Accounting for stock and inventory in you annual accounts

After reading this article, you should be able to have the knowledge of the main principles of accounting for inventory.

What are Inventories?

As prescribed in the International accounting standards (IAS) 2 – inventories include:

- assets held for sale in the ordinary course of a business (which are finished goods)

- assets in the production process for sale (goods in process)

- materials and supplies that are consumed in production (which are raw materials)

- all goods sold to the customer in order to make a profit

How can inventories be measured?

The cost of inventories should include:

- All costs of purchase – including irrecoverable taxes, transportation

- Costs of conversion – including variable and fixed costs

What is not regarded as inventory?

Now the interesting part – how to account for Inventory?

It all begins with keeping consistent and accurate tracking of transactions that occur in the reporting period, which will then determine the correct units of ending stock.

You should keep up-to-date records in your book-keeping software or excel speardsheet.

The basics of Inventory Accounting

Your current outstanding stock is regarded as an Asset, and as you may already know – Assets are shown in the Balance Sheet, demonstrating your business' worth.

Let's look at one example – when you buy stock from manufacturers, this will have an effect on your assets, as they will increase correspondingly to the value of the purchases of stock.

If you do not pay for your purchase at the same time this will have effect on your Liabilities as they will be increased by the same amount of invoices owed to the manufacturer.

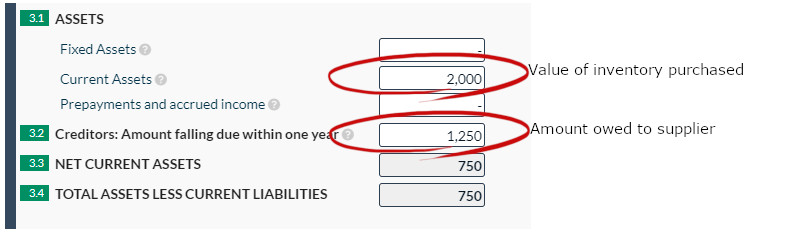

Assuming you purchased £2000 of inventory, paid £750 in deposit for the items, then this would be shown in your balance sheet:

Remember the current assets will also include your cash at hand in the bank and other invoices issued. The above example is to illustrate inventory only.

Cost of goods sold is vital in your financial statements, as it shows the value of what you have sold and ultimately, your profit.

Your total turnover from sales less cost of goods sold will result in your gross profit, which details real-time profitability of your company.

Let's see in practise the effects it will have on both Income Statement and Balance Sheet.

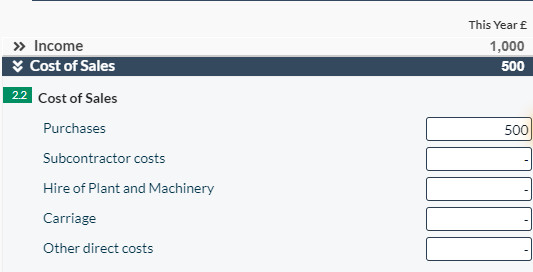

Sales = £1,000

Cost of goods sold = £500

Gross profit = £1000 - £500 = £500

When a sales is made:

| Balance sheet | Income Statement |

| inventory will decrease by £500 | Cost of sales will increase by £500 |

Within our templates this would be shown in the profit and loss:

Most common methods in accounting for inventory

The Periodic Inventory Accounting and Cost of Sale Accounting

- Periodic Method – Opening stock value and Closing stock value, as well as any purchases made during the period,

that results in the cost of sale, when subtracted from the revenues gives the figure of gross profit.

Relevant Formula:

Opening inventory balance + Purchases – Ending inventory balance = Cost of goods sold

Revenues – Cost of goods sold = Gross profit

Let's see an example:

Revenue from sales of products = £2,000

Opening balance of stock = £1,000

New purchase of stock in the period = £700

Ending balance of stock = £500

Cost of goods sold = £1,000 + £700 - £500 = £1,200

Gross profit = £2,000 - £1,200 = £800 -

Cost of sales accounting – this is determined by one of a few cost assumptions:

If a product costs the same amount always, then this methods will produce the same results, however if cost prices change then you need to determine price needs to be use:

FIFO – uses the cost of the oldest inventory, when a sale is made.

LIFO – uses the most recent inventory value for the cost of sale transaction when the sale is made. If cost of a product increases over-time, then the LIFO will result in the lowest profit, and lowest tax paid, because the most recent costs will be higher than the oldest costs.

Obsolete stock

Inventory may become obsolete over time, for instance some goods may become unnecessary in the future, this stock have to be removed from the inventory records. It is usually categorized as an expense or a loss.

deceased or expired stock

It can be either written off or written down, as it can not be sold to your clients, however in some instances, this inventory can be sold to another entity for a different use at a reduced price. Deceased inventory is specific for short-lived products, such as food or medicine. In many cases, deceased stock can not be safely sold, consequently it has to be written off and disposed of.