What is a Directors' Loan Account?

A directors loan account with a company can work in both directions; As a director of a company, you may take out a directors loan from the company to pay off your own bills such as household bills or other non business expenses. or you may also loan your Company money to help with start-up costs, expansion or just to cover short term costs. Either way, when you come to create your end of year tax return and annual accounts, you will need to show the ending balance of the loan account.

A loan from the Company to a director or other close family member is not salary or dividend payments. To make salary payments, the company needs to be registered with HMRC for PAYE. Salary and the deductions should be made through PAYE for income tax and National insurance contributions.

Dividends are paid to shareholders in line with the company profits and they are taxed differently to salary payments.

What happens if the Company Loans you Money?

If you have a directors loan account and the Company loans you or a close family member money, then you must report a directors loan in both your accounts for the CT600 return by completing the CT600A.

In your accounts, the Directors Loan Account balance is shown as a current asset, although it is no longer in the company's bank account, the money is still owed to the company.

In the CT600 - you will only need to report a Directors Loan if the money was still outstanding at the end of the period.

If your Directors' Loan Account is overdrawn at the date of your company's year-end, you may need to pay tax on that. If you pay the whole director's loan within nine months and 1 day of the company's year-end, you will not owe any tax, although it will still need to be reported. You will need to report a director loan in the CT600A by completing the following:

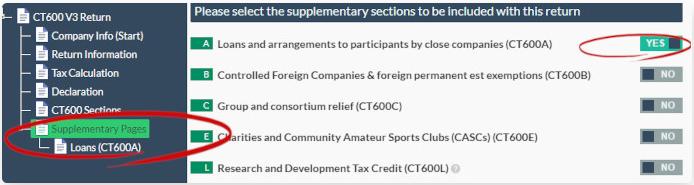

1. Turn on the CT600A:

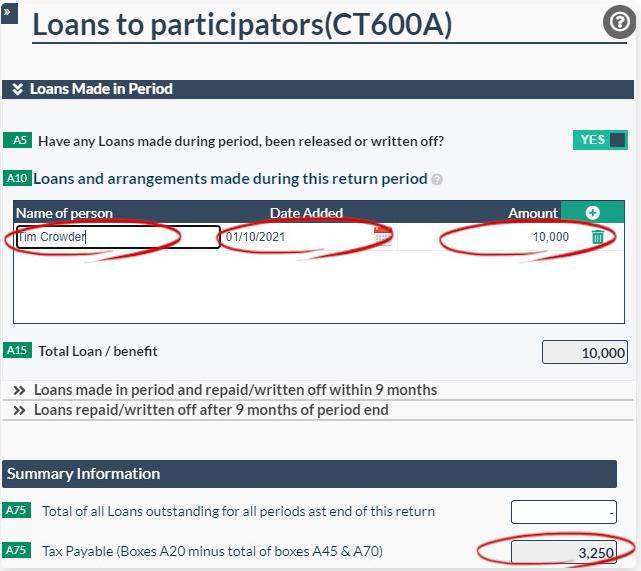

2. Complete the CT600A for loans made:

As you can see from above the tax amount is automatically calculated for you. For Directors Loans made before 31st March 2022, the rate of tax is 32.5%, For Directors Loans made after this date the tax rate is 33.75%.

Once you repay the loan to the Company, the tax will be refunded.

Reclaiming Tax on a Directors Loan

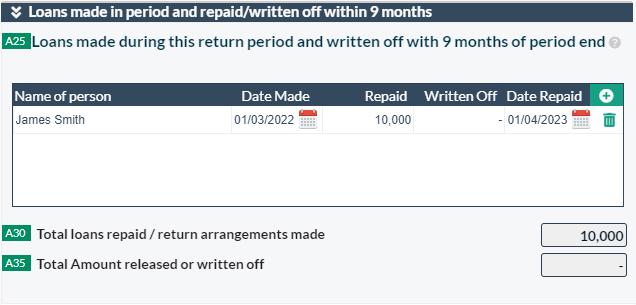

If you repay the loan within 9 months of the end of your financial period, you will be able to report the repayment of the loan by completing box A25:

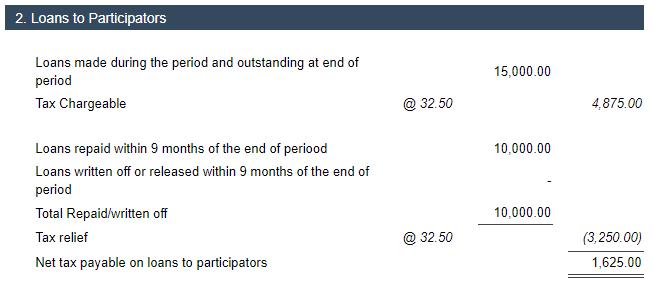

In your computations, in the Report a Directors Loan (Loans to Participators) section you will see that tax is charged on the Directors loan account and then refunded once it has been repaid:

If the loan was repaid after 9 months and before 2 years from the end of the Company accounting period, you can resubmit the CT600 you first used to report a directors loan. You will need to complete box A50 in the CT600A and you will then be able to reclaim any tax paid.

If the loan is repaid after 2 years from the end of the Company accounting period, you will need to complete a L2P form which you can do online or by post.

With Directors Loan account try to avoid "bed and breakfasting", this is where you take out a loan within the 9-month period but is immediately taken out again to avoid paying corporation tax on it. HMRC have introduced a rule which means that any directors' loan over £10,000 which is repaid and then taken out again within 30 days will not be eligible for tax relief.

What happens if you Loan the Company Money?

If you have a directors loan account where the director loans the company money, you will need to report in your accounts when you complete your end of year accounts. The loan will not need to be reported in the CT600A.

To report a directors loan when you have loaned money to the company, you will just need to show the amount as part of your creditors on your balance sheet. You will show it as either a short term loan (creditors due within a year) or a long term loan (creditors due after a year) depending on when the company may be in a position to repay the directors loan.