If you have losses either in your current accounting period or a previous accounting period, it makes sense to use them to off-set against profits in the current year if you have any other income, or to carry them back to a previous year or forward to a later tax year. In this article I will explain how to complete your CT600 Corporation Tax return when using losses in our CT600 Corporation Tax software.

Losses in this year

With the change to the rate of corporation tax, from April 2023, then the movement of losses to a period ending after this date, could be an important consideration in managing your tax liability.

However, if you have trading losses in your current financial year and you have other income, you can offset the loss (or some of it) against your other income. To do this

enter in your income and out goings and you will then see the loss in this year shown in the losses carried forward section of the tax calculation screen.

To use this loss against other income, open up the Deductions and Relief page by going to the supplementary sections area and clicking Box 115 to yes.

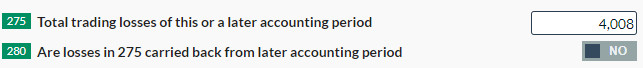

On the Deductions and Reliefs page enter in the amount of loss you are using in box 275. Please note that the amount of loss you use, along with other deductions and reliefs cannot be greater that your total profit.

Leave box 280 as "No"

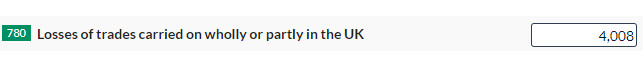

Finally open up the losses and deficits page by going to the supplementary section again and clicking box 120 to Yes.

On the losses and deficits page enter in your total loss for the accounting period into box 780.

Losses Carried Forward from an Earlier Period

If you have a loss from an earlier accounting period and in your current accounting period you have a profit, you can use the loss to reduce your corporation tax liability.

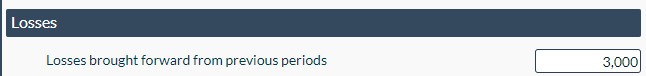

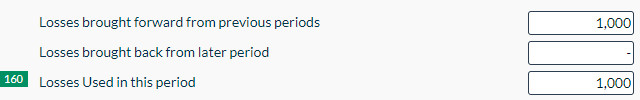

To do this, on the tax calculation page, enter in the amount of loss brought forward in the relevant box:

If you have trading profits in this accounting period and you can use the losses against it by entering the loss you wish to use into Box 160.

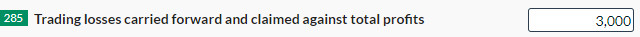

If you do not have trading profits but have other income to use the loss against, open up the Deductions and Reliefs page (as above). Enter the amount of loss brought forward you wish to use in this accounting period into Box 285. Remember total deductions and reliefs can not be greater than total profit.

On the tax calculation page, you will see your loss carried forward will reduce according to how much of the loss you are using in this period.

Losses Carried back from a Later Period

If you have a loss in a period, you can claim for the loss to be off-set against profits for the earlier 12 month period. You can only do this if your Company

was carrying on the same trade during that accounting period.

Please note you must make the claim within 2 years of the end of the accounting period in which you made the loss.

You can claim to carry back a loss in two ways, either in the CT600 of the year where the loss was made or by amending and re-submitting the CT600 of the accounting

period you wish to carry the loss back to.

If you wish to carry back the loss in the CT600 of the year where the loss was made then:

1. On the return information page switch box 45 to yes:

2. Enter the amount of loss you wish to carry back in the losses sections:

The Loss carried back, can only be the same as or less that the profit of the previous period. If you still have losses available they will show in the losses carried forward. You can use this in the next profitable year.

If you are making a claim to carry back a loss by amending a previously submitted CT600, follow the following steps:

1. On the return information page, switch box 38 (this returns amends or replaces a previous return) to "yes"

2. Click box 40 on the returns information page to "yes" - a repayment is due for this period.

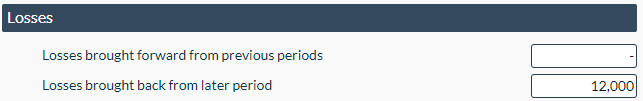

3. On the tax calculation page enter in the amount of loss you are carrying back in the loss section.

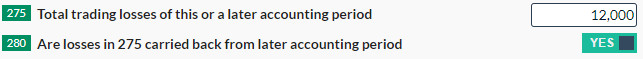

4. On the deductions and relief page, enter in the losses you wish to use in this period in box 275 and click box 280 to yes:

5. Go to the payment and repayment page by switching box 130 to "yes" on the supplementary section page.

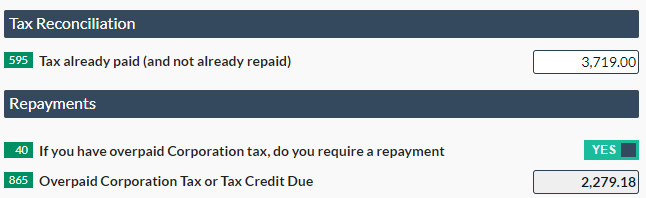

6. Enter in the amount of tax already paid in box 595, switch box 40 to yes and the amount of corporation tax due for repayment will be populated in box 865.

Finally, enter in your bank details for the repayment to be made.

Property Losses

If your Company has property losses from property income, there are separate rules that apply to losses on property income. These are:

- the losses must be offset against other profits in the same accounting period

- the losses cannot be carried back to be offset against earlier accounting periods

- the losses can be carried forward and offset against other profits in the next accounting period, if it cannot be used in the same period, as long as the property business is still being carried on in that accounting period.

Capital Losses

Capital losses can only be used against capital gains.

If you company has capital losses in an accounting period where you do not have capital gains, they have to be carried forward to be used in a period

where you do have capital gains