What is a Confirmation Statement?

The Confirmation Statement is a statutory document that verifies that the important information Companies House holds is still up to date. It must be delivered at least once every 12 months by private limited companies as well as limited liability partnerships (LLP's). The details that have to be checked and confirmed through filing of a confirmation statement include the company’s basic information such as:

- Registered office address

- Current company officers

- Standard Industrial Classification (SIC) codes

- Share capital

- Shareholders or Members

When are Confirmation Statements due?

Confirmation Statements should be filed at least once every 12 months, and the filing due date will be different for different companies – typically you will be required to file your Confirmation Statement on either the anniversary of your last Confirmation statement, or, for a new company, the day before the anniversary of the date of incorporation. You can file your Confirmation statement up to 14 days after the due date.

For example – a company incorporated on 24th of March 2024 will have its 12-month review period starting on 24th March 2024 and ending on 23rd March 2025. The statement date of the company’s first Confirmation statement is 23rd March 2025 and the filing deadline will be 14 days later, hence on 6th April 2025.

An important point to be aware of is, that you can file your company's Confirmation Statement at any time during your review period and as often as you wish, however, once a Confirmation Statement is filed a new 12-month review period will start, which will also affect the filing due date.

For example – if the Confirmation Statement is filed earlier than the end of the 12-month review period (for example on 9th of June 2024), then this is when the new review period will start, therefore the next period will begin on 10th of June 2024 and will end on 9th June 2025, meaning that the filing due date will also be updated to 23 June 2025 (14 days later).

Filing due dates of Confirmation Statements can be viewed online on the Companies House website, so if you are unsure of your company’s Confirmation statement due date – you can double check in Companies House by entering your company’s name.

What changes to your company's information can be reported through filing of a Confirmation statement?

The changes that can be reported include:

- Standard Industrial Classification (SIC) codes

- Statement of capital

- Shareholders’ details

However, if there is a change such as the officers’ personal details, People with Significant Control (PSCs) and Registered Office has to be reported to Companies House, then this has to be done through different Companies House forms.

How to file Confirmation statement though Easy Digital?

Filing Confirmation statements is quite straight forward and it should not take more than 10 minutes to submit! It all can be done in a few steps, which you can find below:

Step 1: Log in to your Easy Digital account and find the company that you wish to file the Confirmation statement for.

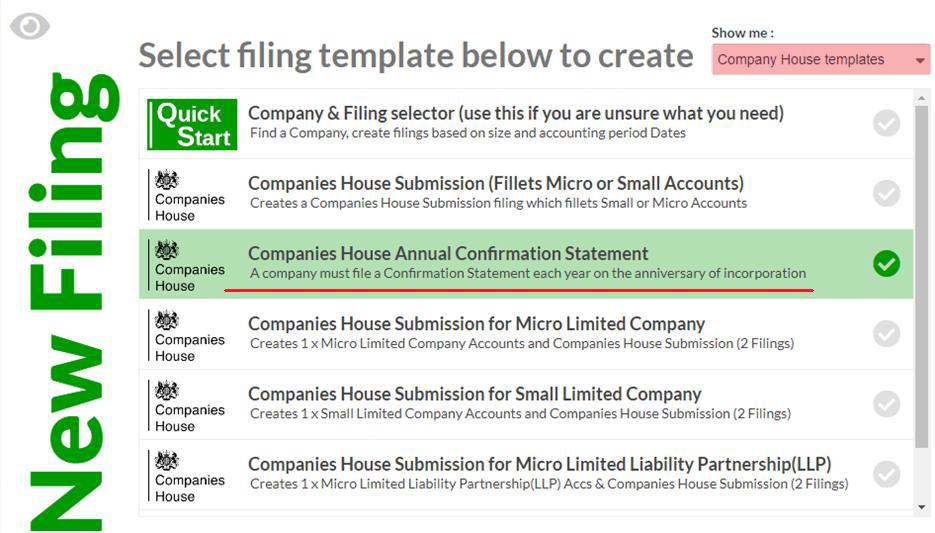

Step 2: Once, on the correct company's 'Filings view' page, click on the blue ‘Add Filing’ button and then from the Filter section select ‘Companies House templates’.

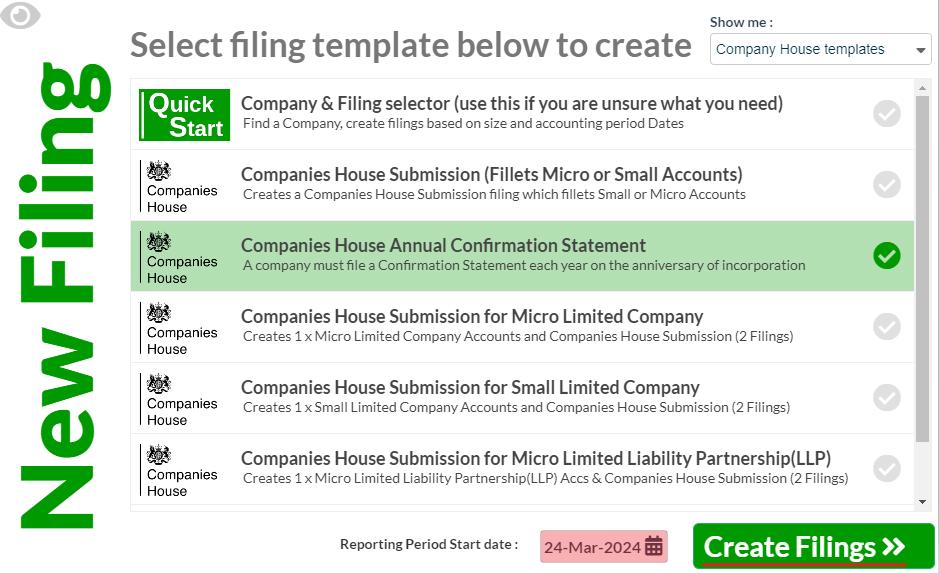

Step 3: Select the ‘Reporting Period Start date’ and click on ‘Create Filings’

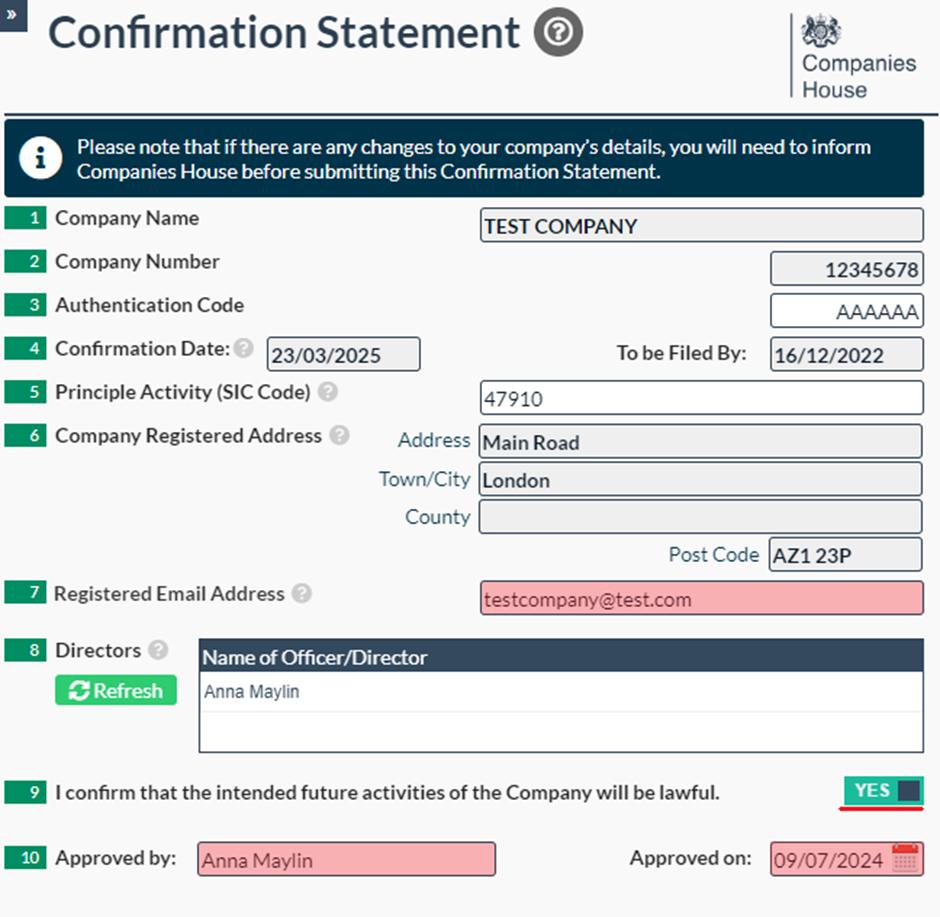

Step 4: Open up the Confirmation statement template and then double check the pre-populated information. If all details are correct – you can enter the registered email address in box 7, Confirm that the intended future activities of the company will be lawful (box 9) and lastly enter the name of the person approving the submission as well as the approval date in box 10.

Please note that from 5th of March 2024, companies and LLPs must also provide a registered email address when they file their Confirmation statements. This information will not be available for the public – it will only be used by Companies House, if they need to contact you. You will need to verify the email address is still correct when the company files its next Confirmation Statement.

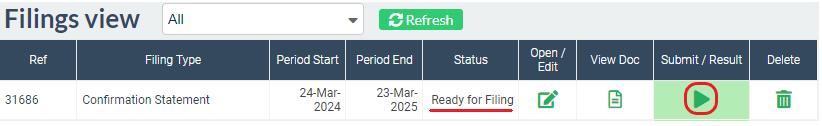

Step 5: Once you are ready to submit your Confirmation statement – you will need to set the filing to ‘Ready to File’ and then click on the flashing arrow in the ‘Submit/Result’ column in order to submit.

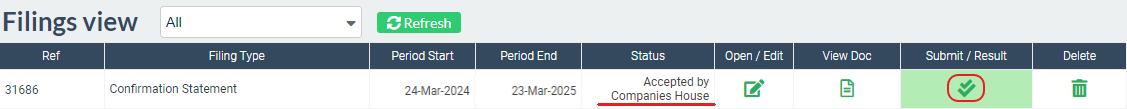

And this is all done! Once your Confirmation statement is successfully submitted, the status of the filing will be updated to 'Accepted by Companies House'.

What happens if a company do not file its Confirmation statement?

All private limited companies, as well as limited liability partnerships, whether active, dormant or non-trading must submit Confirmation statements to Companies House. Failing to submit annual Confirmation statement is a criminal offence, despite no penalty charge is being issued for filing after the deadline. If Confirmation Statement is not filed at all, Companies House will start legal action against the company and its directors and will dissolve (remove) the company from its register. Even if there are no changes to report, Confirmation Statement must still be filed to Companies House as this will indicate that the company’s details are correct.

Confirmation statement - key points to remember

Filing Confirmation statements at Companies House is an important task that has to be completed by limited companies and limited liability partnerships once every 12 months, and this is apart from the other filing requirements such as filing of Annual accounts to Companies House and Full accounts and CT600 Returns to HMRC. You can sign up for email reminders from Companies House which will notify you when your company's accounts and Confirmation statements are due by sending you an email.