Accounting Glossary of Terms

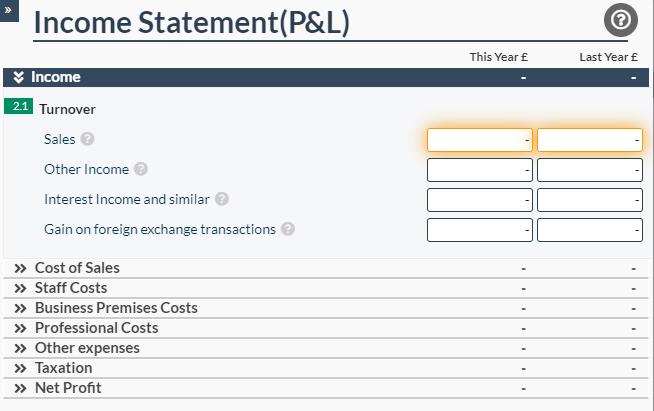

Income statement: You may also hear this referred to as the Profit and Loss statement. This includes all your income and expenditure and displays your net profit or loss for the whole accounting period.

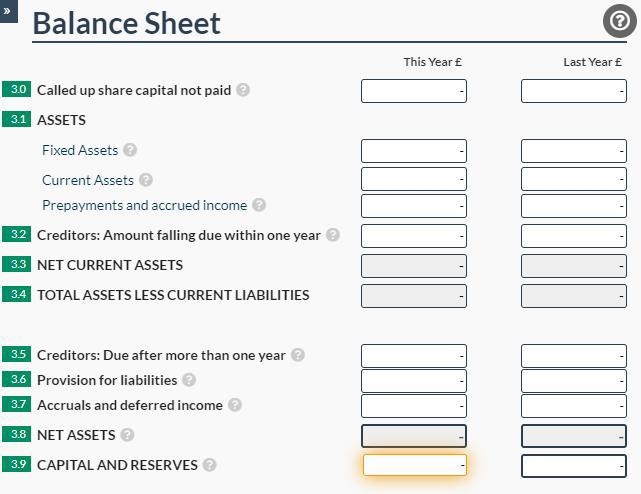

Balance Sheet: The balance sheet or Statement of Financial Position displays all the company’s assets, liabilities and capital at a certain point in time. As the name suggests the balance sheet must ‘balance’. This means your total net assets must equal your total capital and reserves.

Useful terms related to the income statement

Turnover: This is the total income arising from a company’s operations. This is inclusive of trading income, income from interest paid to the company and gain on foreign exchange transactions.

Cost of sales: This includes all costs incurred by the company to produce its main trade or service. Purchases, hire of plant and machinery, carriage, subcontractor costs and distribution costs should all be included here.

Gross profit: Sometimes confused with net profit, gross profit is the cost of producing an item less the amount it's sold for, this is calculated as your sales less costs of goods sold

Net profit: Your net profit will be the figure left once all of the company's expenses for the period including taxes have been deducted from all of the company’s income for the period. If this figure is a positive number it can be carried forward as retained earnings or paid as dividends.

Using Easy Digitals software you will be able to fill in your Income Statement and submit to HMRC.

Useful terms relevant to the balance sheet

Accounts payable: The money a company owes to its creditors for goods/ services which have been provided but not yet paid for, these are included on the current liabilities on the balance sheet.

Accounts receivable: The money owed to a company by its debtors for goods/ services which have been received but not yet paid for. These are accounted for as current assets on the balance sheet, and turnover on the income statement if using the accrual method of accounting.

Amortisation: A method of calculating the current value of an intangible asset by assessing its consumption rate over its useful life.

Asset (current): Assets are divided into two sub categories, current and fixed assets. A current asset is differentiated from non current assets by its lifespan. A current asset (if not already cash) is expected to be converted to cash within a year. Examples of current assets include:

Cash

Short term investments

Accounts receivable (money owed to the company but not yet received)

Inventory

Pre-paid expenses (an expense paid before its due eg. bills)

Assets (Fixed): Assets falling under the fixed category are assets which are not expected to be converted to cash within a year, this could be property, plant and equipment.

Capital and Reserves: This amount must equal your net assets for the balance sheet to be correct. It is the value of the company and includes the total profit or loss for the period, plus any retained earnings from the previous period and share capital. If dividends are paid this should be deducted from the capital and reserves figure.

Creditors due within one year: Also referred to as current liabilities, these are financial obligations (debts) owed by the company which are due within one year, examples include short term loans to the company, tax payable and overdrafts

Creditors due after one year: Also known as non current liabilities, these are financial obligations (debts) owed by the company which are due for repayment after a year, examples include long term loans and finance leases

Depreciation: This is the reduction in value of a long life asset over its useful working life normally calculated by dividing an assets initial cost over its useful working life. The cost of an asset less its accumulated depreciation is known as the carrying value.

Intangible assets: These are assets with no physical substance, examples of this include patents, softwares and good-will.

Using Easy Digitals software you will be able to fill in your Balance Sheet and then submit to HMRC and Companies House.

Other useful accounting terminology

Accounting period: The accounting period is the length of time your financial statements should cover. This should be a year unless it is your first accounting period in which case it may be slightly longer based on the date of incorporation or if you have agreed to change your accounting dates with Companies House.

Accruals: This is an amount of money that has been earnt but not received or spent but not yet paid. If owed to the company the amount will be added to the assets on the balance sheet, if the company owes the amount then this will be included on the liabilities instead.

Bad debt: This is the figure of outstanding balances owed to the company that must be written off due to the debtor not being able to pay

Book value: This is the valuation of an asset or company based on the figure in a company’s ‘books’ or balance sheet. This figure may not necessarily represent the amount an asset would be sold for but is used for tax purposes as it accounts for depreciation.

Break even: The point at which a company’s revenue is equal to its expenses during an accounting period

Capital allowances: A type of tax relief which allows a percentage of capital expenditure ( fixed asset purchases) to be deducted from taxable profits

Carrying Value: Often used interchangeably with the book value, the carrying value is the original cost of an asset less any accumulated depreciation or amortisation.

Creditor: Money that a business owes to other people or organisations

CT600: This is a part of the tax return required by HMRC and should be accompanied by full accounts for the accounting period

Debtors: Money that is owed to a business by other people or organisations

Disallowable expenses: An expense that is not deducted from a company’s profits, therefore not reducing tax payable. This may be due to the expense not being “wholly and exclusively” used for the purpose of the businesses trade such as a travel fare that is not business related but noted on a company’s expenses, deprecation is another example of a disallowable expense.

Dividend: This is when a portion of a company’s profits are paid out to its shareholders, this amount should be deducted from the capital and reserves figure on the balance sheet

Equity: The sum of money that would be returned to a company’s shareholders once its assets had been liquidated and debts paid.

Exit value: This is the amount that would be received if an asset or company was to be sold. To attain a reliable figure the sale should not be rushed and should be derived from an independent third party. The exit value is often considered when making investment decisions.

Fair value measurement: As dictated by IFRS 13, the fair value measurement is the monetary amount that would be received from the sale of an asset during an orderly transaction between market participants at a set measurement date.

Fiscal year: Also referred to as the financial year, this is the set yearly period used for tax and accounting reporting purposes, in the UK the corporate tax year runs from the 1st April to the 31st March the following year. This should not be confused with the personal tax year which runs from the 6th April to the 5th of April the following year. The date a company is due to submit filing as pay tax is based on its own accounting period rather than the fiscal year.

Goodwill: Goodwill is an intangible asset and occurs when an asset is purchased for more than its fair value. The amount paid which is over the fair value of the asset is classed as the goodwill payment.

Holding company: These are parent companies whose primary activity is the control of ownership interests in other companies (subsidiaries). A holding company will not run the day to day activities of its subsidiaries but takes ownership in terms of it being the majority shareholder. A well known holding company includes Unilever.

Impairment: Under FRS 102 impairment is referred to when the carrying amount of an asset is less than the recoverable amount. In other words there has been a large decrease in the price of an asset, this could be due to damage, or a sharp decrease in selling prices. Impairment can be applied to both tangible and intangible assets. The impairment charge is the monetary amount needed to bring the carrying amount to the recoverable amount.

Incorporation date: The legal date a company was formed and placed on the Companies House register

Dormant company: A company that is not actively trading, it should have no trading transactions or other significant income

Liquidity: The ease of converting an asset to a cash amount, for example stock would be considered fairly liquid whereas a non current asset such a land would not.

Market value: This is the value a buyer would be willing to pay a seller for an asset in the financial market according to its market participants. Depending on the asset, market value may be volatile in nature due to its dependency on the economic climate and supply and demand.

Micro company: A company is defined as micro if it meets any of the following two requirements, a turnover of £632,000 or less, £316,000 or less on the balance sheet or 10 employees or less. Due to a micro companies size they are exempt from an audit.

Offsetting losses: If a company makes a loss during an accounting period it can carry this amount forwards or backwards against profits made in another period. This reduces the tax payable. It is also possible to offset losses against other income.

Opening balance: The amount of cash in a company’s account/s on the first day of its accounting period

Overheads: Ongoing business expenses not directly related to the company’s main trade such as office rent

PAYE: This is HMRC’S system to collect taxes due from personal employee income such as income tax and national insurance from source. The employer then passes the collected tax onto HMRC.

Petty Cash: A small sum of money kept on hand to cover minor expenses such as office supplies. A record should be kept of any petty cash transactions.

Realised gain: The income amount received for the sale of an asset which is higher than its original purchase price. A realised gain is when a monetary amount has been received and the asset sold, an unrealised gain occurs when no sale transaction has occurred and no money received although the gain is recognised on paper.

Retained Earnings: This is the earnings remaining from the net profit once dividends have been deducted. To calculate a company's total retained earnings the net income or loss should be added to the previous years retained earnings, any dividends paid should be deducted from this figure.

Share capital: The total value of shares issued by a company to its shareholders.

Small Company: A company will be defined as small if it meets any of the following two requirements, a turnover of £10.2 million or less, £5.1m or less on the balance sheet or 50 employees or less. Due to the size of a small company it will be exempt from an audit.

Variable Costs: These are expenses that fluctuate in cost proportionally to production or sales volume, a good example of variable costs are delivery charges.