What is a dormant company?

A dormant company is one that is not active, and is not trading or conducting any business activities. This means that they are not receiving any income and they do not have expenses. You can either become dormant when you incorporate your company at Companies House, or you can become a dormant company after previously trading. If you have previously been an actively trading company, then you will need to inform HMRC that your company is now dormant. You can do so online, through this link here.

Once you become a dormant company, you can still become a trading company at a later stage - there are no restrictions. In order to do this, you will need to let HMRC know that your company is trading again by registering for corporation tax through your company's government gateway account.

A company is considered active for corporation tax purposes if it is doing any of the following:

- Carrying on a business activity, such as a trade or professional activity

- Buying and selling goods with the intention of making a profit

- Providing their services

- Earning interest

- Managing investments

- Receiving any other income

If your company is not doing any of the above, then it can be considered as a dormant company. For more on whether your company is considered dormant for either Companies House or HMRC, please feel free to take a look at HMRC's website here.

What are the filing requirements?

Dormant companies are only required to submit their annual accounts to Companies House, however, they sometimes are also expected to submit a corporation tax return to HMRC as well.

Companies House:

All companies, whether they are a dormant company or not, are required to submit their annual accounts to Companies House per accounting period. These annual accounts include just the balance sheet only.

If you have been a dormant company since incorporation, then it is unlikely that you will have any figures showing on your company’s balance sheet only the share capital is accounted for – however, it is important to note that you must still file your annual accounts no matter what the figures are like.

Dormant companies are also required to submit their annual Confirmation Statement to Companies House each year, which is a requirement of all companies, to ensure that their information is up to date. This information includes the company's registered address, the registered email address, their SIC code(s), the company's officers (directors, secretaries, etc), and more! It is typically only filed once a year, however, you can file a confirmation statement at any time if needed, such as when you want to change your company's information. For more on confirmation statements, please feel free to check out our article 'How to file a company Confirmation statement?' on our Knowledge Base.

HMRC:

Not every dormant company is required to submit a CT600 (corporation tax) return to HMRC. If you have informed HMRC that your company was dormant during the accounting period that you are filing for, then, they will not expect you to complete a tax return. HMRC will let you know if they are expecting you to file a corporation tax return by sending you a ‘Notice to file a tax return’ letter to your company’s registered address. If you have received a letter to file, then you must submit a tax return to HMRC, whether your company is dormant or not. If you are unsure whether they are expecting you to submit one, then you can always double check by calling them on their corporation tax helpline. You can call them on 0300 200 3410. Alternatively, you can find their contact information here.

If your company is dormant and you are required to submit a corporation tax return, then it is worth noting that you do not need to submit annual accounts with your return. This is one of the main difference between active and dormant companies filing to HMRC. Active companies are required to submit full accounts (income statement and balance sheet) along with their CT600 return to HMRC, however, dormant companies do not have to attach any accounts and instead, are just required to submit a nil (blank) return.

How to file through our software:

So, now that you know what the filing requirements are, and whether you have to file to just Companies House, or HMRC as well – here is how to file through us!

For filing confirmation statements, please check out article here instead.

Companies House:

If you are filing, just to Companies House, as a dormant company then you will need two filing templates – one is the Companies House Accounts Submission template, and the other is either the Small or Micro Company IXBRL annual accounts template (depending on whether you were previously active, what size your company is, and if you wish to file under FRS105 or FRS102).

For this example, we will assume that we are filing dormant accounts for a company’s first accounting period (meaning that they were dormant from incorporation). In this scenario, we will use the micro company accounts template.

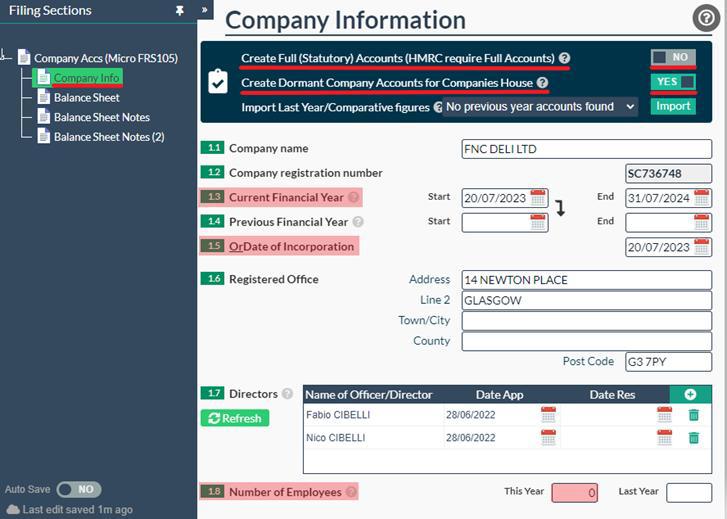

Once you have added the relevant filings in your annual accounts, you will need to start completing the templates. To start, it is important to remember to switch the box that says ‘Create Full Accounts’ to ‘No’ and the box that says ‘Create Dormant Company Accounts’ to ‘Yes’ on the ‘Company Information’ page. See below:

You will also need to enter the dates for the accounting period that you are currently filing for in box 1.3, and also the date of incorporation in box 1.5. Since this is your company’s first accounting period, you can leave box 1.4 blank, as it is only relevant for companies who have had previous periods. In box 1.8, you will need to enter the total number of employees – typically, dormant companies do not have any employees as there has been no income or expenses.

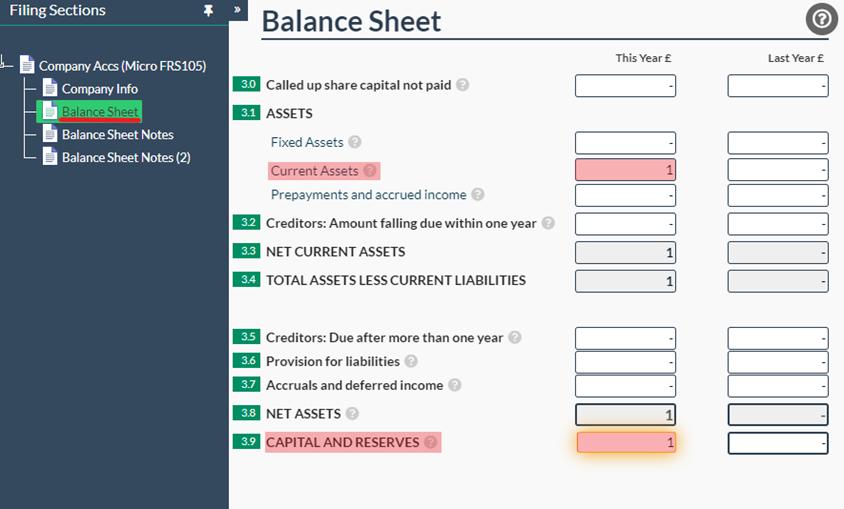

Once this has been completed, you can click on the ‘Balance Sheet’ tab on the left-hand side of your filing and enter your figures into the appropriate boxes.

For this example, we have assumed that the company had £1 of paid share capital, so this has been reflected in both the current assets and the capital and reserves boxes. For more on how to complete your balance sheet, please feel free to check out our article 'Balance Sheet Basics', from our Knowledge Base.

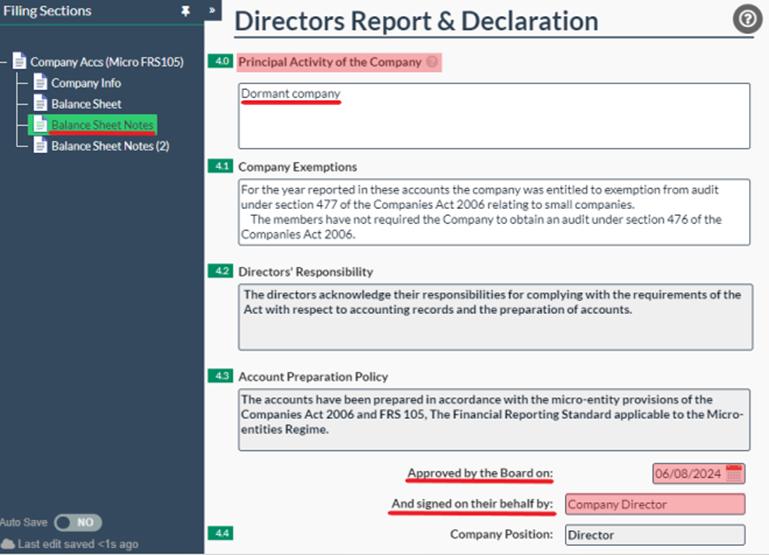

Once the balance sheet has been completed, the only thing left to do in the annual accounts is to complete the ‘Balance Sheet Notes’ section. Here you will need to enter the principal activity of the company, and then add the name of the person approving the accounts, along with the date of approval.

When a company is dormant, it is expected that it is not trading – this means that you can put ‘Dormant company’ into the ‘Principal Activity of the Company’ box.

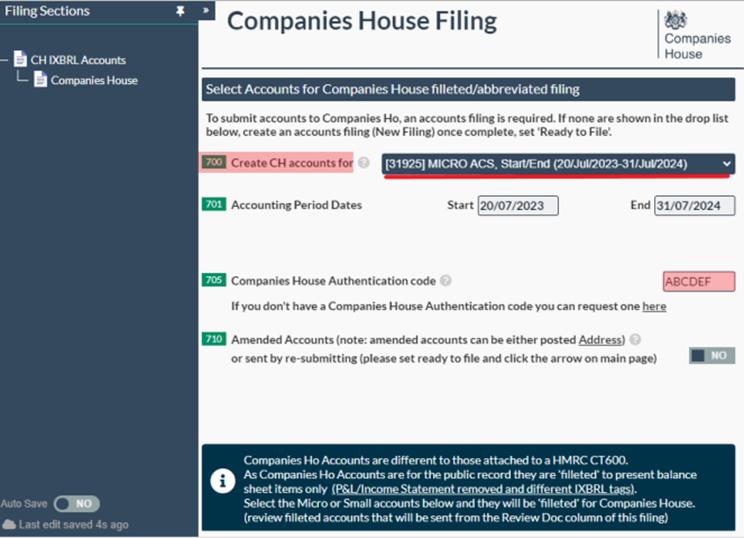

Now that you have completed the annual accounts, you just need to attach them to your Companies House Accounts Submission template, enter your Companies House authentication code into box 705, and file! To attach your accounts, you need to select the correct accounts from the drop down in box 700.

If you are happy with your filings, simply set them both as ‘Ready to File’ and then click on submit! Your annual accounts will then be submitted to Companies House.

HMRC:

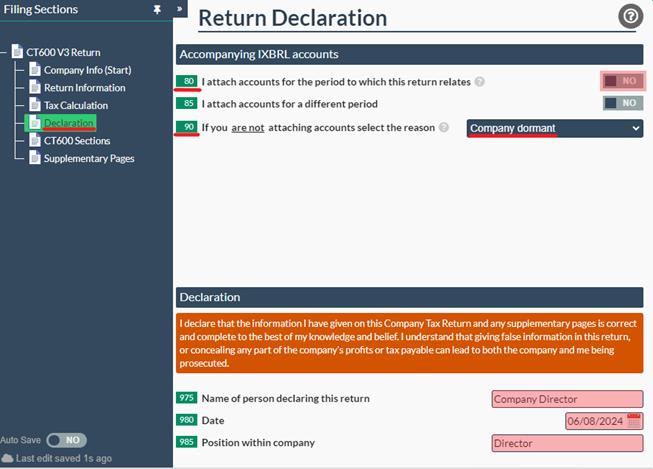

If you are also required to submit a dormant company CT600 corporation tax return to HMRC, it is a much simpler process! As you will be completing a nil (or blank) return, there are no figures that need to be input, so the only section that generally needs to be completed is the ‘Declaration’ page.

As the company is dormant, you do not need to attach annual accounts, so box 80 should be switched to ‘No’. Then, from the drop-down menu in box 90, you will need to select ‘Company dormant’. Once this has been done, you just need to complete the details of the person signing the return in boxes 975, 980, and 985.

If you are filing for your first accounting period, then it is likely that your period is extended, meaning that you will need two CT600 returns to cover the entire period. If this is the case, please remember to also switch box 50 to ‘Yes’ on the ‘Return Information’ page.

Managed Filings:

If you are still unsure how to file through our software, we also offer a managed filing service, where one of our account specialists will complete the returns for you and submit them to either Companies House or HMRC, upon your approval. To find out more about our managed filing service, please feel free to check out our website Easy Digital Tax.

Now that you know how to file as a dormant company, create an account with us today to get started!