How to work out Corporation Tax

The amount of corporation tax a company pays is based on its profits for the previous accounting period, which usually runs for 12 months and matches the dates on your annual accounts. In simple terms, the profit a company makes is sales plus other income minus the allowable operating expenses. Accounting periods are also known as reporting periods, in which companies gather and analyse their financial data into the CT600 corporate tax return ready for submission to HMRC.

If you have made a profit during your accounting period, you will need to pay corporation tax to HMRC no later than 9 months and 1 day after the accounting period has ended, applicable to micro and small business with a turnover of less than £1.5 million. For companies with taxable profits above this threshold, different payment rules apply.

Note: If you have any disallowable expenses, this will be added back onto your taxable turnover. If on the other hand you are claiming capital allowances, this will reduce your taxable turnover.

What are Corporation Tax Rates?

The current rates of corporation tax are 19% and 25% depending on your company profits. If your company made over £250,000 for the accounting period you will pay the 25% standard rate. If your company made £50,000 or less you will be eligible for the small profits rate of 19%, and any amount in between £50,000 and £250,000 is also subject to the standard 25% unless you can claim Marginal Relief.

If you have made a loss for the financial year, there will be no tax due. However, it is important that you still file a CT600 return with HMRC to inform them that you have no tax to pay. Otherwise, you could receive a penalty for not filing.

What is the Deadline for Paying Corporation Tax?

Any Corporation Taxes due should be paid 9 months and 1 day after the end of the accounting period. This is applicable if your taxable profits are less than £1.5 million. For example, if your accounting period ends on 30th September 2024, Corporation Tax would be expected to be paid by 1st July 2025.

While corporation tax is due to be paid 9 months after the end of the accounting period, the CT600 corporation tax return is due to be filed after 12 months, so companies often file their tax return ahead of time to ensure they pay the right amount of tax.

Note: If you have submitted a CT600 before payment is due, the Corporation tax payable figure will be displayed in your Government Gateway account.

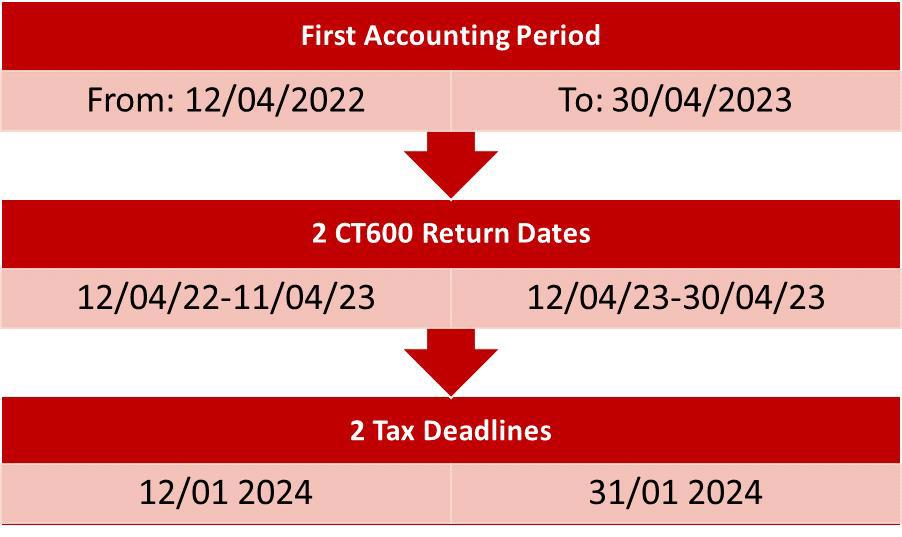

If you are filing for your companies’ first accounting period, this is usually longer than 12 months, so HMRC expects two CT600 returns to be filed to cover the full period. This means that you will also have two Corporation Tax payment deadlines. For subsequent periods, you will only have to file one tax return with one payment deadline unless you extend your accounting period.

Here is an example:

Company X ’s first period is 12th April 2022 (incorporation date) to 30th April 2023. HMRC would expect 2 CT600 Returns with the following dates: 12th April 2022 to 11th April 2023 and 12th April 2023 to 30th April 2023. The deadline for paying tax for the first CT600 Return is 12th January 2024 and for the second CT600 Return, tax is expected to be paid no later than 31st January 2024.

HMRC Interest on Late Payment

It’s always important to note the deadlines to avoid any interest incurred on late Corporation Tax payments. Interest is charged if you have not paid enough or if you have not paid at all. You can expect HMRC to start charging any late payment interest the day after the tax payment is due.

You may find it useful to note that the interest charged is an allowable expense for the following period, which means it is tax deductible.

Furthermore, HMRC will also pay you interest in you have paid more Corporation Tax than required (repayment interest) and if you have paid your tax bill early (credit interest). This is regarded as ‘other income’ in the accounts for the following period and it is a taxable source of income.

How to Pay Corporation Tax:

To pay your Corporation Tax bill, you will need your 17-character payment reference number, which can be located on either your notice to deliver your tax return from HMRC, any reminders sent or in your company's Online Gateway account.

Note: The payment reference number is updated to reflect each new accounting period and is made up of the 10-digit company Unique Tax Reference (UTR) number, 5 standard characters and 2 numerical digits indicating the accounting period.

When making the payment, it is important that the correct reference number is used to avoid payment delays.

You can pay Corporation Tax in a variety of different ways via online or telephone banking, bank transfer, or direct debit, but HMRC recommends paying online through your Government Gateway

account as details like the payment reference number will be automatically entered and it reduces the risk of payments being allocated incorrectly or being processed late. It can also take a few working days for the Government Gateway to be updated after payment has been sent to HMRC.

Note: You will need to register and activate Corporation Tax services online in HMRC’s Government Gateway to file your corporation tax, and pay corporation tax.

Simplify your company tax return

We specialise in helping small and micro companies file their taxes and accounts with Companies House and HMRC, ensuring that they meet their legal obligations and file on time using our simple, intuitive software. Try it out for free before filing or send a message to one of our team.