Sometimes deadlines surpass us and we hand things in late - but what happens if you miss the deadline for filing your annual corporation tax returns? If you are not able to submit your annual returns to HMRC or Companies House by the date that they are due, then you may be fined a late filing penalty.

How much is a late filing penalty?

The late filing penalties for HMRC and Companies House vary depending on how late the filing is, and which filings have not been submitted.

If you do not submit your annual accounts to Companies House by the filing deadline, but you submit it within one month of that, then the late filing penalty is £150 (for a private company or LLP). If you file it between 1 and 3 months late, then the late filing penalty increases to £375, and the penalty continues to increase the later you file it, with the maximum fine going up to £1,500 for filing after 6 months.

You will not be fined if you do not submit your Confirmation Statement to Companies House on time, however, if it is not filed by a certain date after it is due, then your company may be struck off the register and dissolved by Companies House. It is important to always keep on top of your filings and their deadlines to ensure you do not miss anything and avoid any unfortunate circumstances.

If you do not submit your annual corporation tax returns to HMRC by the deadline, then you may also be given a late filing penalty, however, you can also be charged interest on any corporation tax that is owed as well, if not paid by its deadline. Corporation tax returns are due 12 months after the accounting period end date, however, any corporation tax due is to be paid 9 months and 1 day after the end of the accounting period.

If the filing is late by 1 day, then you will receive a late filing penalty of £100, but if it is submitted within 1 day and 3 months of the filing deadline, then you may be fined another late filing penalty of £100. Up until 6 months after the filing deadline, your Corporation Tax bill will be estimated by HMRC and a penalty amounting to 10% of the unpaid tax will be added as another fine. Another 10% will be added after 12 months as well.

It is important to remember to file your returns on time to avoid any late filing penalties!

But what happens if I do get fined? Where do I account for that in my filings?

While it is unfortunate to be fined for late filings, it is still crucial to account for these on your returns during the next accounting period - so here I will break down how to do that.

Interest:

As mentioned, if there is any corporation tax due and you are not able to make the payment by the due date, then you will be charged interest on the total amount. The current interest rate that is charged on late corporation tax payments is 7.75%. The interest that is charged on the late payments is deductible for corporation tax purposes, so you can include this as an allowable expense. You will need to add this as an interest expense in the income statement, and then you will also need to include this as an interest expense in the CT600 (corporation tax) return. Here is how to account for this on your filings:

Example 1: Accounting for interest

In this example, we will assume that the company's corporation tax due for the previous period was £367.84, and that they paid this three months after it was due. This means that they paid a total interest of £92.33:

| Interest | Balance | |

| Start | £367.84 | |

| Month 1 | £367.84 x 7.75% = £28.51 | £396.35 |

| Month 2 | £396.35 x 7.75% = £30.72 | £427.07 |

| Month 3 | £427.07 x 7.75% = £33.10 | £460.17 |

| Ending | £92.33 | £460.17 |

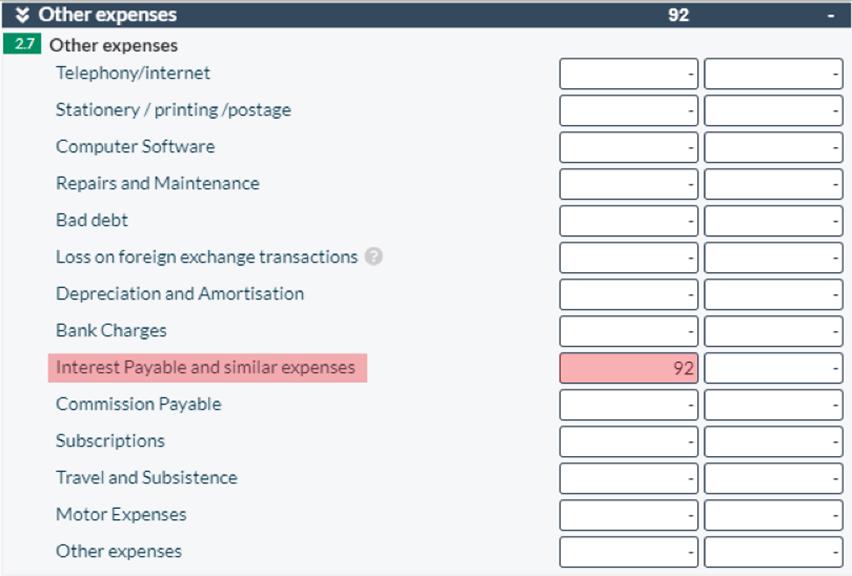

Now that you know how much interest was charged on the late corporation tax payment, you will be able to add this to your income statement as 'Interest payable and similar expenses'. For this example, we will also assume that the company has had £4,530 of income, and £3,260 of direct costs.

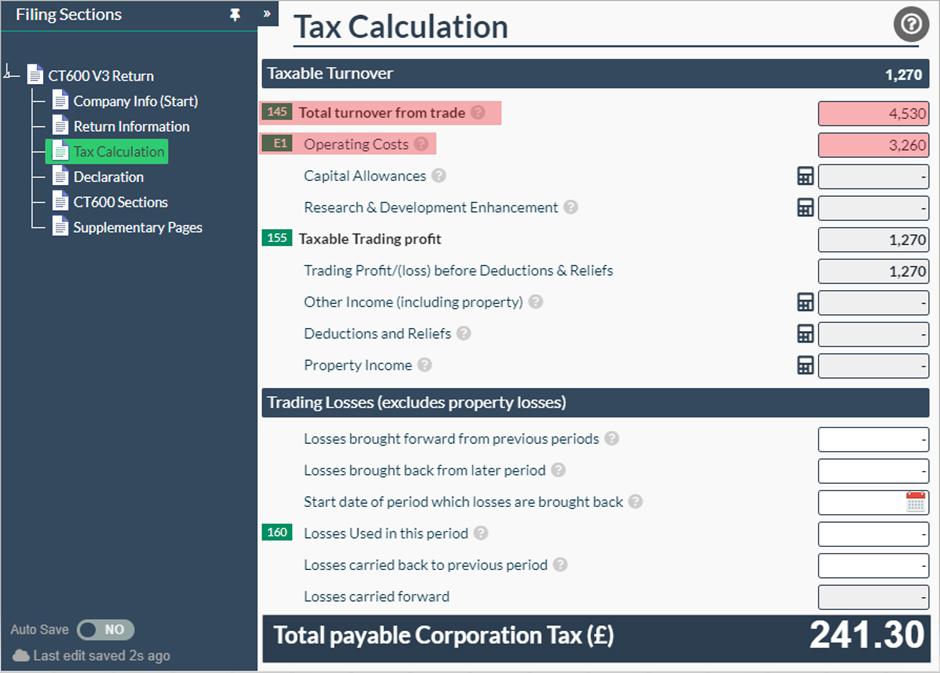

Then, once you have completed the income statement, you can enter the total income and expenses into the CT600 return. In this example, the company we are filing for is trading company, so the income and expenses will be entered into boxes 145 and E1.

As the interest is an allowable expense, you can include this in your CT600 return, which will then reduce your taxable profits, however, this is not included in your 'Operating Costs', and is accounted for separately in the 'Non trade loan relationship deficits' (NTLD) section instead.

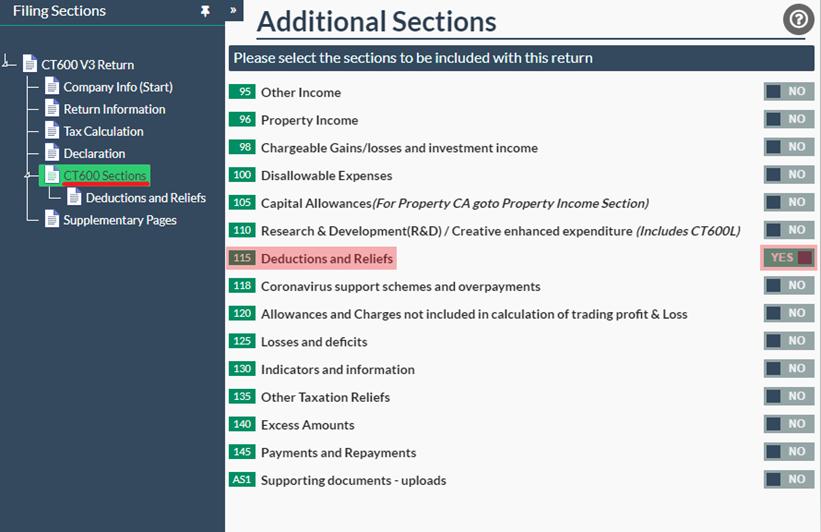

First, you will need to click on the 'CT600 Sections' tab in your CT600 return filing template, and then switch box 115 (Deductions and Reliefs) to 'Yes'.

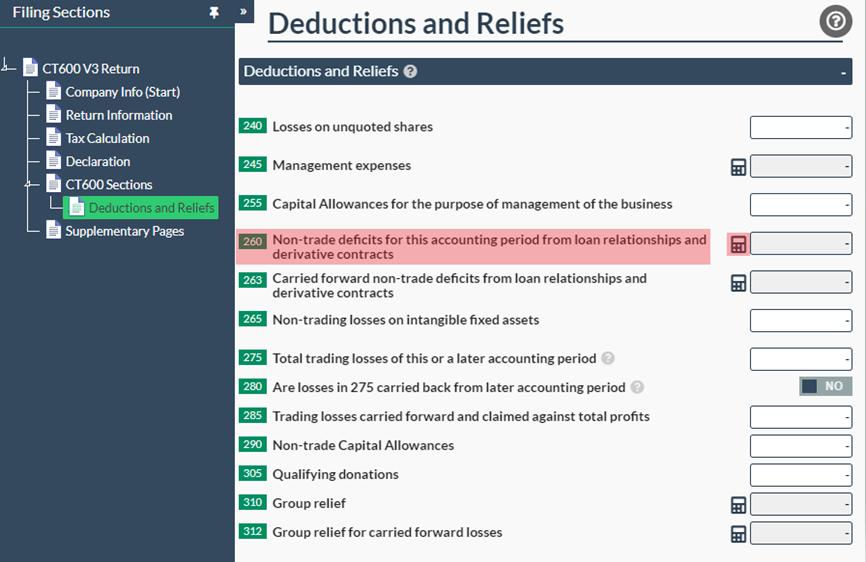

Then, once on the 'Deductions and Reliefs' page, you will need to click on the calculator icon next to the box for 'Non-trade deficits for this accounting period from loan relationships and derivative contracts' (which is box 260).

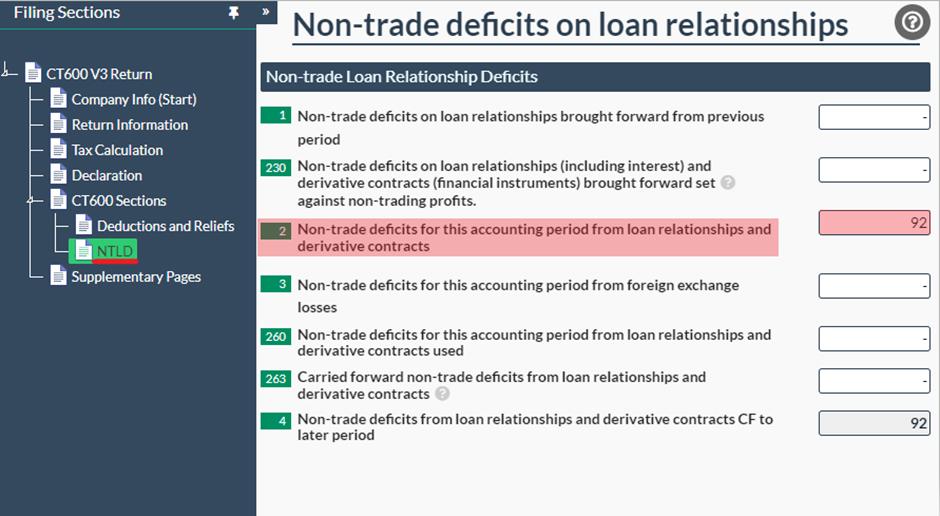

This will then create the 'Non-trade deficits on loan relationships' page, where you can enter the total interest charged in box 2.

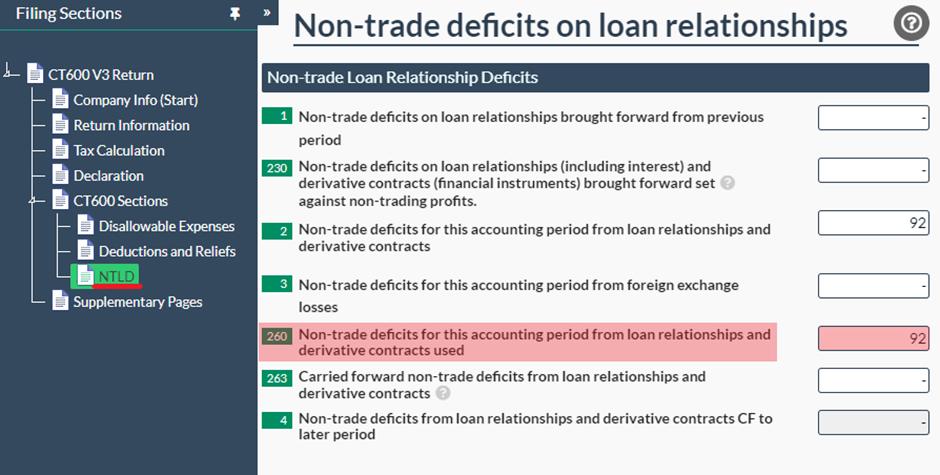

These are now considered as losses carried forward, however, you can use these losses against your taxable profit to reduce it, and, essentially, have them considered as an allowable expense (as they would reduce your taxable income by that amount). To do this, you will need to enter the total losses you wish to use, which, in this case is £92, into box 260 on that same page (the NTLD page):

Please note that you can only use the losses in the accounting period if there is a taxable profit, however, if the company is already loss making, then they can be carried forward instead and used in the future against your taxable income.

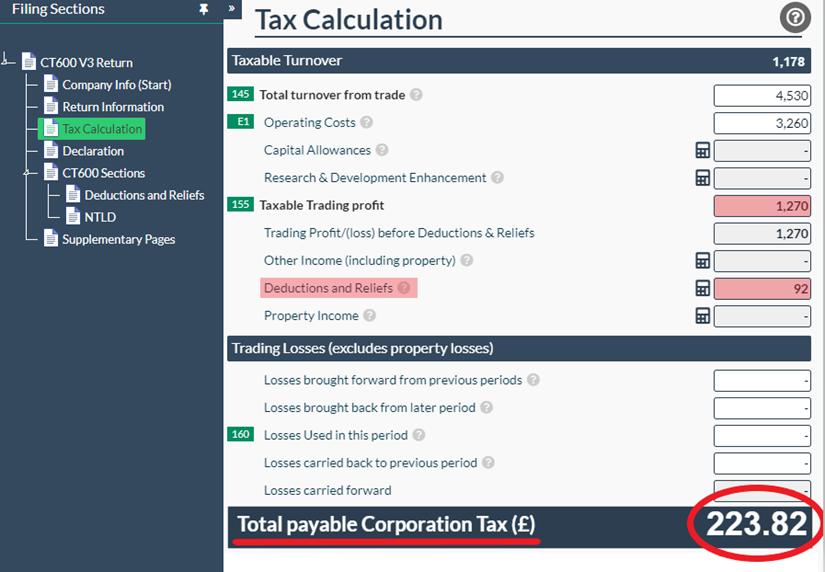

As you can see below, the £92 was deducted from the total profits, thus reducing the corporation tax which is due.

So, just to break it down for you:

£4,530 (income) - £3,260 (expenses) = £1,270 (taxable profits).

Then, £1,270 (taxable profits) - £92 ( interest "losses" an allowable expense) = £1,178.

£1,178 (taxable profits after deductions and reliefs) x 19% (the corporation tax rate for small profits) = £223.82 (which is the total corporation tax due).

So, that is how to include the interest charged on late corporation tax payments. However, what happens if I actually receive a fine for filing late? Let me show you how to account for this as well.

Late filing penalties:

As previously mentioned, fines from late filings to either Companies House or HMRC are a disallowable expense and therefore are not tax deductible, however, they still need to be accounted for on both the income statement and the CT600 return.

Example 2: Accounting for fines

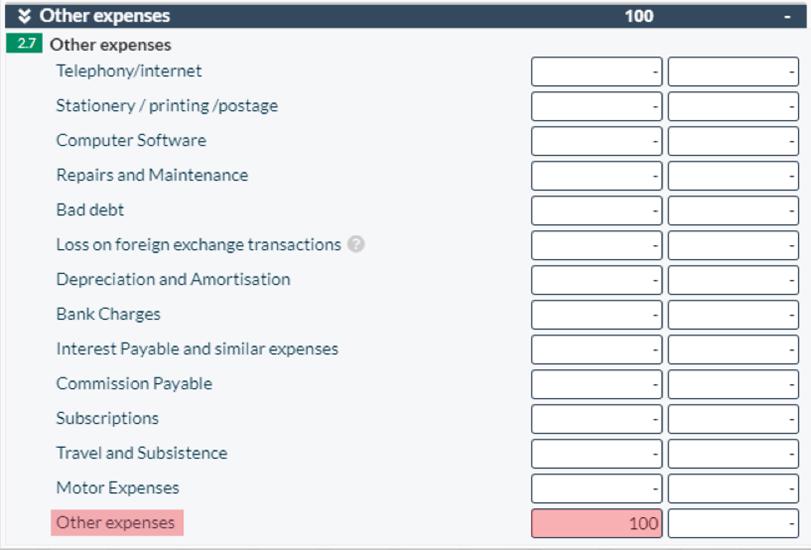

In the income statement, you can place the fines in any box that you feel is most appropriate. In this example, we will assume that the company did not file their annual corporation tax return by the deadline, and were fined £100, until they submitted it a month later. We will also assume that they had total income of £7,980 and total expenses of £4,510 for this accounting period. First, you need to enter these into the income statement of your company accounts filing template. In this case, I will consider the £100 as 'Other Expenses' and will place it in this category on the income statement.

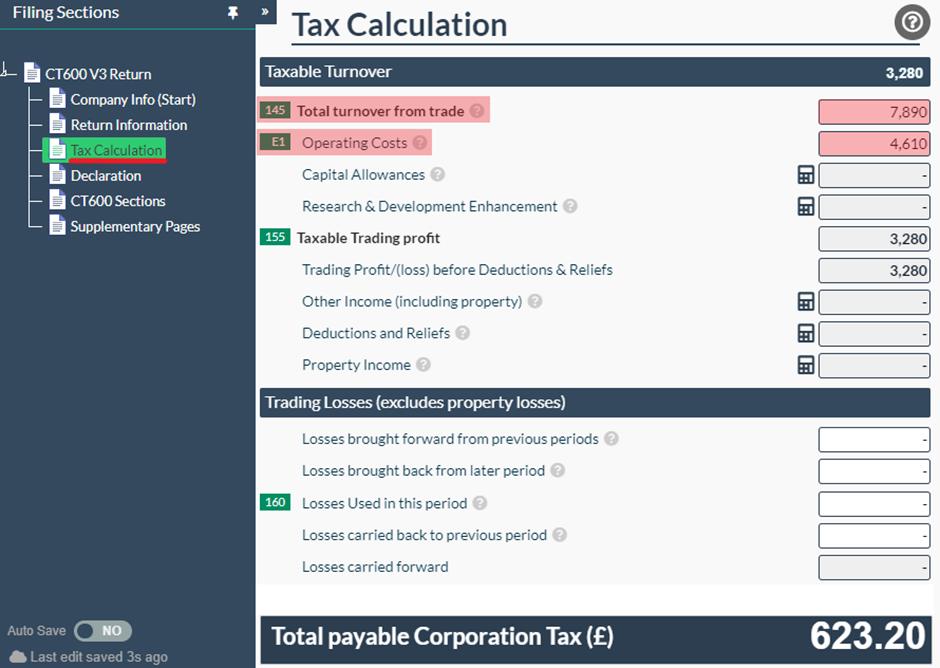

Since the fines are a disallowable expense for corporation tax purposes, they need to be considered declared as a disallowable expenses when completing the CT600 return. First, you need to take the total income and expenses (including the fines) and place those figures in box 145 (Total turnover from trade), and box E1 (Operating Costs), respectively, on the 'Tax Calculation' page of the CT600 return.

So, the total expenses to be entered into box E1 is £4,510 (which were the total expenses), plus the £100 (of fines), which equals £4,610.

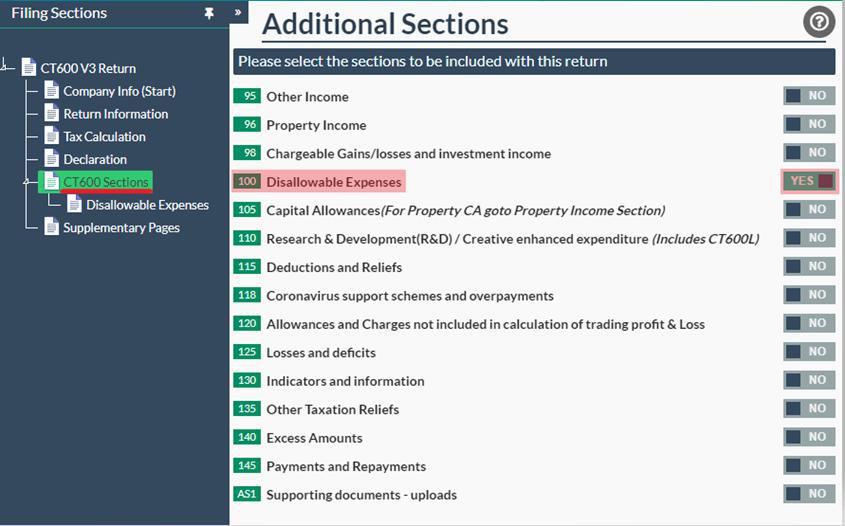

Then, you need to head to the 'CT600 Sections' tab and switch box 100 (Disallowable Expenses) to 'Yes'.

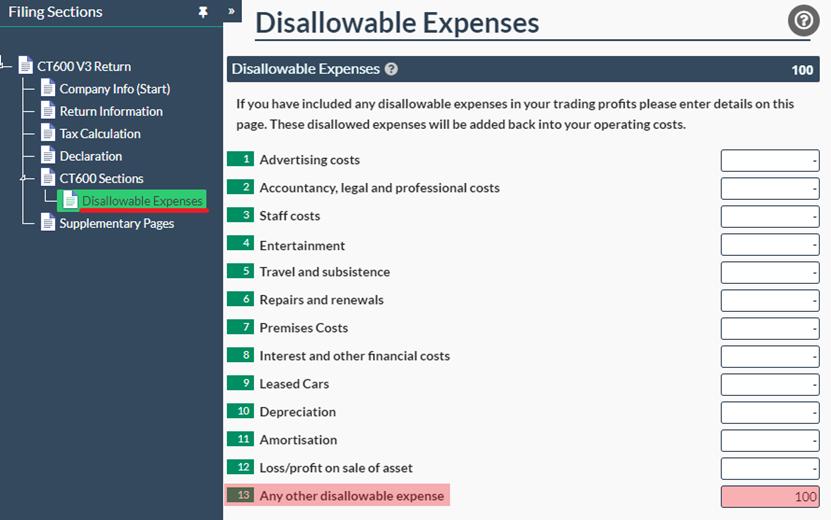

This will then create the 'Disallowable Expenses' page, where you will need to enter the total fines in box 13 (which is 'Any other disallowable expenses').

This will then add back the disallowable expense to your taxable profits, since it is not an allowable expense, thus increasing the corporation tax due.

So, at first, the taxable income was £3,280 (£7,890 - £4,610), making the corporation tax due of £623.20. However, after adding the £100 as a disallowable expense, the taxable income is increased to £3,380 (which is £7,890 - £4,610 + £100), making the corporation tax due of £642.20. For more information on this, please feel free to check out our article titled 'Disallowable Expenses'.

Summary

So, to conclude, here are the key rules to remember when filing for a company who has had received either a late filing penalties, or made late corporation tax payments:

- Corporation tax penalties and Companies House fines are not tax deductible, so they must be included as an expense in your income statement and then added back as a disallowable expense in your CT600 return.

- If you are not able to make the corporation tax payment by it's due date, then you may be charged interest on top of the amount due - this interest can be considered as an allowable expense in both the income statement and when completing the corporation tax return.

Hopefully you won't have experience any filing penalties, but if, unfortunately, you do, then now you should have a better understanding of how to account for them in your annual returns!