What is Double Taxation?

Double taxation occurs when a company is liable to pay tax on the same set of income twice by two different entities. This is typical for companies or individuals that trade overseas and receive foreign income where the double taxation is dependant on the overseas country's tax laws.

As double taxation incurs a higher corporation tax bills, this can significantly impact the profitability for companies like multinational corporations, therefore the UK has in place methods to reduce these liabilities. Typically, you will be able to claim relief on the double taxation to receive either some or all of the tax back.

It's important to note that the UK will need a Double Taxation Agreement (DTA) with the overseas country in order to apply for double taxation relief and avoid being taxed twice. Currently the UK has double taxation treaties with over 100 countries worldwide and allow for relief for different types of income including:

- Interests

- Pensions

- Royalties

- Purchases Annuities

To find out which countries the UK has double taxation treaties with visit HMRC

Applying for Double Taxation Relief

The relief available to claim will depend on the terms of the Double Taxation Agreement and HMRC will decide the claim if allowable. Then if the claim if authorised HMRC will either issue a full repayment or a payment with tax deducted at a reduced rate in line with the taxation treaty.

There are different ways that you can claim this through HMRC:

- Claiming through a DT Company form - This form requires the confirmation of residence of the country, typically done through a tax authority in said country. As well as, details of the income from the country and the treaty article evidence for which it is claimed. This completed form must be sent to the Double Taxation Treaty Team at HMRC.

- Direct relief by repayment - applications can be for 'relief at the source' which is before the tax is deducted from the payment or for repayment, which is after the tax has been deducted.

Claiming Double Taxation Relief Through Us!

Through our software, you will be able to claim double taxation relief on any foreign income tax that has already been incurred. Any amounts claimed in the Corporation tax (CT600) return will offset any current tax payable calculated and offset the total liability.

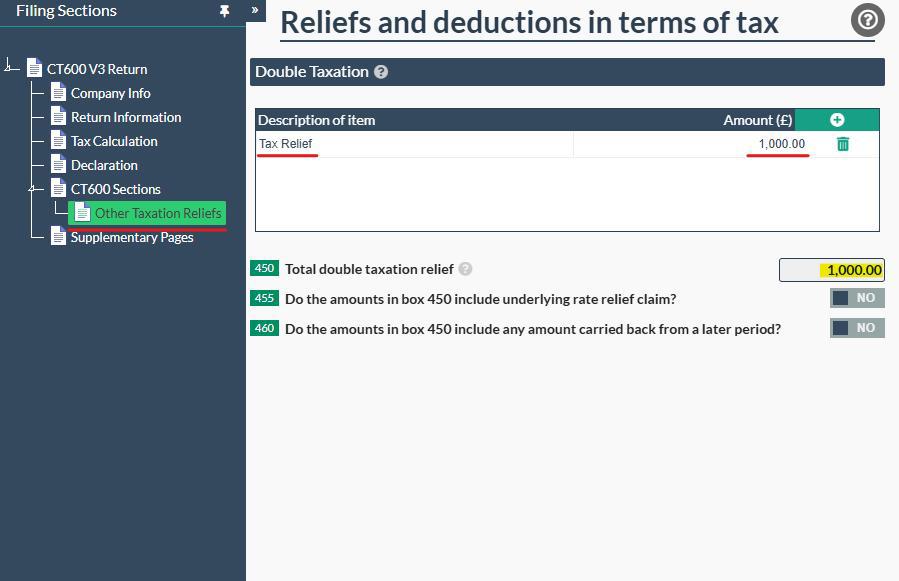

If claiming using our software templates, you will need to head to the 'CT600 sections' page and switch box 135 to YES. This will then allow you to open he 'Other Taxation Reliefs' page, where you can enter the double taxation description and amount. The totalling amounts entered will return in box 450.

Once returned, this will now offset the current amount of tax due in the 'Tax Calculation page'.

Usually the amount of relief claimed will be reflective of the amount already paid on the foreign income from an overseas country. It's important to note that you cannot claim more relief than the amount of tax payable for the period. In the same way that if the company is loss making, you will not be able to claim any double taxation relief.

For example:

Say that you have a total turnover of £70,000, including the foreign income amounts received, and have total expenses of £35,000. Currently the trading profit for this period comes to £35,000 (the turnover - expenses) making the corporation tax liability: £6,650.00

Now let's say, as a UK company, you receive royalties of £50,000.00 as foreign income from a US company. The US applies 15% withholding tax, meaning that you can claim 15% x £50,000.00 = £7,500.00 from double taxation. Since this amount is more than the current tax payable you will not be able to claim all of this and instead can only claim up to the amount of current corporation tax (£6,650.00).

Entering this amount in the 'Other Tax Reliefs' page would now reduce the corporation tax liability to zero!

Main Takeaways

- Double taxation refers to the same set of income being taxed twice by two different entities, typically foreign income taxed by the UK and the overseas country.

- Depending on the overseas country's tax laws, you may be entitled to claim taxation relief if double taxation affects the foreign income received.

- You can claim double taxation relief in the CT600 return to offset any outstanding corporation tax liabilities.