What are ABGH Distributions Comprised of?

ABGH income refers to dividend income received by a company that is exempt from corporation tax.

The letters ABGH refer to the relevant section of the clause that defines them within the Corporation Tax Act (CTA 2010). The vast majority of dividends; these are dividends from UK companies, intra-group dividends and dividends from foreign (overseas) companies, are exempt.

After April 6, 2016, the term 'ABGH exempt distributions' replaced the previously known 'Franked Investment Income' (FII). Essentially, it refers to income received as tax-free dividends, irrespective of whether they originate from a UK or non-UK resident company.

But why are Dividends Received Exempt from Corporation Tax?

Dividend income received from other UK and Non-UK companies are paid out of the profits of the distributing company, therefore the ABGH income has already been subject to corporation tax. In order to avoid double taxation, such dividends are not included in the taxable total profits of the recipient company.

Prior to April 2023, receiving ABGH income had no affect on a companies corporation tax. However, since this date, if a company is in a group or has associated companies and has a profit, then receiving ABGH income can increase corporation tax.

Understanding Associated Companies: Criteria and Entities Included

- Associated companies are under the same control, meaning that there is a shareholding of more than 50%

- Even if a company is associated only for a part of an accounting period, it will mean that the company was associated for the whole of that period

- Both UK resident and overseas companies are counted for associated companies purposes

- Dormant companies (not trading) will not count as being associated.

How Should Dividends be Recorded in a Company's Accounts, Particularly on the CT600 Return, Considering Their Exemption from Corporation Tax?

Let's consider the following two cases:

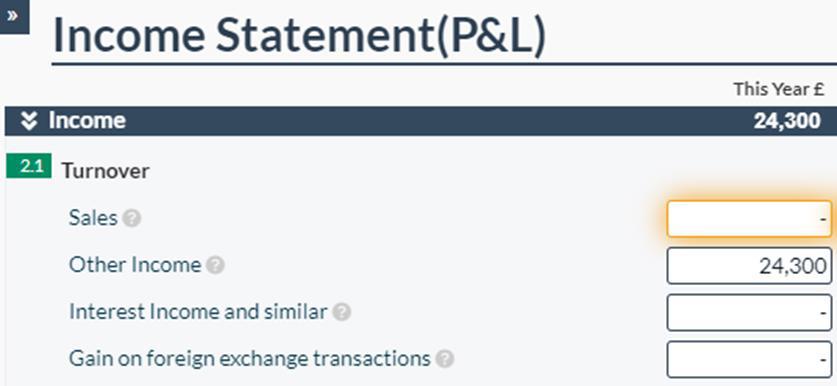

i) Company A received exempt dividends of £24,300 from a non-group company

Accounts

Typically, dividend income will be recorded as 'Other income' as it is a non-operating gain, therefore, it does not fall within the 'Sales' category.

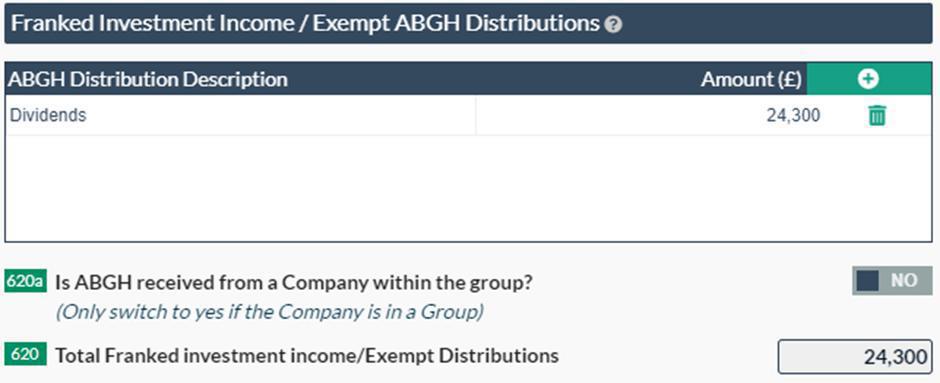

CT600 Return

In order to account for the dividends received on the CT600 return box 98 'Chargeable gains/losses and investment income' should be switched to 'Yes' (this page can be accessed by navigating to 'CT600 Sections') and then allocate these accordingly:

A note here* - the total amount of ABGH distributions should not be separately included as 'Total turnover from trade' or 'Other income' as once it has been entered on the 'Exempt ABGH distributions section' our software will automatically reflect these as 'exempt distributions', and the amount will not be added to the company's taxable profits.

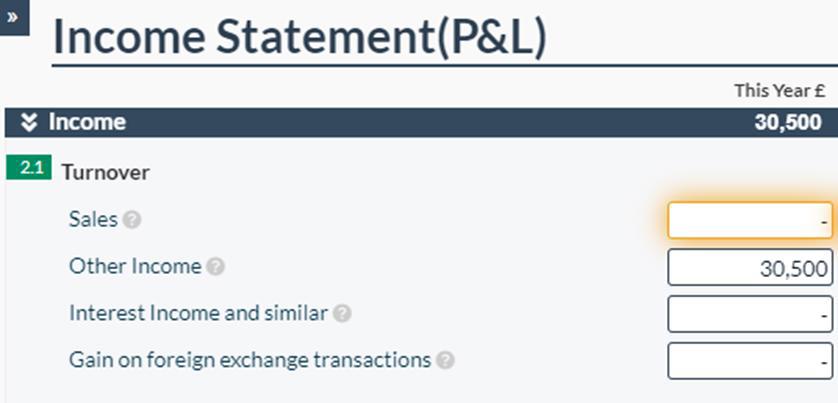

ii) A company receives £30,500 dividends from a company within its group and part of the accounting period falls after 1st April 2023

Accounts

Again, in the accounts the dividend income will be recorded as 'Other income'

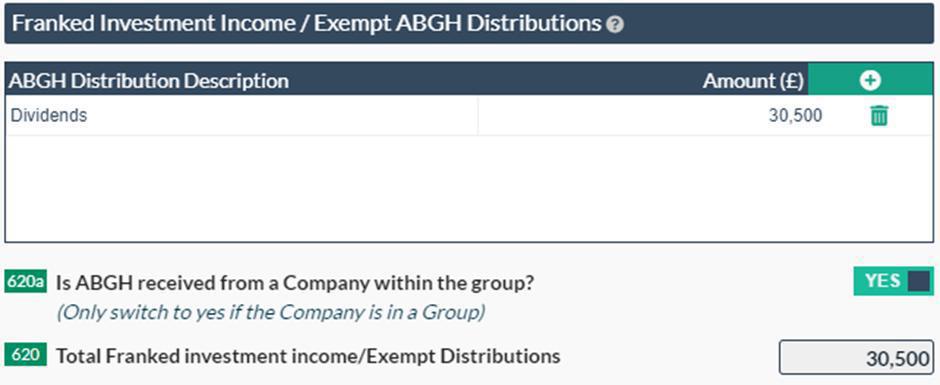

CT600 Return

Again, in order to account for the dividends received, you will need to switch box 98 ‘Chargeable gains/losses and investment income’ to ‘yes’, and then allocate the amount accordingly. However, since the dividends received are from a company within the group, box 620a should be switched to ‘yes’ too.

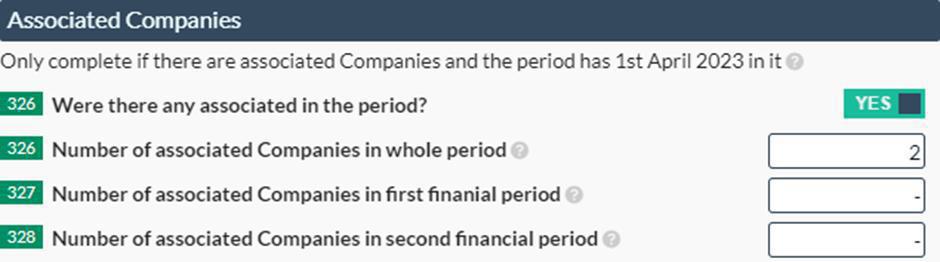

Additionally, it is important to note that the ‘Associated companies’ section of the CT600 return should be completed as well. This page can be accessed through the ‘CT600 Sections’ – box 130 ‘Indicators and information’ should be switched to ‘yes’ and then either box 326 only or boxes 327 and 328 should be completed.

If your company has ABGH income will also contribute to your augmented profits. Augmented profits are used in the calculation of corporation tax, since the rates of corporation tax changed in April 2023. If your company is in a group or has associated companies, this will affect the upper and lower limit used in your corporation tax calculation.

What are Augmented Profits, and why are they Important?

Augmented profits consist of a company's taxable total profits (TTP) for the period, along with ABGH dividends or franked investment distributions from non-group companies. This figure excludes group dividends. Augmented profits are crucial when it comes to corporation tax payments, as they are compared with the profit limits to determine the rate of tax applicable to a company. Augmented profits also aid in determining if large companies must pay corporation tax in instalments.

Please note: The total taxable profits are subject to corporation tax, and not the augmented profits.

Corporation Tax Rate Change, Augmented Profits and Marginal Rate Relief (MRR)

As of April 1, 2023 (2023/2024 Tax year), the corporation tax rate increased. The small profits corporation rate of 19% is applicable if a company's augmented profits do not surpass the lower limit of £50,000. The main rate of corporation tax of 25% applies when augmented profits reach £250,000 or exceed the upper limit. Companies with augmented profits between the lower and upper rate are benefitting from Marginal Rate Relief, which reduces the corporation tax rate. The lower limit of £50,000 and upper corporation tax limit of £250,000 are effectively shared if a company has associated companies which affects the corporation tax rate. For more information about calculating corporation tax since the introduction of upper and lower limits and marginal rate relief, please see our article calculating marginal rate relief.

I hope this paper has clarified the key aspects of ABGH income for you. Nevertheless, we recognise that this topic can be complex. That's why we've simplified the process as much as possible. Just allocate your entries, and we'll take care of the rest behind the scenes!