HMRC requires most companies to submit Full or statutory IXBRL Company Accounts as part of their Corporation Tax CT600 return. The size of your company will dictate which reporting standard you need to use. For Micro sized companies the reporting standard is FRS 105. In this article we guide you through the information you need to include to comply with FRS 105 to meet HMRC's Accounts requirements for corporation tax filing.

Step 1 - What are micro accounts, FRS 105 and IXBRL?

FRS 105 is a UK accounting standard for micro-entities regime.

A Micro Company is where two of the following apply:

- A turnover of £1 million or less

- A balance sheet total of £500,000 or less

- 10 or less employees

So a company's turnover can be £1.650,000, but if its Assets are less than £500,000, and has 10 or less employees it would still be classed as a micro and would be eligible to report under the FRS105 reporting standard for supporting Accounts for Corporation Tax filing.

IXBRL stands for Inline eXtensible Business Reporting Language. These are computer readable tags that we add to the information that you input into your Limited Company Accounts template to comply with HMRC's requirements.Ok, that's all the definitions over with, now let's get into the details of how to create your accounts using our micro entity accounts templates.

Step 2 - Lets get started

If you have not created an account, you can do so for free. If you already have an EasyDigitalFiling account,

logon and create a new IXBRL Accounts Filing template, either through QuickStart or by creating a new Micro Company filing (Filings Manager -> New Filing Button).

The Micro Company template consists of only 4 pages and the information you need to provide is very limited,

so if you have kept on top of your Income and Expenses through the year then you will have most of the information to hand.

Let's start with the easy bit - Company Information

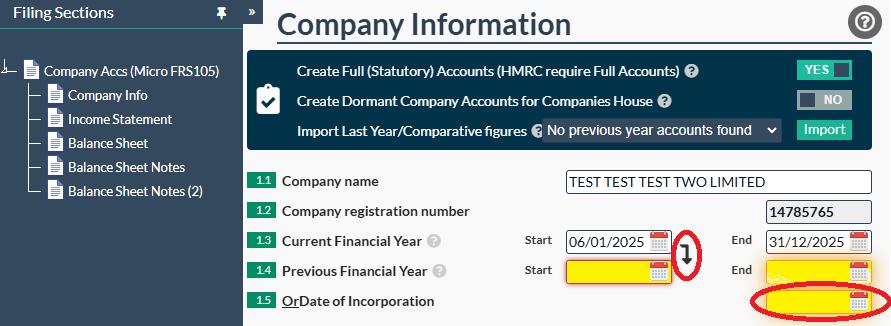

Most of your Company details will have been pre-populated if you selected your Company using the QuickStart,

the only fields you may need to complete are either Box 1.4 (Previous Financial year Start date) or Box 1.5 (Previous Financial year End date).

If you have been trading for longer than your current financial year please enter the start and end dates for your previous financial year in Box 1.4 using the copy function.

If you were incorporated during your current financial period or are creating your first financial year accounts please enter your incorporation date in box 1.5.

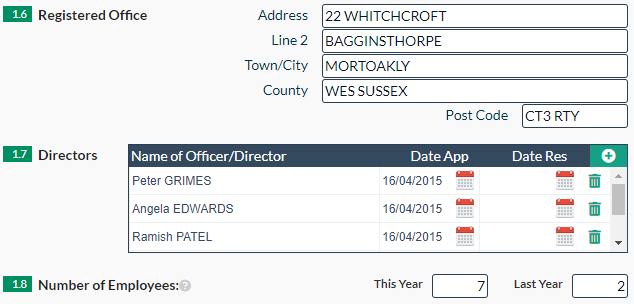

As mentioned above, your company registered address (Box1.6) and directors (Box 1.7) should have been pre-populated if you used QuickStart,

however its worth checking the format of the address (this information comes from Companies House Data, if it in incorrect please update at Companies House as well),

and also remove any directors who were not in office during the accounting period using the trash can symbol.

Finally, enter the number of employees for this and last year in Box 1.8.

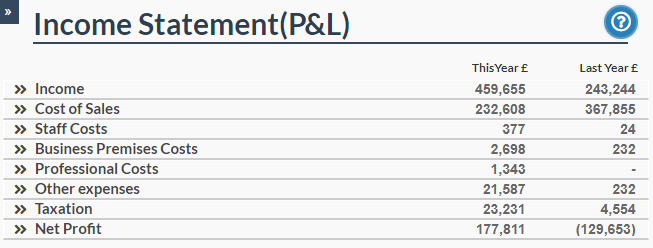

Step 3 - Income Statement

The income statement, also referred to as the profit and loss statement is a report of all the company's revenue, gains, expenses, losses,

net income and other totals

for the accounting period. It usually shows the year you are reporting for and the previous year's figures as a comparison.

If this is your first year of trading leave the comparative year's figures blank.

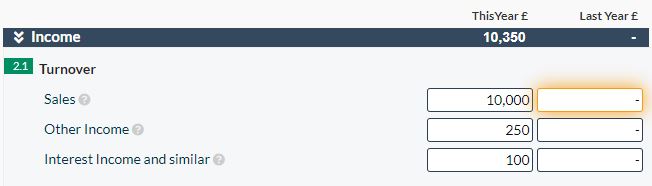

So let's start with income, this is split into 3 parts, income from trade (sales) from the main activity of the Company.

If you have any other income from other activities within the business enter in the next box and similarly if you have any bank interest enter in the last box.

These items will be added up for you and displayed in the top banner. Enter in the information for the Company's previous year if applicable.

The next 5 sections relate to the costs you have incurred during the trading year, these are divided into cost of sales, staff costs, business premises costs,

professional costs and other expenses. These are further sub-divided into more specific areas within these categories.

Just fill any of the boxes where your Company has sustained costs. Some may not be applicable, leave any that aren't blank.

In the meantime you will notice the net profit box at the bottom of the grid, calculates your profit as you go.

Finally, enter any corporation tax that is due (if you have completed our CT600 template, your tax will have been calculated for you, so simply copy the figure across). If you have no tax to pay leave blank. Your net profit will be updated and your income statement is complete!

Step 4 - Balance Sheet

Ok, now this is the part that most people find more tricky, let's take it step by step, please also see our article on balance sheet basics.

The balance sheet show the health of the business. It is divided into 3 sections:

- Assets - These are what your business owns, examples include fixed assets, such as computer equipment, plant and machinery, and company vehicles, cash in the bank and unpaid invoices.

- Liabilities - These are the debts your Company has, what your Company owes (its Creditors). Examples are outstanding taxes and any money you owe your suppliers - invoices the company needs to pay

- Shareholders Equity - This is the value of the shareholders investment in the Company. The equation for this is:

Shareholders' Equity = Total Assets - Liabilities

We will now go through each of the boxes and discuss the information you should enter into each one.

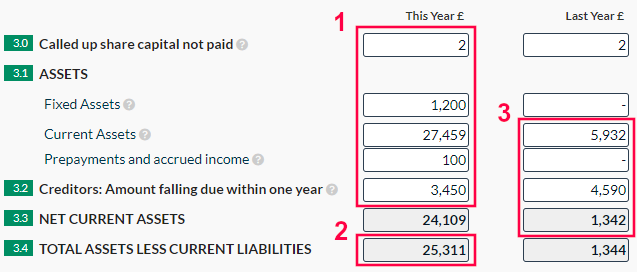

Box 3.0 - Called up share capital not paid. If you remember back to when you incorporated your Company with Companies House you would have declared: how many shares you were creating in the Company, the value you attached to these shares and whether they were paid or not. If they were not paid for and they haven't been since, then the value goes in this box.

If you have issued more shares since incorporating and these have also not been paid for, add the value to the initial value and enter in this box.

Keep a note of this value as when we get to creditors we will need it.

Boxes 3.1 - Assets, this is divided into 3 sections:

- Fixed Assets - include any items that you have purchased by your business that are for long term use, such as land, buildings equipment, or vehicles. Please see our article on CT600 fixed assets for more details

- Current Assets - this includes cash in the bank, or a resource you expect to convert into cash within one year. Resources are items such as accounts receivable (outstanding invoices), inventory/stock items that you have available to sell, and short term investments.

- Prepayments and accrued income - A prepayment is when you pay an invoice that covers more than one period. e.g if you pay office rent quarterly, depending on when

you paid your invoice you may have paid some rent that covers months outside the financial period you are reporting on. This part of the payment would count as prepayment.

Accrued income - this is income that has been earned but not yet received. An example could be bank interest that is already earned but will not be paid to the Company until after the end of the accounting period.

Box 3.2 - Creditors: amount falling due within one year. These is money that the Company owes to others. It maybe any unpaid taxes (such as Corporation Tax), or invoices you have received that are not yet paid.

Hopefully you still with me.

You will be pleased to know the next 2 boxes are added up automatically.

They are:

- Net Current assets - this is your current assets and pre-payments minus any Creditors(people the Company owes money to) due within a year (box 3 below).

- Total Assets - the same as above with fixed assets added in as well(box 1 and 2 below).

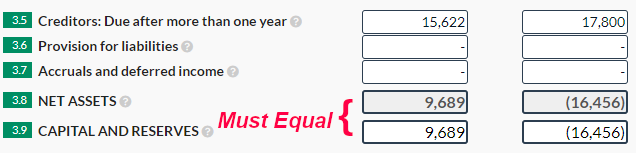

The Remaining part of the Balance sheet are the Creditors due in more that a year (long term loan etc),

any provisions (amounts you need to keep for liabilities e.g a known Tax bill), and any accruals

(where the company has received cash, but not yet provided the service). Details below:

Box 3.5 - Creditors - Amount falling due after more than one year. These are any long term liabilities that the Company expects to pay after a year. Examples might be loans or mortgages.

Box 3.6 - Provision for liabilities - This is the amount the business puts aside to cover a probable future debt/liability.

Box 3.7 - Accruals and deferred income - These are the opposite of prepayment and accrued income, so when the Company has received income but not yet provided the goods or service.

Box 3.8 - Net Assets - This is calculated for you. It is: Total assets minus creditors and accrued/deferred income.

Box 3.9 - Capital and Reserves - This is the value of the Company and must equal net assets. This figure is the total of profit or loss for this year, plus any

retained earnings from the previous year, paid for share capital minus any dividends taken during the financial period.

If you require any further information about accounting for your dividends please see our dividend article.

Step 5 - Balance Sheet Notes

There are certain statutory statements that must be included in your accounts.

These are the statements on the Company's exemption from audit, the directors' acknowledging their responsibility under the Companies Act and the account

preparation policy

To help you along we have included the standard wording for these in Boxes 4.3, 4.4 and 4.5. If for any reason you need to change them, you can edit these boxes.

The only other box you must complete is Box 4.2 - the principal activity of the company, a few words describing what the company does will be sufficient.

To finish we will just look at the other notes that can be added.

Box 4.0 - Directors advances, credits and guarantees. If the company has made any loans to any of the directors during the financial period make a note of it here.

Box 4.1 - Outstanding obligations - If you have any outstanding loans, you need to make a note of the nature of them in this box.

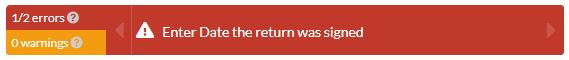

Finally, the only thing left to do is enter the date the accounts were approved by the board and enter the name of the director who signed the accounts on behalf of the board.

If you have any errors or warnings at the bottom of the template, please click on them and they will take you to the relevant section.

RED warnings will prevent you from filing with HMRC and must be addressed before you complete your filing.

AMBER warnings are there to help you with your filings. If they do not apply just accept the warnings when

you are ready to file.

And that's it! Accounts produced, ready to file to HMRC, now just complete your CT600, file and relax!