 2023. The upper rate of £250K will also be apportioned, along with your total taxable profits.

For example, if your accounting period end date is 31st May 2023 - there are only 61 days in the period from the 1st April 2023 to 31st May 2023. Your total profit will be apportioned across the 61 days, as will the upper limit of £250K. This means for a profit of £100K, your CT600 corporation tax calculation will look like this:

As you can see box 329 is checked, meaning that either the small profit rate or marginal rate relief is applied. As they are over the threshold for the small profits rate, the taxable profits that fall into the financial year starting April 2023 will initially be taxed at the 25% rate. The marginal rate relief is then applied in CT600 box 435 and reduces the overall corporation tax. Pre April 2023 the tax on £100K would have been 19%, with just 61 days falling in the period starting 1st April 2023, you will pay an additional £629.69 in corporation tax.

Other rules around Marginal Rate Relief:

There are a few other rules to be aware of if your company is trying to claim marginal rate relief:

1. Overseas companies

If you are an overseas company, then you will not be eligible to claim marginal rate relief or the small profits rate. This means that no matter what your taxable profits are, you will be charged corporation tax on them at the main rate of 25% from the 1st April 2023 onwards.

2. ABGH Income (Distributions)

If you have received any ABGH income (such as dividends income which is taxed at source), then this will be added to your total profits and used in the calculation of your marginal rate relief, thus reducing the amount of marginal rate relief you can claim/eligibility for the small profits rate. It is important to note that it does not get added in when calculating the actual tax due on your taxable profits, however, is taken into account just for the marginal rate relief calculation.

3. Associated companies

If you have any associated companies or are part of a group, then the number of associated companies must be declared. You can do this in the 'Indicators and Information' section of your CT600 return (in either box 326 or 327/328).

The Marginal rate relief/small profit rate thresholds will be divided between all the companies within the group, so the amount of relief that each company can claim is reduced in the corporation tax calculation. For example, if your company has 1 other associated company, then your thresholds will change from between £50k and £250k to between £25k and £125k. This means that your taxable profits must be below £25k to be eligible for the small profits rate and if they are above £125k, you will be charged at the corporation tax rate of 25% instead.

These will all be calculated in our software, so you will be able to continue to use our templates without having to complete these complicated calculations yourself. Please feel free to either log in, or create an account with us today to test it out for free!