What is Exporter Information?

Within the Corporation Tax Return (CT600) there was a new section which was initially added in 2022 for Exporter Information. It was then formally introduced into the CT600 in 2023. The Exporter Information section asks companies to provide information on whether they exported any goods and/or services to parties outside of the UK during the accounting period that is being filed.This section was introduced by HMRC to collect information about companies that export goods and services to parties outside the UK. This information is then shared with the Department for Business and Trade.

The Department for Business & Trade is a new ministerial department of the Government which was established on the 7th February 2023. Its purpose is to advise and support British businesses and to help them to export their goods and/or services to parties outside the UK. The information collected by HMRC is used by the Department for Business and Trade to help them provide high quality support to UK companies that export their goods and/or services.Where Can I Find The Exporter Information Section in the CT600?

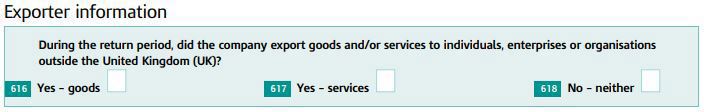

The exporter information section can be found within the CT600 V3 form. The exact location where it can be found is on page number 7. Here you will find the three boxes numbered 616, 617 & 618. Please see the image below which shows how these boxes are presented on the CT600 form:

Box 616 - Yes - Goods | A company should tick this box if it DID export any GOODS to individuals, enterprises or organisations outside the UK during the period which the return is being filed for |

Box 617 - Yes - Services | A company should tick this box if it DID export any SERVICES to individuals, enterprises or organisations outside the UK during the period which the return is being filed for |

Box 618 - No - Neither | A company should tick this box if it DID NOT export any GOODS and/or SERVICES to individuals, enterprises or organisations outside the UK during the period which the return is being filed for |

How Can I Complete the Exporter Information Section Using Easy Digital Filing?

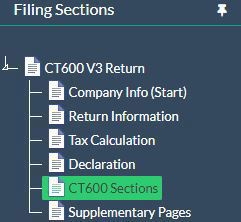

If you are using our Corporation Tax Return Template that we provide through our software and you wish to complete the Exporter Information section within your company's CT600 please follow the steps outlined below:

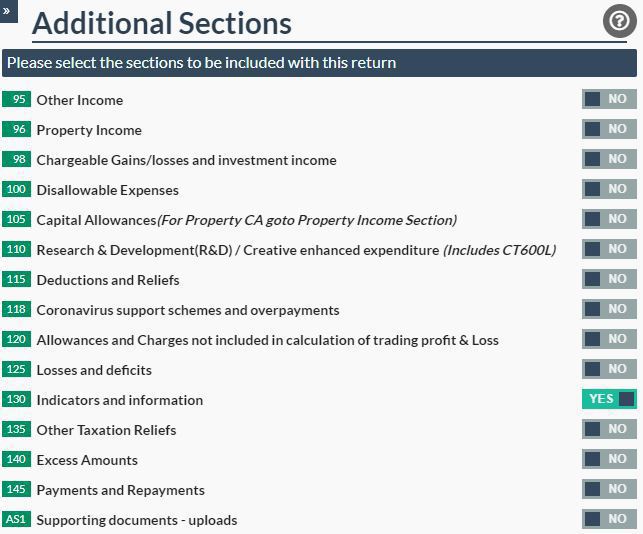

Step 2 - Once in the 'CT600 Sections' please tick Box 130 'Indicators and Information' to 'YES' as shown in the image below:

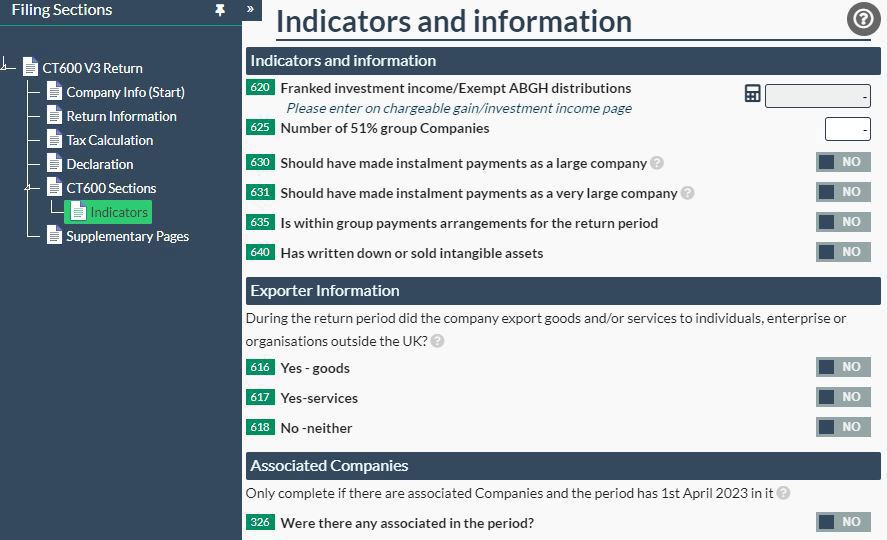

Step 3 - Now that you have turned on the 'Indicators and Information' section please click on the 'Indicators' heading in the left hand column

Step 4 - Within the 'Indicators' section you can now complete the 'Exporter Information' section by ticking the boxes to 'Yes' if the box is relevant to your company or leave as 'No' if the box is not relevant

Want Some More Info?

I trust this article has answered any questions that you may have had about the Exporter Information section of the Corporation Tax Return. If you wish to continue reading, you can find a range articles on our Knowledge Base with articles about How to Account for Inventory to a Glossary of Accounting Terminology. If you are ready to start filing your company's corporation tax return, you can get started here!