Capital allowances can be a confusing area. They are associated with different terms - you may hear fixed assets, tangible fixed assets, capital allowances, depreciation, write down value, balancing charge ....need I go on? So in this article I will explain what they mean, and how to treat them on your CT600. As this is such a large topic, please see our knowledge based article on fixed assets in accountsto see how to treat them in your accounts.

What are Capital Allowances?

Capital Allowances are allowances for items purchased for your business that you expect to use for longer than a year. These items are equipment such as computer equipment, furniture, machinery or vehicles that you use in your business. You can deduct some or all of the value of the item from your profits to reduce your corporation tax bill.

These items will also be shown on your balance sheet, however, they are treated differently on your balance sheet and this often causes confusion, but read on and hopefully we can shed light on this. Remember this article is about the CT600, the calculations of capital allowances and the treatment of capital items for tax purposes.

You may have heard of the term "pools" as well. We will just keep this article to main pool and special rate pool, as they are most applicable to small and micro business.

Items that qualify as a capital item are plant and machinery, computer equipment cars/vehicles (see below), part of a building - known as integral features such as a fitted kitchen or bathroom suite or fixed air-conditioning, and alterations to buildings to allow for installation of plant and machinery (not repairs though).

You cannot claim for things you lease, buildings including doors, gates, mains water or gas systems.

Annual Investment Allowance

Each tax year, a company has an annual investment allowance. This is the maximum that a company can claim in any one year against their corporation tax bill. From 1st January 2016 to 31 December 2018 it was £200,000 per year. From 1st January 2019 to 31 December 2020 it is £1 million.

If you purchase capital items in your tax year you can choose to use the whole amount in your tax calculation, providing it is below the annual limit or uses part of it. If you only use part of it or have exceeded the annual investment allowance, then the remainder is eligible for write down allowance (see below).

To claim annual investment allowance open up the capital allowance page either by clicking the calculator button from the tax calculation page, or by selecting in the supplementary section.

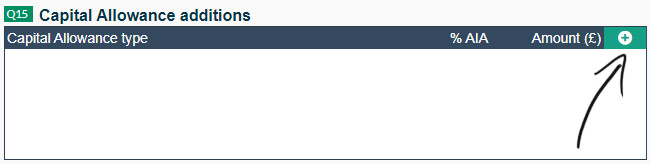

Go to the Capital Allowance additions section and click add:

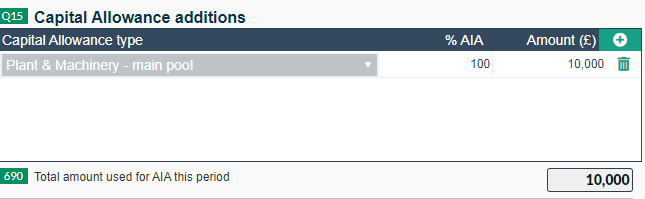

In the dropdown box that appears select the type of pool the item falls into.

Main Pool items includes the majority of equipment bought by your business. Do not include cars with high CO2 emissions, see below.

Special rate pool items are certain building fixtures or integral features of buildings, such as electrical systems (wiring), lighting, heating or ventilation systems, long-life assets (these are items that you would expect to have a useful life of 25 years) or vehicles with higher CO2 emissions.

Enter the cost of the item and the percentage of the cost you want to claim. The annual investment allowance will automatically be calculated. If you are not claiming 100% of the cost of the item, the remainder will have write down value calculated for you and added to your return.

Super Capital Allowances

From the 1st April 2021 until end of March 2023, HMRC have introduced super-deductions for purchases of capital items. Please see our Super deductions article to see how this change could benefit your company.

Vehicles

If you are claiming capital allowance for a car or company vehicle the pool it belongs to depends on its CO2 emission, the table below shows which pool it belongs to and what you can claim (for vehicles purchased from April 2018):

| Description of Car | Pool | Claim |

| New and unused, CO2 emissions of 56g/KM or less or electric | Main* | 100% |

| Second hand, CO2 emissions of 110g/km or less or electric | Main | 18% writing down allowance |

| New and unused, CO2 emissions between 56g/km and 110g/km | Main | 18% writing down allowance |

| New or second hand, CO2 emissions above 110g/km | Special | 6 or 8%** writing down allowance |

| * if your company has already claimed the maximum annual allowance then this can be claimed as first year allowance | ||

| ** 6% from 1st April 2019 | ||

Write Down Allowance

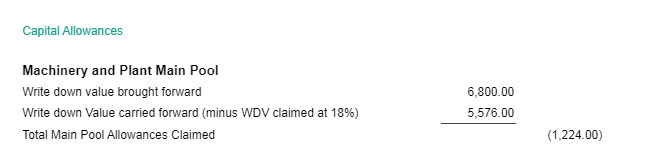

If you have not used the full purchase price of your asset in your corporation tax calculation or if you have a vehicle as set out above, you qualify for write down allowance. The rates of write down allowance are set by HMRC (note this is different from depreciation - see our fixed assets article). The write down allowance amount you are allowed to claim depends on which pool your asset is in.

If your asset is in the main pool then the amount of write down allowance is 18%/year and if it is in the special rate pool it is 6%/year (from April 2019, prior to this it was 8%/year).

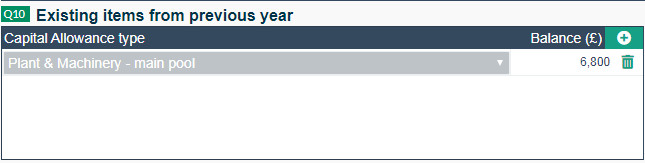

To claim write down allowance open up the capital allowance page and in Box Q10 (Existing items from previous year, this is also the where you would add vehicles that do not qualify for 100% relief).

Select the pool that your item falls into and enter in the amount that was either brought forward from the previous year or the purchase price, if the item is a vehicle. We will then calculate the amount of WDA you are entitled to. If you look at your computation you will see how we have calculated this.

The carried forward value will be the amount you enter in this section when you complete your CT600 in your next financial year.

Disposals

If you sell an asset you have claimed capital allowances for, the value of that sale needs to be deducted from the balance of capital allowances or added to your taxable profits. If you have any write down allowances or capital allowances it is deducted from these. If you don't have any write down allowances or capital allowances or insufficient to cover the value of the sale, it is added to your profits. This is called a balancing charge.

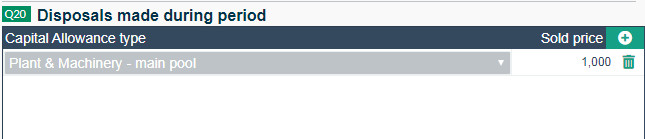

To add the value of a sold asset into your tax calculation, open up the capital allowance page and in Q20 add in the item by selecting which pool it was in and the amount you sold it for.

Our software will then calculate how much tax you need to pay, depending on the data you have entered in boxes Q10 and Q15.

To see how to deal with assets in your accounts, please see our article.