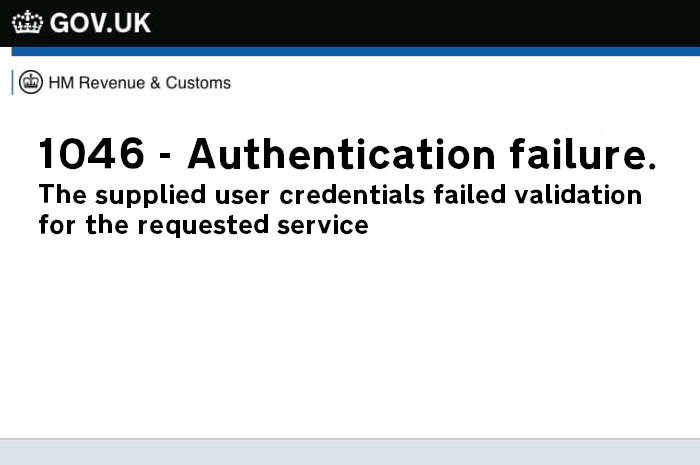

If you are receiving a 1046 error message after submitting your CT600,

to the HMRC gateway this is because the details entered

when attempting to file are incorrect, or they do not match

what HMRC are expecting. The EasyDigitalFiling Service sends your UTR together with User

ID and Password exactly as you have entered these.

To resolve this error message, please go through the steps below.

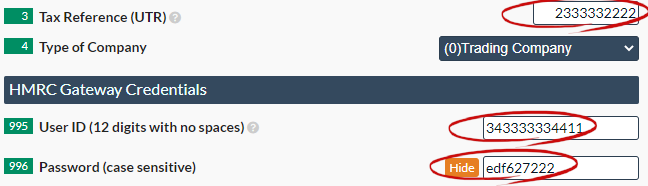

Step 1 - Check that your Gateway HMRC User ID and Password are valid

This may seem obvious, but its very easy to type a userID or password in incorrectly, as per HMRC rules we send both userID and password exactly as they are entered. So please check that any upper or lower case characters are correct. To check that the password is correct, you can click on the show button below.

If the HMRC gateway User ID and Password look correct, check that using these you can actually sign in directly to the gateway - you can sign in here.

If successful, you will be presented with a security message

(click on Next to carry on). If unsuccessful, you will receive an error message and will need to

follow the on-screen instructions to reset your username and/or password.

If you have already tried to log in three or more times, then HMRC

will have locked your account for two hours and you will therefore need to wait before trying again.

If you are logging into your HMRC account as a new user, you will presented with a list of services. To register for corporation tax you will require your UTR and either your Companies House Registration Number (CRN) or your registered office postcode. You will then be sent an activation code by post.

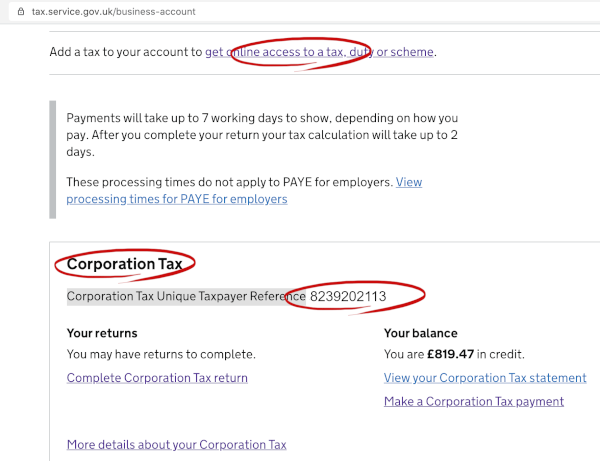

Step 2 - Check that the UTR you have entered is correct

If you successfully logged into your gateway account in step 1, then the UTR should be shown in the Corporation Tax section of your Government gateway main page. (see Image below) Check this is the same as you have entered into your EasyDigitalFiling Account for the Company you are filing for. You can also validate that your UTR is correctly formed on this page What is a UTR Number?

Step 3 - Activate the Corporation Tax or Self Assessment Tax service

Probably the most common reason for the 1046 error is the gateway account does not have the Corporation tax service added / or activated. If you see the Corporation tax service on your Gateway account like the image above, then it's already activated. However, if you are not seeing this service you will need to click on the link (top item, red circled in the image above) to request an activation code.

If you are a partnership submitting to HMRC the nominated partner must log into their government gateway account and make sure the self-assessment tax service is activated. To do this, you should click 'Get online access to a tax, duty or scheme', (circled in red in the image above). This will enable you to request an activation code that will activate the tax service.

After selecting add service, you will need to wait for the activation code to be sent via post (this can take up to 10 days) once received, this code needs to be entered into HMRC's website. In some instances, you may need to wait 24 to 48 hours after activation before trying to file to HMRC. Please note that you have 3 attempts to enter the code otherwise you will be locked out and have to request another.

Don't worry about leaving your filings, they are all saved for you. Once you have activated the Corporation Tax or Self Assessment Tax service, just log back in and submit.

Step 4 - Check that the UTR is not linked to an Agent ID(Accountant)

If an accountant has previously filed for the company they may have used their own Agent Account. In his case the UTR may be still linked to the accountant's details. When this happens you can remove the authorisation from the UTR from the accountants Agent ID by logging into your business tax account and then:

- Go to ‘Manage account’ at the top of the page.

- Under tax agents, select on ‘Add, view or change tax agents’.

- Select ‘Corporation Tax’

- Select ‘manage agents’.

- Select ‘remove’.

- Then select ‘remove agent’.

Alternatively, you can contact HMRC and ask then to remove the link (un-authorise) the UTR from the accountants Agent ID. They normally can do this whilst you are on the phone - you can contact HMRC Corporation Enquiries here

Once you have worked through each of these steps to ensure that the information in your Easy Digital account is correct, and the corporation tax is activated, you will need to open your CT600 return and set it back to 'Ready to File', before attempting to submit the filing again.