There are various capital allowances a company can claim depending on their expenditure. In this article, we'll delve into the Full Expensing capital allowance and make comparisons to the other capital allowances. If a company is profitable, any capital allowances claimed can be off-set against the profit; therefore, reducing corporation tax payable.

What is Full Expensing?

Full expensing was first introduced in the spring budget of 2023. It allows companies to claim 100% of any capital items that qualify as main pool items. These are items such as plant and machinery, computer equipment, vehicles such as lorries and vans (not cars) and office furniture.

Full expensing was introduced to compensate for the phasing out of the super-allowance capital allowance. Super-deductions were introduced to help businesses recover after lockdown due to the pandemic. Super-deductions gave businesses an attractive enhancement of 130% deduction on profits if they purchased capital items.

Full expensing was initially meant to end in March 2026, however, the Chancellor extended it indefinitely during the 2023 autumn budget.

Full expensing is only available for companies subject to corporation tax. Therefore, unincorporated companies are not eligible for this deduction. Like the supper-deduction allowance, it can only be used on new and unused items (not second-hand items).

If you have a short period (less than 12 months), then the full amount can still be claimed.

Full expensing is considered a first year allowance.

What is Special Rate Allowance?

The Special Rate Allowance was also introduced after the pandemic. It was an enhanced capital allowance that gave companies that have purchased items which qualified for the special rate pool, the benefit of claiming 50% of the cost of the item in the period the item(s) were purchased. This compared to 6% annual write allowance previously available. This allowance has now been continued and will not be phased out as was initially expected.

Items that qualify for the special rate allowance are items that are considered integrated items such as air conditioning, hot and cold water systems, and cars that have CO2 submission over certain levels. The remaining 50% then goes into the special rate pool, which means it will qualify for 6% write down in the special rate pool in subsequent accounting periods.

What is Annual Investment Allowance (AIA)?

Annual investment Allowance, also known as AIA, is a long standing capital allowance which was introduced in 2008. This allowance allows businesses to claim 100% of their capital expenditure made in a period up to a maximum level of expenditure. In January 2019, this maximum level was increased to £1million. Over the years, this maximum amount claimable for AIA has increased and decreased since it was introduced. The maximum has not been changed since 2019.

Unlike full expensing, Annual Investment Allowance can be used to claim relief on second-hand items. However, if you have a short period (less than 12 months) then only a pro-rata amount of AIA can be charged. If you had a six month period and were claiming Annual Investment Allowance, then you would only be able to claim half of the amount spent. The remainder would then be added to the main pool to claim further capital allowances in subsequent accounting periods.

How do I claim Full Expensing?

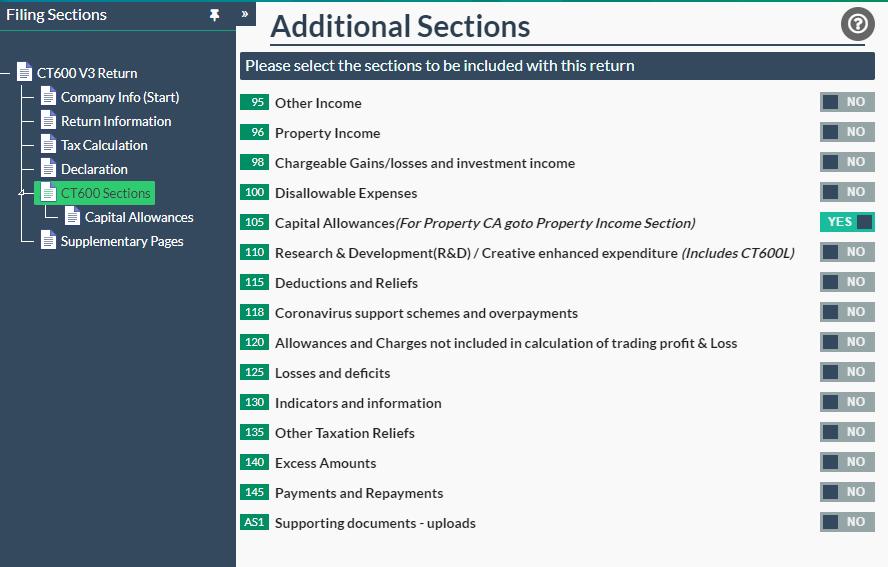

You can claim full expensing if you are using Easy Digital Filing to file your tax return. Once you have created your filings in your account, open up the CT600 and got to the capital allowances page:

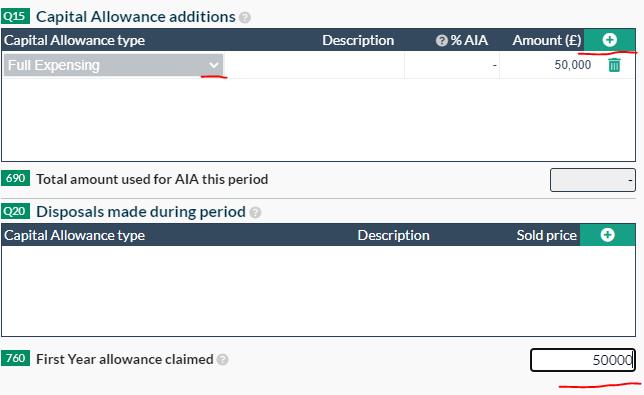

On the capital allowance page, click 'add an item' and then in the drop down box select the type of capital allowance you are claiming:

Don't forget to total all the first year allowances you are claiming and enter into box 760.

What does this mean for Small Businesses?

As most small businesses are unlikely to spend more than £1 million on capital allowances in an accounting period, there is no real benefit. For economical purposes, a lot of capital items may be purchased second-hand, meaning that small business would miss out on full expensing altogether.

However, if a small business has purchased items that qualify for the special rate allowance, then being allowed to claim 50% of the cost in a period would be beneficial.

For most small business purchasing main pool capital items, claiming Annual Investment Allowance will still remain the preferred option as this allows the cost of items that have already been used to be claimed.

Please also see our articles on Claiming Capital Allowance in a CT600 and Recording Fixed Assets in Company Accounts to continue your reading.