HMRC requires that full accounts (the income statement and balance sheet) are required to be submitted alongside the corporation tax return. However, there are different options for preparing your statutory end of year accounts. If you are filing for a micro entity, you can adopt FRS 105 (the Financial Reporting Standard 105), however, if you are a small entity, you may need to file under FRS 102 instead. But this leads us to the question – which companies qualify as micro or small?

Micro Entities:

At the moment, the Companies Act 2006 states that a company is classified as micro if two of the following conditions are met:

- It has a turnover of £632,000 or less

- It has a balance sheet total of £316,000 or less

- It has 10 or less employees

However, it is important to note that these thresholds will be changing soon. For any financial years starting from the 6th April 2025 onwards, a company is considered as a micro entity if it meets two of the following conditions:

- It has a turnover of £1 million or less

- It has a balance sheet total of £500,000 or less

- It has 10 or less employees

If the company you are filing for meets two of the above criteria, then it can file its statutory accounts under the provisions of FRS 105. This financial reporting standard is based on the FRS 102 (which is applicable for small entities), however, it has been tailored to reflect the simpler nature of micro entities as well as their legal requirements – representing the true and fair value of the company. This regime allows for a more simplified format of the company’s accounts, as in the majority of cases, micro companies are owner-managed and do not have complicated relationships which require the use of more complex accounts in order to communicate the company’s financial performance.

Certain financial reporting standards do have some exemptions for the financial reporting requirements – for instance, micro and small entities are entitled to the audit exemption, which means they do not have to file an auditor’s report. Furthermore, other exemptions may apply, such as being exempt from including a director’s report within the accounts.

What must be included in the accounts prepared by a micro entity?

- A balance sheet, along with footnotes

- An income statement that complies with the provisions of FRS 105

- Notes to the accounts

Furthermore, when filing, micro entities can choose to submit abridged accounts to Companies House, which is the extracted balance sheet – meaning that less information is available on the public register. However, HMRC will require a full set of accounts – the income statement and balance sheet – to accompany the corporation tax return, which will not be available to anyone other than the tax authority.

Note that micro entities can also choose to file under FRS 102. One of the main reasons that micro companies choose to adopt the small reporting standard, is that assets cannot be revalued and investment properties cannot be measure at fair value, only historic value under FRS 105.

Small Entities:

Now let’s take a closer look at what criteria a company must meet in order to be considered as small. A company is small if two of the following are met:

- It has a turnover of £10.2 million or less

- It has a balance sheet of £5.1 million or less

- It has 50 or less employees

Once again, these thresholds will be changing from the 6th April 2025, so from then on, a company is considered as small if it meets two of the following criteria:

- It has a turnover of £15 million or less

- It has a balance sheet of £7.5 million or less

- It has 50 or less employees

Not only do these threshold changes apply to small and micro limited companies, but they also apply to small and micro limited liability partnerships as well.

If the company you are filing for meets these criteria, then it must file as a small entity under FRS 102. It’s worth noting that if your company was previously considered as micro, and grows to become a small company, you have a grace period of 1 year - meaning you can still file as micro if you would prefer, for the first year after becoming small.

Additionally, micro entities may choose not to file under FRS 105, in which case they can also prepare their accounts under FRS 102. Compared to the micro accounts, small accounts are bit more complicated, however, they are still required to disclose less information than medium and larger sized companies.

What must be included in the accounts prepared by a small entity?

- A balance sheet

- An income statement

- Notes to the accounts

EWhen filing as a small entity, you are still only required to submit abridged accounts to Companies House, so just the balance sheet is submitted. Once again, this helps keep some of the company’s more complex financial information off the public register. However, as with micro entities, HMRC still requires the full accounts to be submitted with the corporation tax return.

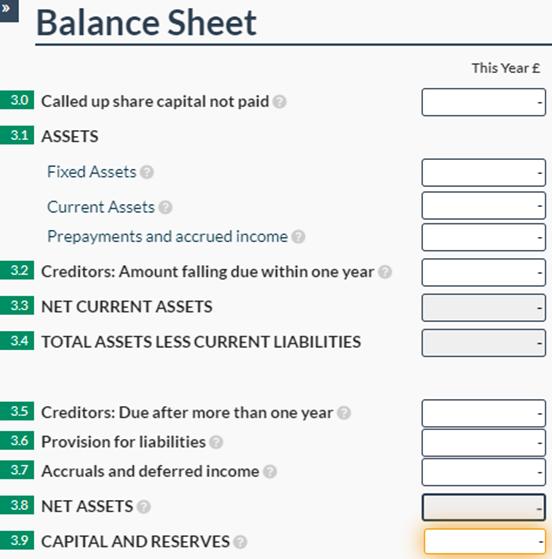

For your reference, here is how the balance sheet template looks under FRS 105 (Micro Entities):

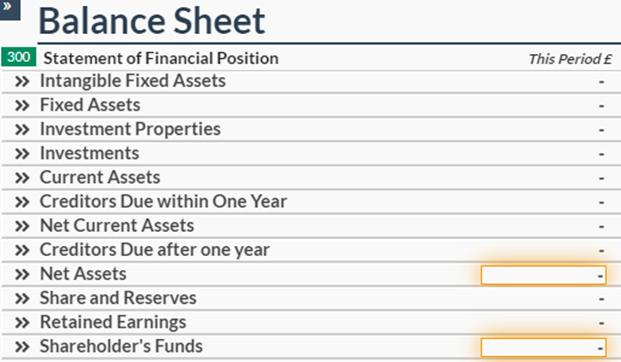

Here is a balance sheet template under FRS 102 (Small entities):

As you can see from the above, the balance sheet for a small entity has far more headings and disclosures than for a micro entity!

To summarise, in our software, you can produce your accounts under FRS 105 as well as FRS 102. The statutory required notes for both Financial Reporting Standards have also already been auto filled with the standard wording to comply with HMRC and Companies House’s requirements, however, you can amend them if you wish to.

For further help on creating a micro entity balance sheet, please see our related article on Balance Sheet Basics.