Autumn Budget Highlights

The Autumn budget will introduce significant changes for over 5.6 million small businesses across the UK. It is expected to raise taxes by £40 billion, making it the largest tax-increasing budget in history. There have been a number of key changes announced that will impact National Insurance contributions, minimum wage and employment allowances.

Key announcements:

- Increase to national minimum wage

- Changes in employers national insurance contributions (NIC)

- Employment allowance will be increased

- Increase on Capital Gains Tax (CGT)

Below, we will highlight and explain the key features that will affect small business owners.

Rise In Minimum Wage

The UK Autumn Budget introduced a rise to minimum wage and a rise to the national living wage, which will impact small businesses by increasing their staff costs. As a result, employers will need to allocate more funds to meet the new wage requirements, which could be especially challenging for small businesses with tighter margins. Businesses may need to adjust the number of staff they employ, reduce hours, or increase prices to offset the higher wage bill. While the wage increase benefits workers, it presents financial pressure for businesses, particularly in industries such as hospitality and retail that are particularly reliant on minimum wage employees.

From April 2025 national minimum wage for those over 21 is set to increase by 16.3% and national living wage for those aged 18-20 is set to increase by 6.7%. The nominal values of the changes are outlined in the table below:

| Current Rate (2024) | Rate As Of April 2025 |

| National Minimum Wage | £8.60 Per Hour | £10 Per Hour |

| National Living Wage | £11.44 Per Hour | £12.21 Per Hour |

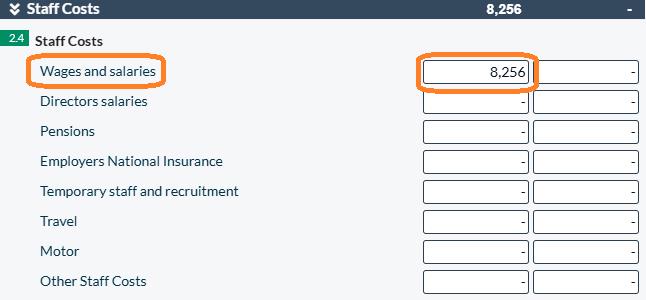

How is this recorded on the income statement?

Example: Business ABC have an employee who earns the national minimum wage. They work 80 hours a month.

So, to calculate your staff costs you must do the following:

80 (Hours per month) X £8.60 (NMW) = £688 per month

£688 (Monthly wages) X 12 (Months per year) = £8,256 per year

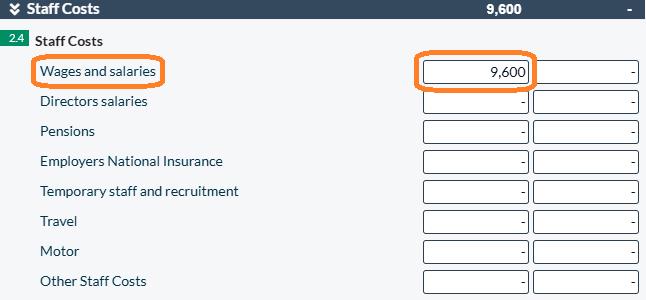

How will the new minimum wage affect staff costs?

Example: Business ABC still has one employee working 80 hours a month.

80 (Hours per month) X £10 (New NMW) = £800 per month

£800 (Monthly wages) X 12 (Months per year) = £9,600 per year

Once the figures have been input to the template you will be able to see that the yearly wages from the example have increased by £1,344. This cost could be unaffordable for some small businesses, potentially putting jobs at risk or forcing the business to pass the additional expense onto consumers through higher prices.

This will also have an impact on staff paid above the above the minimum wage, as there salaries will be closer to the minimum wage and they may expect a similar salary increase.

NI Contribution Rates

Employers currently pay national insurance contributions of 13.8% on an employee's earnings above £9,100 per year. From April 2025 employers will pay 15% national insurance contributions on their employees earning over £5,000 per year, this is a 1.2% jump from the current 13.8%. It will lead to higher costs for businesses. This is particularly true for small companies that employ a lot of part-time or casual workers, such as catering businesses. This will inevitably put further pressure on small businesses, potentially leading to businesses limiting pay rises or reducing pension contributions.

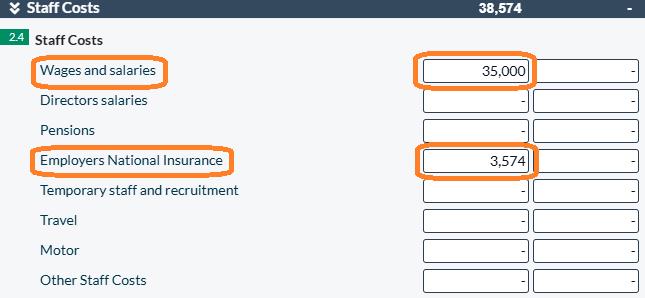

How is this recorded on the income statement?

Example: Business ABC has an employee with an annual salary of £35,000. Let's assume the employer is paying the current NIC rate of 13.8%. Meaning the employer is paying NICs on £25,900 of the salary (£35,000 - £9,100 threshold).

This means the amount of NICs due from the employer is: £25,900 X 13.8% = £3,574

The employers national insurance contributions need to be accounted for in the income statement, as shown below.

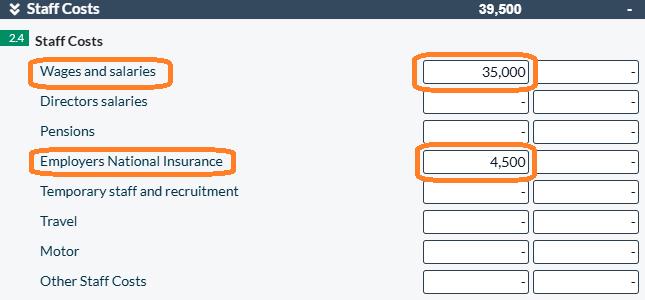

How will the new rates affect the income statement?

Example: Business ABC still has one employee with an annual salary of £35,000. Now, let's assume the company is paying the new employer NIC rate of 15% alongside the new employment allowance of £5,000. This means the employer is paying NICs on £30,000 of the salary (£30,000 - £5,000 threshold).

Meaning the NICs due from the employer is: £30,000 X 15% = £4,500

Employment Allowance

From April 2025 employment allowance is increasing from £5,000 to £10,500. Employment allowance allows eligible employers to lower their annual National Insurance contributions. It is intended to assist small businesses by offering financial flexibility, helping them to invest in their operations and workforce. From April 2025 employers must meet the following eligibility criteria:

- Operating as a business or a charity (including community amateur sports clubs)

- Registered as an employer and employing staff

- Class 1 National Insurance liabilities were less than £100,000 in the previous tax year

- Have two or more directors who who earn more than the secondary threshold for class 1 NICs (If you are a Ltd company only employing directors)

You can claim Employment Allowance at any time during the tax year as part of your Real Time Information (RTI) submission to HMRC in your payroll process. Keep in mind that the allowance applies per business, not per employee, and can only be claimed through one payroll if the business has multiple. Once the £10,500 limit is reached, any amount exceeding this will need to be paid to HMRC. For example, if the business's National Insurance bill comes to £12,000, the business will only need to pay the remaining £1,500.

Planning Ahead

With the upcoming Autumn budget changes, now is the perfect time to plan ahead and prepare for the adjustments that will affect your business. We recommend using the following tools to stay on top of the upcoming changes:

- Corporate Tax Calculator: This can be used to calculate how the increase in expenditure resulting from the Autumn budget will impact your corporate tax payments.

- User-friendly tax filing software: Take advantage of user-friendly software to stay on top of your business's finances and keep up with financial regulatory changes. Our software will automatically update to align with any Autumn budget updates, making it even easier to file your business accounts. You can sign up and try our software for free while you prepare your tax filings.

Hopefully this article has helped clarify how the Autumn budget will affect your business. For more information on topics related to the UK economy, feel free to explore our Knowledge Base. If you have any additional questions about how the Autumn budget will affect your small business, don't hesitate to reach out to us here.

This article is information only and has been prepared for general guidance on matters of interest only, and does not constitute legal, accounting, tax, investment or other professional advice or services. You should not act upon the information contained in this article without obtaining specific professional or legal advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this article, and, to the extent permitted by law, Comdal Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.