What are Management Expenses?

Management expenses are expenses that are incurred by a company whose main business involves making investments. These investments must be 'allowable', meaning that they must be related to the business' activities. For example, if a property rental company purchases (or invests) in properties to let, then that would be considered an asset for the company which is related to its main business purpose. That means that the fees relating to the purchase of this property would be considered an allowable expense as well. It is up to you when completing your returns whether certain expenses are considered as management expenses or not.

How Do I Report Them in My Accounts?

As you may know, HMRC requires full accounts to be submitted alongside the CT600 return, which means that you must complete an income statement and balance sheet. But that leaves us with the question, "where do I put the management expenses on my income statement?"

These can just be placed in any category on the income statement that you feel is most appropriate for the expense. This could be 'other premises costs', 'other professional fees', 'other expenses', etc., so it is best to determine which category the expenses best fit into.

Where Do I Place Them on the Corporation Tax -CT600 Return?

Although management expenses are considered an allowable expense, they need to be recorded separately on the CT600 return. This means that you will need to remove them from your company's total expenses and then place them in the management expenses section only.

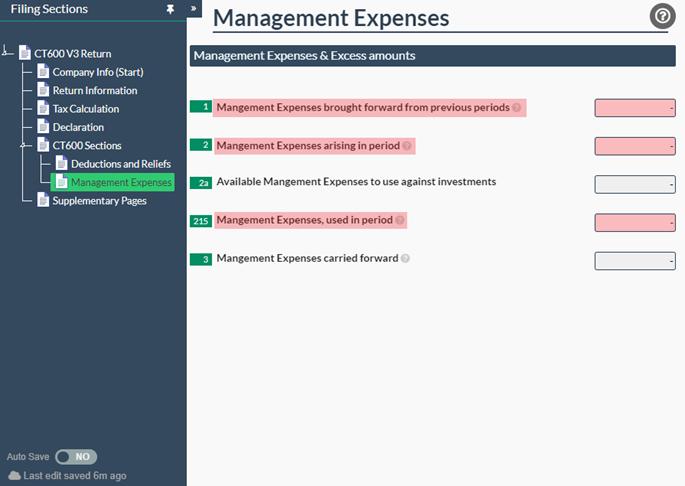

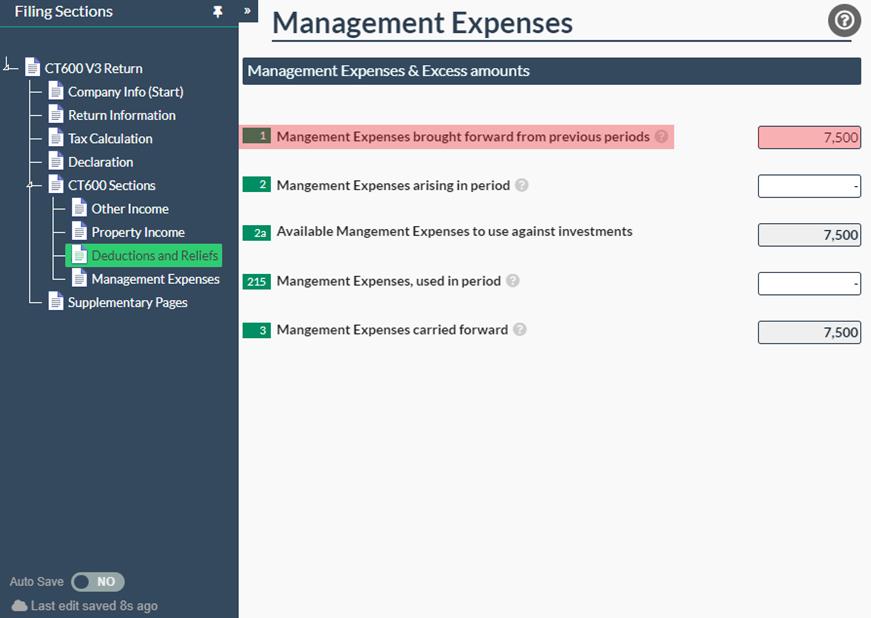

If you are filing your returns through Easy Digital Filing, you can access the 'Management Expenses' section through the Deductions and Reliefs page. First, you will need to open your CT600 return filing template, head to the 'CT600 Sections' tab on the left-hand side, and switch box 115 (which is called 'Deductions and Reliefs') to 'Yes'. Once on the Deductions and Reliefs page, you will need to click on the calculator icon next to box 245, which is called 'Management Expenses', and it will take you to the necessary page, where you can then enter your figures relating to management expenses.

Example 1

How to find the 'Management Expenses' section in your CT600 return.

Step 1: Turn on the Deductions and Reliefs page

Step 2: Click on the calculator icon next to 'Management Expenses' (box 245)

Step 3: Enter your figures into the appropriate boxes on the 'Management Expenses' page

Management expenses can be really useful when you are looking to reduce your corporation tax liability, as you can use your management expenses losses against your taxable profits to offset the amount of corporation tax due.

Example 2

How to complete your CT600 return with management expenses.

In this example, we will assume that there is a property company which had income of £35,000, total expenses (including management expenses) of £52,500, and management expenses of £7,500.

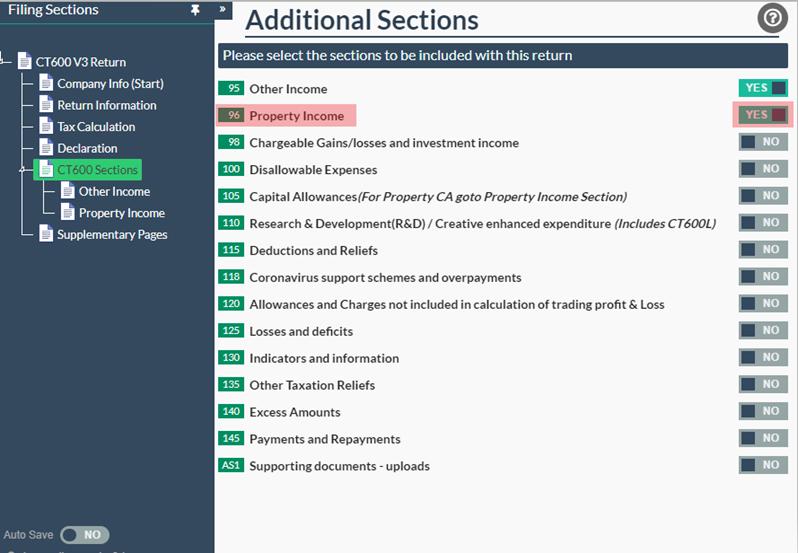

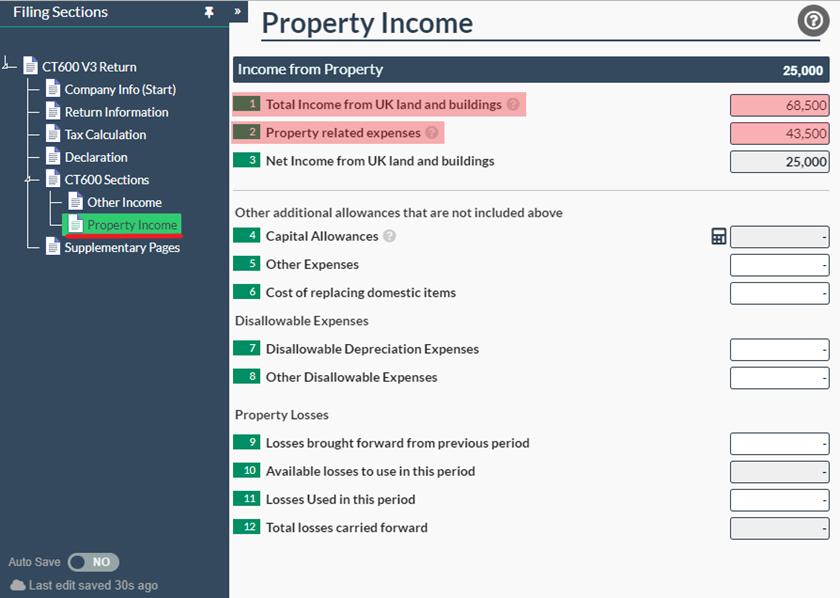

To start, you will need to include these on the 'Property Income' page, which you can find by switching box 96 to 'Yes' on the 'CT600 Sections' tab of the CT600 return filing template.

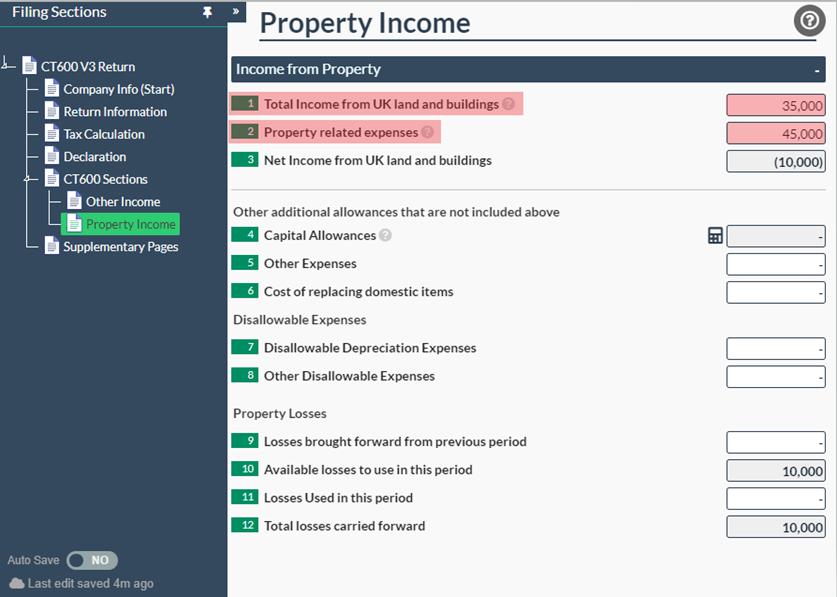

This will then create the property income page, where you can enter your income and expenses. The income is £35,000, however, it is important to remember that the management expenses must not be included in your total expenses—so we first need to calculate the total expenses.

Expenses = £52,500 (total expenses) - £7,500 (management expenses) = £45,000

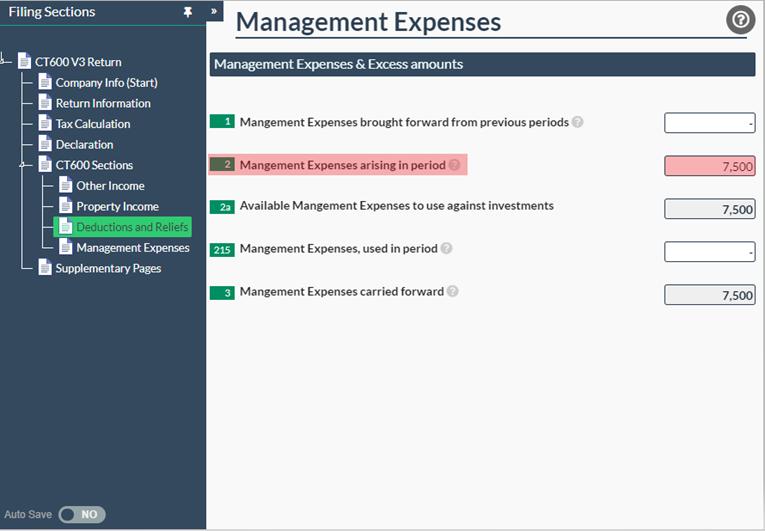

Once you have completed the 'Property Income' page, you can turn on the 'Management Expenses' page and then enter the total management expenses for the current accounting period in box 2.

This is the only section where the management expenses need to be reflected, including any management expense losses that you wish to use against your taxable profits.

In this example, the company was loss-making already, so there is no need to use their losses in this period as there are no taxable profits. Management expenses can only be used if there is a a taxable profit. If there is no taxable profit, then the management expenses can be carried forward to your next period.

Example 3

Carrying forward management expense losses and using them against taxable profits.

In this example, we can assume that the same company from the previous example is filing for their next accounting period, so there are management expenses losses carried forward of £7,500, which they can use against their taxable profits. We will also assume that during this accounting period, there was income of £68,500, total expenses of £46,750, and management expenses of £3,250.

As this is a property company, we will once again start by turning on the 'Property Income' page in the CT600 return by switching box 96 to 'Yes' on the 'CT600 Sections' tab.

Then, we will enter the total income for the accounting period of £68,500 in box 1, and, once again, we will need to remove the management expenses from the total expenses before entering that figure in box 2.

Expenses = £46,750 (total expenses) - £3,250 (management expenses) = £43,500

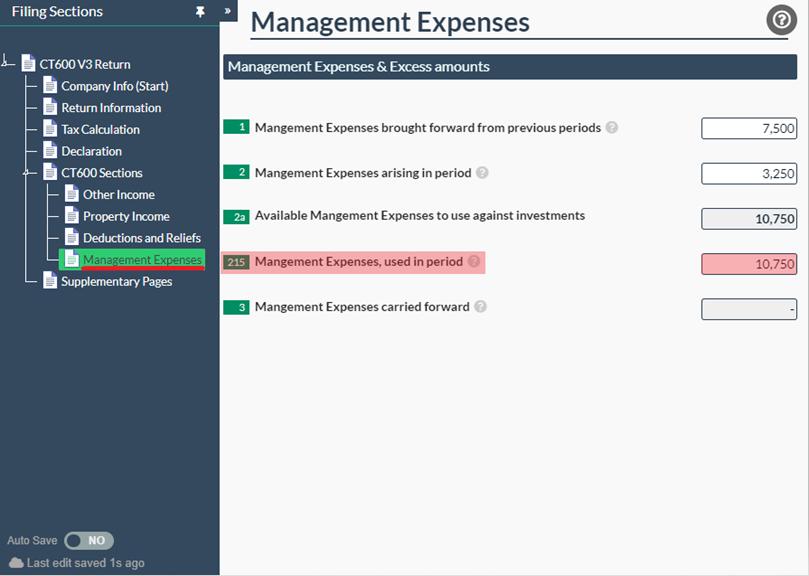

Once you have entered the income and expenses in the 'Property Income' page, you will need to turn on the 'Management Expenses' page and complete the necessary boxes there.

As this company made a loss in its previous period, it has management expenses losses to carry forward to this accounting period of £7,500. This will need to be entered in box 1 on the 'Management Expenses' page.

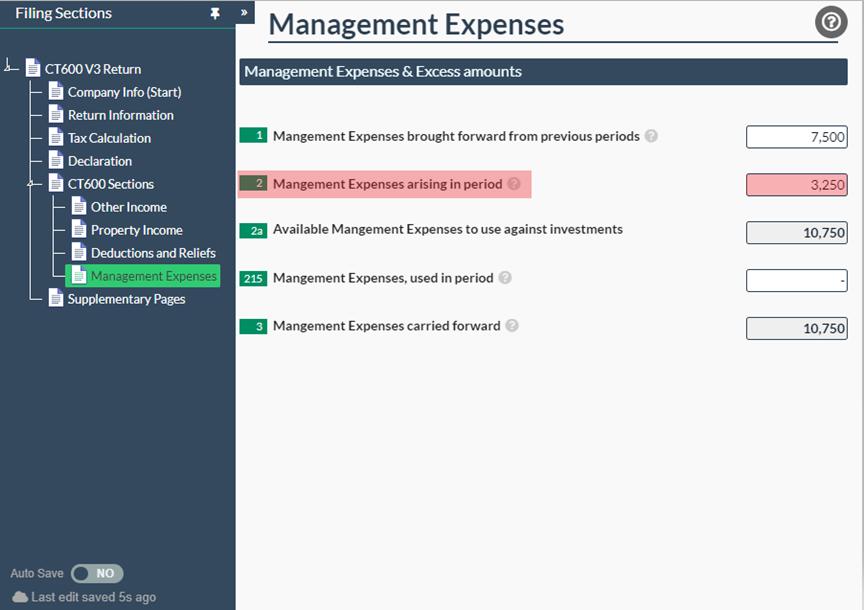

Next, you will need to enter the management expenses of £3,250 from this accounting period in box 2 on the 'Management Expenses' page.

This leaves us with total management expenses losses of £10,750, which they can use to offset their taxable income and reduce the corporation tax due.

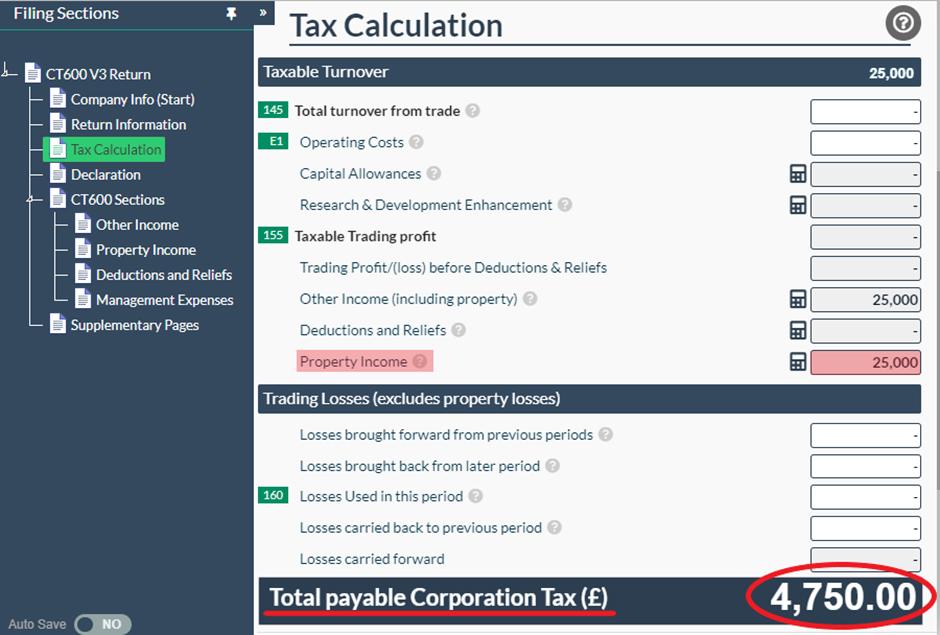

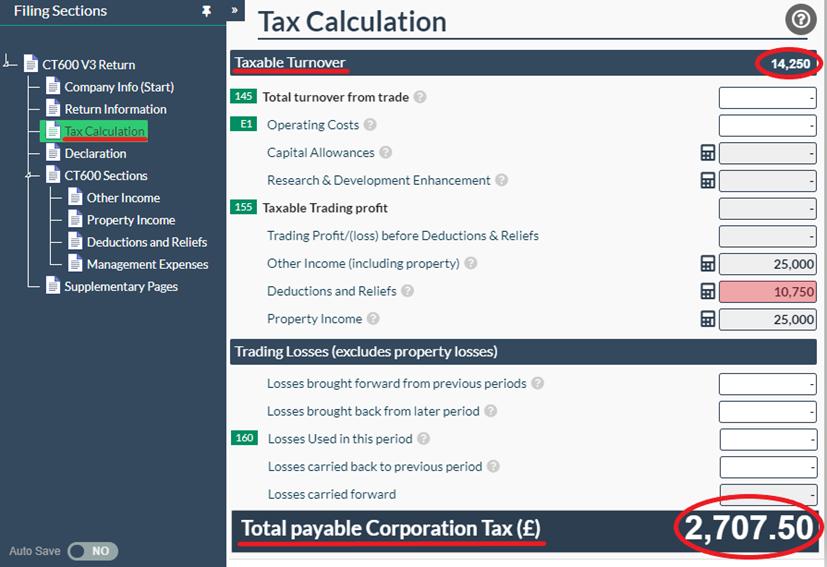

At the moment, we can see that there is a total taxable profit of £25,000, so the total tax due is £4,750 (which is £25,000 x 19%). They can reduce the total amount of tax due by using the management expense losses to reduce their taxable income.

To do this, you will need to enter the total amount of losses you wish to use in box 215 of the 'Management Expenses' page. In this case, the company's total management losses are less than the total taxable profit, so they may as well use all of their losses in this period.

Now that the management expense losses have been used, the total taxable income will be reduced by £10,750, leaving a total taxable profit of £14,250.

As you can see, the total taxable turnover has been reduced, which, in turn, has reduced the tax due for this accounting period. The total tax due is now £2,707.50 (which is £14,750 x 19%).

Key Points to Remember

This may all sound a little overwhelming as there are several rules to be aware of. Below are reminders of the key points to remember when filing for a company which has management expenses:

- Income Statement: Your management expenses can be placed in any category on the income statement that you feel fits it best. Typically, management expenses may be professional fees, rent, rates, office expenses, and more.

- Expenses: It is important to remember that your management expenses must be removed from the total expenses when entering them into your CT600 return. They must then be separately entered in the 'Management Expenses' page in box 2.

- Deductions & Reliefs: The 'Management Expenses' page is accessed through the 'Deductions and Reliefs' page, which can be found by switching box 115 to 'Yes' on the 'CT600 Sections' tab of your CT600 return.

- Losses: If you wish to use your losses against your total taxable profits, then you need to enter that figure into box 215 on the 'Management Expenses' page. Please remember that you cannot enter a figure larger than your total taxable profit. Any losses leftover will be carried forward to the next accounting period.

Now that you know how to account for your management expenses on both the CT600 return and the income statement, you are all set to file your returns!