What are limited Companies' annual filing requirements?

HMRC and Companies House, although both government bodies are separate entities, so there are different filing requirements for limited companies. Often times, people believe that if they have filed to one, then they have filed to the other, however, this is not the case and often leads to people missing filing deadlines by mistake!

Your filing requirements may differ, depending on the type of company you are, whether you are registered for VAT, etc., however, there are general returns that every company must make each year and submit to either Companies House or making HMRC company returns. So, what are they?

Companies House Annual Accounts

This is a submission that confuses a lot of people because both HMRC and Companies House require you to submit annual accounts, however, the requirements for the accounts differ depending on which entity you are submitting them to.

Companies House Abridged Accounts

Companies House requires that your annual accounts be submitted each year - the deadline for when Companies House annual accounts are due is dependent on your company's accounting period. Each company can have a different accounting period as this is determined by the date that your company was incorporated on.

For example, if your company was incorporated on 18th August 2024, then your first accounting period, which is extended, will run from 18th August 2023 to 31st August 2024. Then, any subsequent periods will run from 1st September to 31st August the following year (so, for example, 1st September 2024 to 31st August 2025). This is the period that your annual accounts must cover.

Companies House annual accounts are not just standard accounts - they are abridged accounts. This means that they only require the balance sheet to be submitted, not the income statement as well.

However, it is important to note that this is not always the case for every company. For example, if the company that you are filing for is a Community Interest Company (C.I.C), then the requirements may differ - typically, C.I.C's are required to submit full accounts (income statement and balance sheet) to Companies House. If you are a micro-sized C.I.C, or a dormant C.I.C, then you are required to submit your full accounts by post, along with the C.I.C 34 report, as they cannot file online.

Your Companies House annual accounts are due either 21 months after the date of incorporation, or 9 months after the end of your company's accounting period. This means that if you incorporated your company on 18th August 2023, then your first Companies House annual accounts will be due by 18th May 2025. However, from that point onwards, your accounts will be due 9 months after the end of your accounting period (which is 31st August 2025), so the next accounts would be due by 31st May 2026.

Full Accounts:

HMRC company returns differs from Companies House in their annual accounts requirements as they expect you to submit full accounts (income statement and balance sheet), rather than just the balance sheet. This causes a lot of people's filings to get rejected, as they attach their Companies House annual accounts submission to their corporation tax return, however, as it doesn't include the income statement as well, HMRC will not accept the submission.

HMRC Company Returns:

HMRC company returns includes the corporation tax return, also known as the CT600 return, is the tax return that companies must complete and submit to HMRC. As previously mentioned, you are expected to submit your full accounts with this return by attaching them separately. Also, it is important to note that you are not required to submit your CT600 to Companies House.

Within the CT600 return, you need to input the company's total income and expenses, along with any other sections that may need to be completed, such as disallowable expenses, or capital allowances, etc. There is no need to provide a breakdown of the income and expenses in the return, because you are already attaching your full accounts as part of your HMRC company return, so you just need to fill in the necessary information in order to determine how much corporation tax is due.

Once again, the period on the HMRC Company return depends on the accounting period of the company - so the dates of the return can differ from company to company as well. Following on from our example earlier, we will assume that the company which was incorporated on 18th August 2023 is trying to file their returns to HMRC for their first accounting period. As it is an extended period, they will need to complete two CT600 returns to cover the entire period, as one CT600 return can only cover 12 months. So, one CT600 return will need to cover the period from 18th August 2023 to 17th August 2024, and another CT600 return will need to cover the period from 18th August 2024 to 31st August 2024. However, your full accounts can cover the entire extended period from 18th August 2023 to 31st August 2024 - they do not need to be split into two filings.

Dormant companies are not typically required to submit a corporation tax return to HMRC, as since their company was not trading, they wouldn't have had any income or expenses - meaning that there should not be any tax to pay. For more on dormant companies, please feel free to take a look at the article 'How to file for a Dormant Company' on our Knowledge Base.

Confirmation Statement

As part of a Companies' annual filing requirements, all companies are also required to submit their annual Confirmation Statement to Companies House each year. This is to ensure that the company's information is correct and up to date - this information includes the company's registered address, registered email address, their SIC code(s), company's directors and secretaries, and more! It is typically only filed once a year, however, you can file a confirmation statement at any time if needed, such as when you want to change your company's information. For more on confirmation statements, please feel free to check out our article 'How to file a company Confirmation statement?' on our Knowledge Base.

How do I file these returns?

You can file through a software provider, such as Easy Digital Filing. We offer submission packages for either HMRC or Companies House, or combined packages for filing to both!

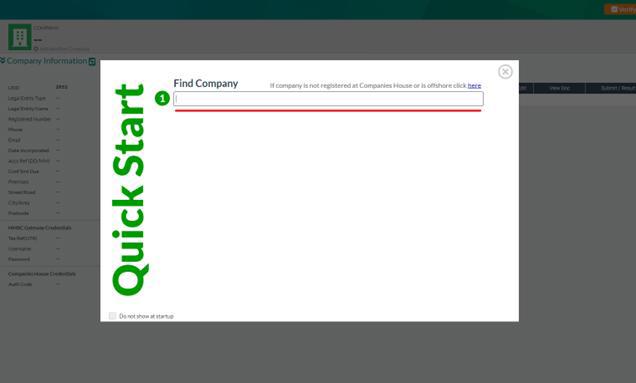

To start, you will need to create and account with us, and then add your company to your account. Simply type the name of your company in the Quick Start box, as shown below:

Once you have typed in the company name, you can add it to your account - and then you can add the filings!

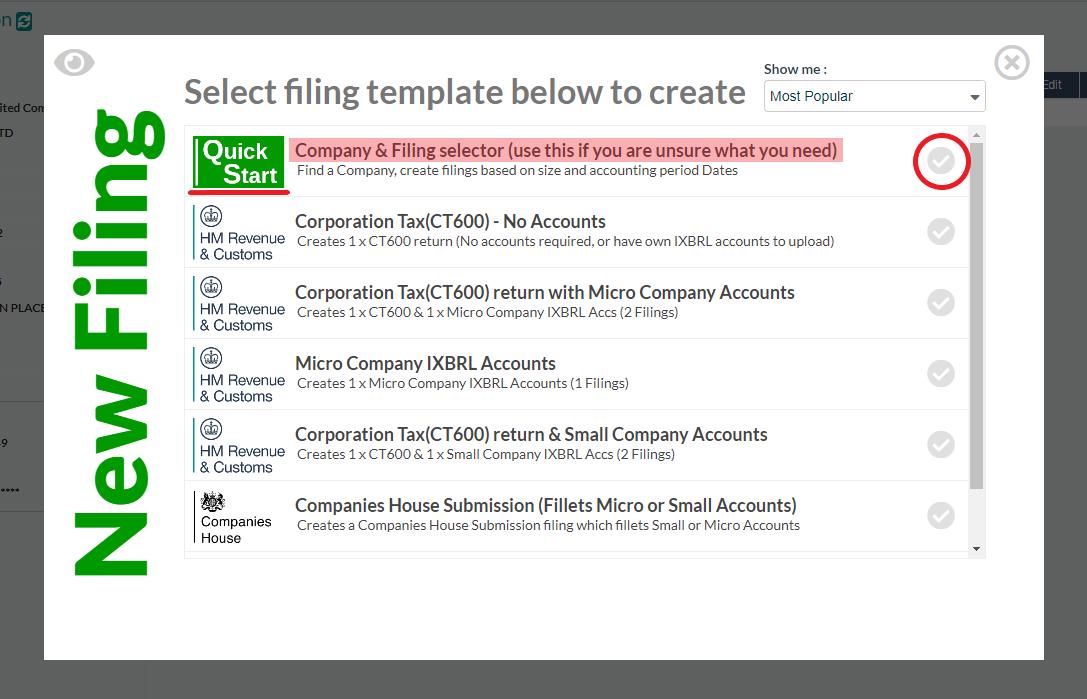

To add the filings, you will need to click on the blue 'Add Filing' button at the top right-hand side of the screen, and then select the Quick Start menu - this is the easiest way to ensure that you have added all the correct filings to your account.

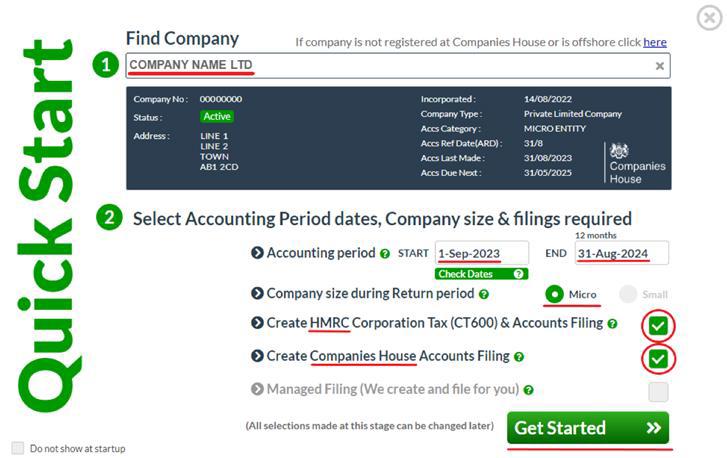

You can then enter your company's accounting period, select the size of the company (either micro or small), and then select whether you want to file to HMRC, Companies House, or both.

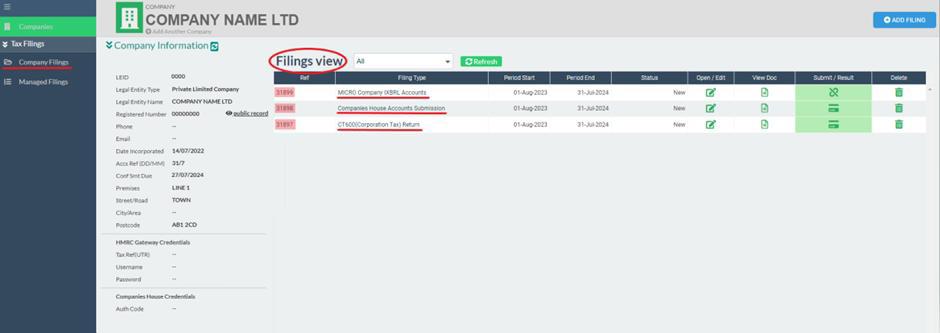

Once you have added the filings, they should be showing in the 'Filings view' section of your account (within the 'Company Filings' tab).

From there, you can click on each of the filing templates to complete them, and once you are ready to file, you can purchase the necessary package before submission! If you are struggling with how to complete the filings, there are several tool tips within the templates to help you, or you can check out our wide range of Knowledge Base articles! So, what are you waiting for? - create an account with us for free today to get started!

Key Points to Remember:

- Companies House Annual Accounts - you are expected you to submit abridged accounts (balance sheet only), whereas HMRC expects you to submit full accounts (income statement and balance sheet).

- HMRC Company Returns - You are required to submit your full accounts (income statement and balance sheet) in IXBRL format alongside your tax return. Typically, you cannot attach a PDF document of your accounts, as they are expected to be submitted in the IXBRL format.

- Confirmation statement - This is an annual filing requirement that each company must make to Companies House. It does not contain any figures, but just ensures that the company's information is correct.