How to pay yourself as a director

If you are the director a limited company you can pay yourself through a salary, dividends or through a combination of the two. Taking a salary through PAYE means that you will technically be employed by your business so that even if it doesn’t profit, you are still entitled to payment. Dividends are only paid out as and when the board decides to distribute them, however they are not subject to National Insurance Contributions and any income tax is usually paid at a lower rate.

PAYE:

Pay As You Earn, (PAYE) is a payroll system set up by HMRC which covers tax and national insurance every month for employees. If you pay yourself through PAYE, you do not need to fill out a self-assessment tax return at the end of the year. To be paid as an employee through PAYE at your own company, you can register though your company's Government Gateway account.

If you are a business owner looking to pay your employees through PAYE, read our article 'How Do I Register for Payroll (PAYE) Services with HMRC' on the Easy Digital Company Knowledge Base.

- When paid through PAYE, directors are paid regular wages, which are reported on the income statement

- Wages are an allowable expense, reducing the amount of corporation tax due.

- Directors are charged tax on any wages they receive at the normal rate of income tax

Dividends:

Dividends are paid to shareholders or directors out of company profits, and at the discretion of the board. The number of dividends paid out depends on the amount of shares held by each person, and the amount to be paid cannot exceed the total company profit. If the company is loss making, shareholders typically do not get paid any dividends. If there is money left over from a business that has not made profit, any payment that is made to shareholders is considered to be a director's loan and must be repaid to the business.

- When paid through dividends, directors receive ad hoc payments, which are reflected on the company balance sheet

- Dividends are not an allowable business expense so they cannot reduce the amount of corporation tax due

- For the director, they will be charged tax on the dividends at the dividends tax rate, which is lower than the income tax rate

Tax Efficient directors payments

Company director pay though a combination of a salary and dividends is the most tax efficient way to be paid from your own business, and varies depending on tax thresholds for the financial year. Personal allowance before tax is currently £12,570 (unless you earn more than £100,000 in the tax year), and any salary above the personal allowance threshold is taxed at the normal rate of income tax. Tax on dividend payments is free up to £500, and then charged at a basic, higher and additional rate depending on which tax bracket you fall into.

How to account for PAYE

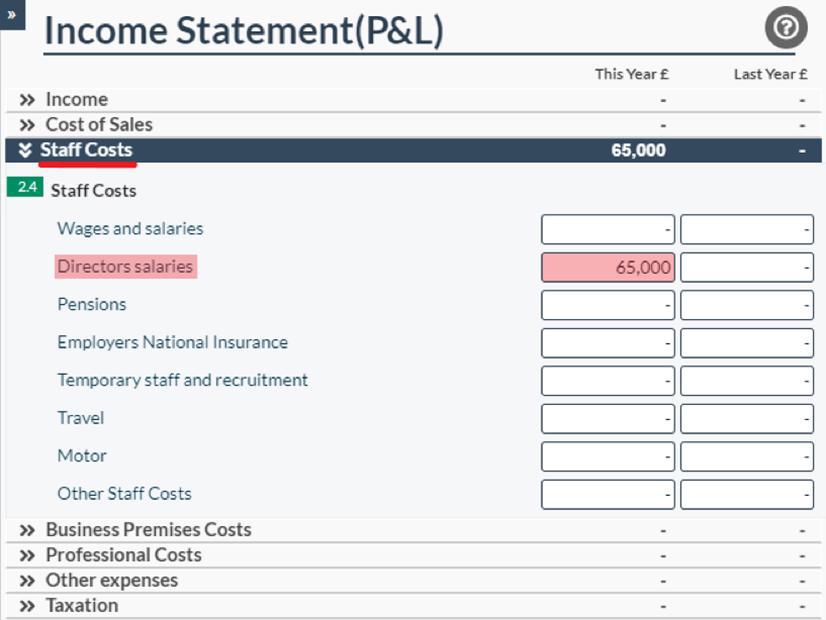

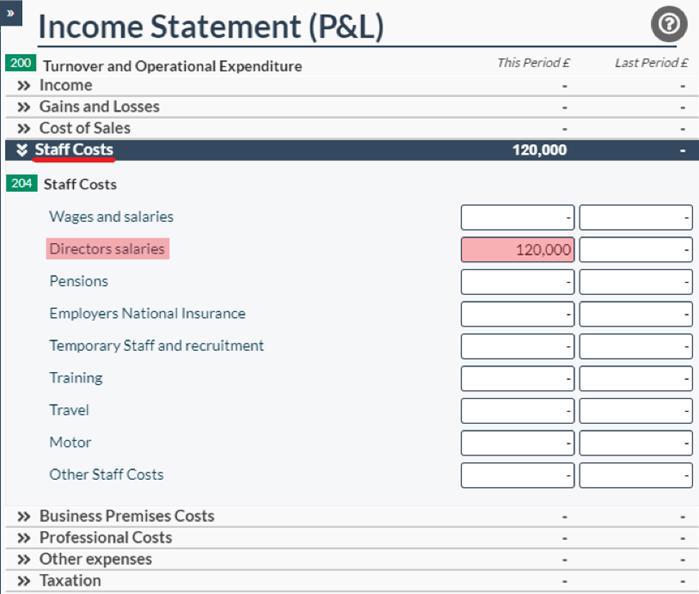

If you are being paid a wage from your company through PAYE, this is reflected on the income statement and would be considered as an allowable expense for the company, which is not reflected on the balance sheet. Typically, this is accounted for as 'Directors wages', reflected under Staff Costs. Our tax filing software, allows you to file as either a micro or small entity - with both options, the directors wages are reflected in the same way.

Micro Accounts PAYE:

Only wages should be entered into the director's wages section, national insurance contributions and pensions are filled in separately. Once entered into the income statement, this will affect the net profit by reducing it.

Small Accounts PAYE:

The small accounts template varies slightly from the micro accounts as it follows the Financial Reporting Standard 102, rather than 105 which is for micro accounts, however, the wages are still considered as 'Directors Wages' under Staff Costs.

Once again, this should only be entered into the income statement, not the balance sheet.

How to account for Dividends

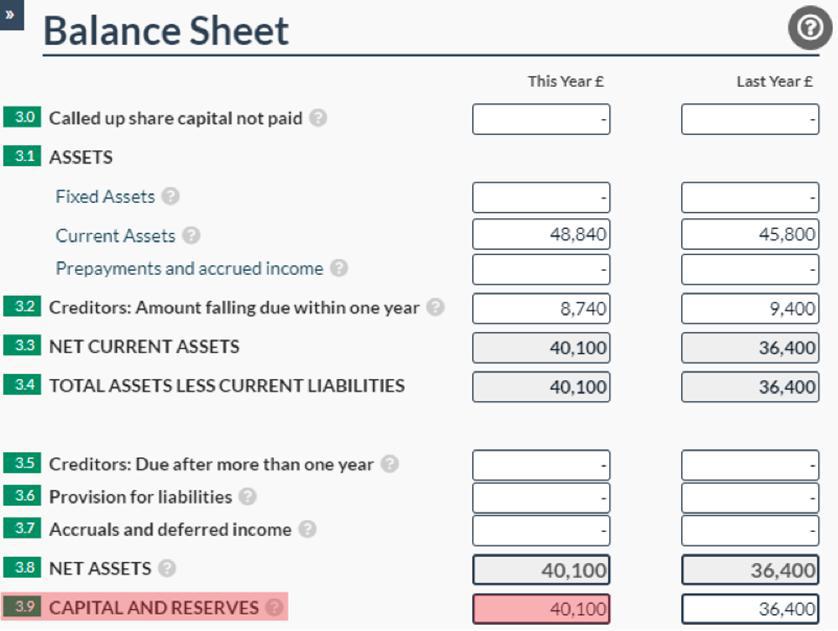

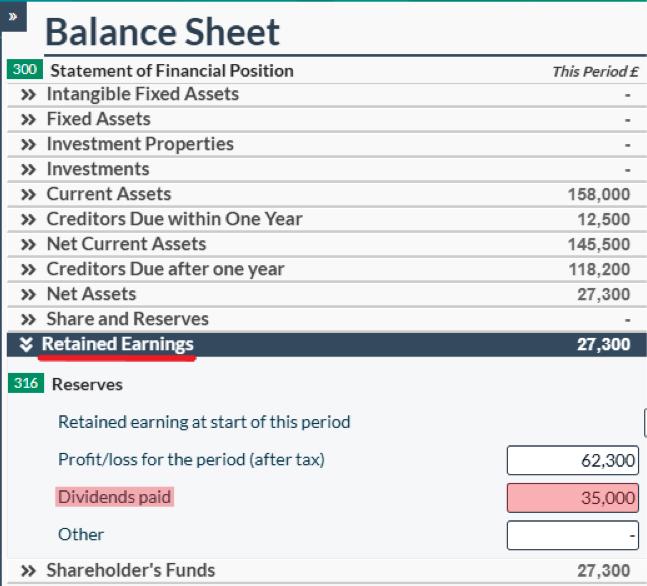

If you are being paid through dividends, these would only be reflected in the balance sheet. This is because dividends are not considered as an allowable expense for the company and cannot be used to reduce the corporation tax due.

They are reflected slightly differently in the micro accounts (under FRS 105) and small accounts (under FRS 102), however, are still only shown on the balance sheet, not the income statement.

Micro Accounts Dividends:

Micro accounts dividends are reflected in the capital and reserves figure, which is calculated by taking the capital and reserves figure from the previous period (if applicable), plus the net profit from this period, minus any dividends taken within the period.

There is no separate section for the figure to be entered on the balance sheet, however this will be shown in the capital and reserves figure.

Small Accounts Dividends:

Small accounts dividends are reflected in the shareholder's funds figure, which is calculated using the entries from the boxes under 'Retained Earnings'.

Unlike the micro accounts section, you don't need to calculate the Shareholders' Funds figure yourself, as the software will automatically calculate it for you based on the entries in the 'Retained Earnings' and 'Share and Reserves' sections.

For more on how to reflect dividends in your accounts, please feel free to read our related article 'Dividends in Micro Company Accounts' available on our Knowledge Base.

Dividends vs Salary - How does it affect tax?

Salary payment

As an allowable expense, paying yourself a salary can reduce corporation tax, which is usually between 19% and 25% of taxable turnover. However, you will still be required to pay a standard rate of income tax on your salary, so while the business is taxed less, you will personally pay more tax compared to a dividend payment. PAYE is taxed every month at a rate of 20%, 40%, and 45% depending on your total earnings over the financial year. So many company owners choose to pay themselves a lower salary and top up their earnings with dividends to pay an overall lower rate of tax.

Paying yourself dividends

As a disallowable expense, dividends should be paid out of company profits after any corporation tax is due, so they can't be used to reduce the company tax bill. However, they are charged at a lower rate than salary payments starting at 8.75% for earnings above the £12,571 personal allowance threshold, compared to 20% for PAYE. Company Directors are responsible for reporting and paying tax on dividend income through the SA100 Self Assessment tax return

For more information on the varying tax rates, please feel free to check out our article ‘Corporation Tax vs. Dividend Tax: A Detailed Comparison for Businesses’ on our Knowledge Base.

This Article describes how to report salary and dividends in your company accounts. To find out more about Self Assessment or CT600 Tax Filing, visit Easy Digital Filing and start using our software with a free account.