Employment Rights in the UK

UK employment law is extensive, and there are several things that employers need to be aware of to ensure that employee’s rights are protected. employers' responsibilities includes providing a safe working environment, paying fair wages, and following the correct legal procedures related to hiring, managing, and termination.

Here are some of the key employment rights to bear in mind when hiring employees:

Right to a written contract: All employees in the UK must receive a written statement of the main terms and conditions of their employment, including job role, salary, and working hours, within two months of starting the job.

National Minimum Wage: Employers must pay their staff at least the UK minimum wage, which varies based on age and employment type. It’s essential to stay updated with the rates to ensure compliance.

Breaks and working hours: Employees should not be required to work more than 48 hours per week unless they voluntarily agree to increase their working hours. Employees are also entitled to rest breaks and daily and weekly rest periods under the UK Working Time Regulations.

Paid Annual Leave: Employees are entitled to at least 28 days of paid annual leave including bank holidays. Note that holiday allowance is adjusted for part-time workers and those on zero hours contracts.

Protection against unfair dismissal: This law is more flexible as employees have different rights depending on how long they have worked for a company. For example, employers may reserve the right to instantly dismiss employees during the first 6 months of employment whilst employees are still within their probationary period (subject to contractual terms). Once employees have successfully completed their probationary period, they have a legal right to work a notice period, unless they are dismissed for gross misconduct. However, only certain offences can be classed as gross misconduct. After 2 years of employment, employees are entitled to redundancy pay, if their position is made redundant.

Anti-Discrimination Laws: Employers are responsible for ensuring that they take the necessary measures to avoid discrimination in the workplace based on ‘protected characteristics’ such as race, gender, disability, religion, sexual orientation, or age.

Health and Safety: As per UK law, employers must ensure the health and safety of their employees. This includes carrying out risk assessments, providing adequate training, and maintaining safe working conditions.

Employing staff for the first time

As a starting point, new employers are required to register with HMRC for PAYE, obtain employer’s liability insurance and when you actual employee someone, ensure that their workers have a legal right to work in the UK. They may also need to carry out other employment background checks such as DBS checks, paying staff through PAYE, and enrolling staff into a workplace pension scheme.

See more guidance for setting up as an employer on the .gov website

Employers' Responsibilities – tax, payroll, and data protection

Employers in the UK must comply with tax and payment laws, and failing to meet these obligations can result in legal consequences, so new employers should take note of the following:

Pay and Pensions: You must ensure employees are paid correctly, including making deductions for National Insurance and income tax through PAYE. Eligible employees must also be automatically enrolled in a pension scheme, which employers are responsible for contributing to. Enrolling employees into a pension scheme can be deferred for the first 3 months of employment.

Employee Data Protection: It is an employers' responsibility to ensure that you also comply with data protection laws, ensuring that employee data is stored securely and only used for legitimate purposes in line with GDPR regulations.

Types of employment – choosing a contract

When hiring, one of the first steps is deciding on suitable contracts of employment, and the type of contract that you offer impacts your legal obligations under UK employment law, including tax responsibilities. Furthermore, depending on the needs of your business, you may choose to employ staff under different contract types:

Full-Time and Part-Time Contracts: These employees are permanently hired and work regular hours, entitling them to all standard employment rights.

Fixed-Term Contracts: Employees are hired for a specific duration or project. They must receive the same benefits and employment rights protections as permanent staff while under contract.

Zero-Hours Contracts: These contracts offer flexibility by not guaranteeing specific working hours. Employees on zero-hours contracts still have certain rights, such as the National Minimum Wage and rest breaks.

Contractors and Freelancers: Independent contractors or freelancers are self-employed and typically do not have the same employment rights as full-time workers. They are responsible for managing their taxes and do not receive employee benefits.

Contract types and employment status

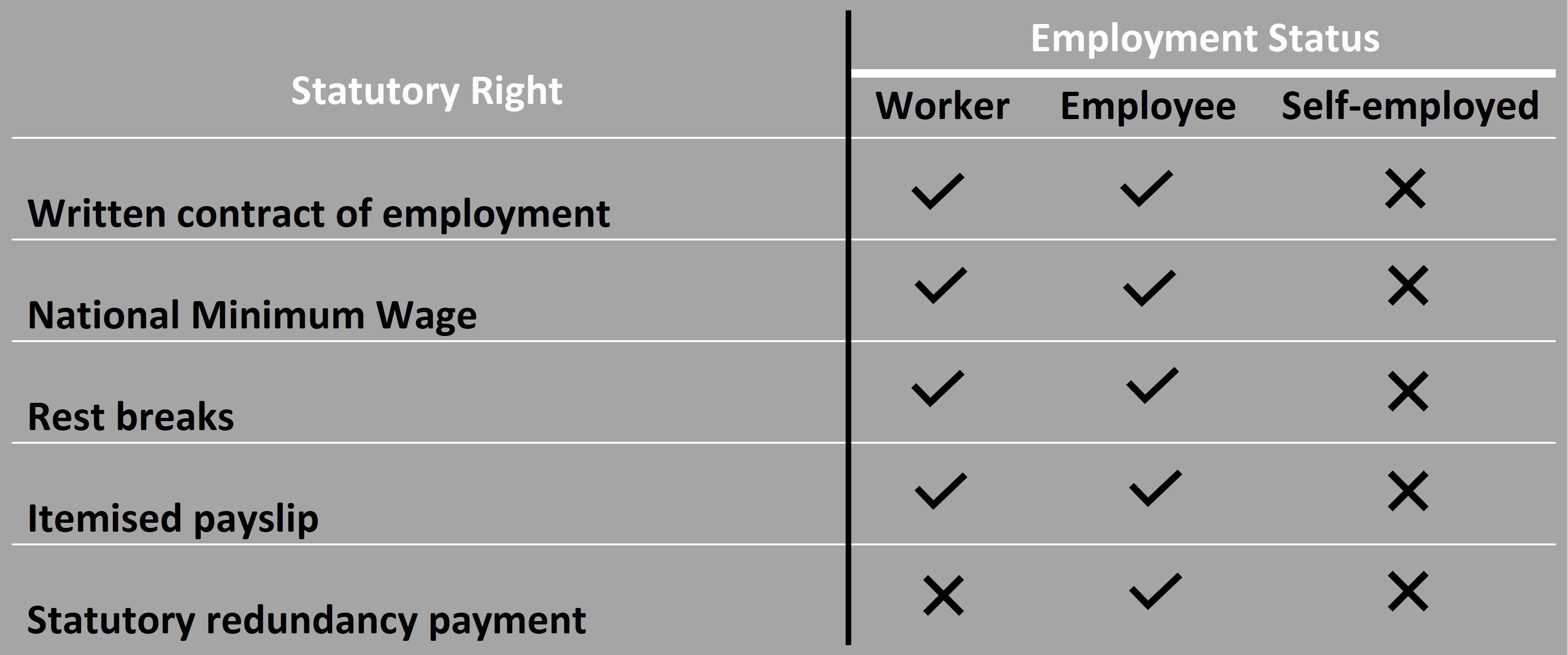

It’s important to note that different contract types impact the employment status of employees and your legal obligations as an employer.:

Workers have flexible arrangements and may not be guaranteed set hours, but they are entitled to basic employment rights such as minimum wage, paid holiday, and protection against discrimination.

Employees receive all the protections available to workers, plus additional employee rights including statutory sick pay, redundancy pay, and parental leave.

Self-Employed and Contractors are self-employed and are not covered by most employment law protections but must still follow health and safety rules and are protected against discrimination.

Pre-employment background checks

As an employer, UK background checks and other screening processes help ensure you meet your legal obligations and hire the best candidates, and every employer in the UK is required to carry out background checks into an employee’s legal right to work.

Other types of pre-employment screening may also be a legal requirement depending on the job role, such as carrying out DBS checks if employees are working with vulnerable people.

Obtaining satisfactory references may be mandatory in certain circumstances, although these are usually only required at the employer’s discretion. For some jobs, particularly those involving physical work, employers may require health checks to ensure applicants can meet the physical demands of the role.

Registering with HMRC and Setting Up Payroll

Once you hire your first employee, you must register as an employer with HMRC within the first 4 weeks, and it can take up to 30 days to get an employer PAYE reference number to pay your staff.

You will then be responsible for deducting any PAYE and National Insurance contributions, and providing employees with payslips detailing this information.

You will also need to set up a payroll system to manage PAYE tax and National Insurance contributions. Even if, as a director of a limited company you are the only member of staff, you must still register with HMRC if you are taking a salary.

Employers' Liability Insurance

Another key employers' responsibility is obtaining employers' liability insurance to provide a legally compliant working environment. By law, you must have at least £5 million of insurance coverage to protect your business if an employee is injured or becomes ill while working.

To summarise, being an employer in the UK requires you to meet several legal obligations, including respecting employment rights, conducting pre-employment screenings, and ensuring compliance with tax and payroll regulations. By fulfilling these responsibilities, you can provide a workplace that supports both your business and your employees.

We help employers pay taxes

At Easy Digital Filing we help employers to meet their tax obligations, ensuring safety and compliance with our easy-to-use online platform for filing corporate tax returns. Whether you’re paying tax as an employer for the first time or you want a more streamlined and cost-effective solution for paying corporation tax, our proprietary software can help you get the job done.

Send us a message or get started to use the platform with a free account.