What is a chargeable asset and how do chargeable gains arise?

The taxable total profits of a company for an accounting

period include any chargeable gains arising on the sale or disposal of an

asset. As we all know, gains chargeable to tax are applicable to both individuals

and companies, however there are crucial differences in the rules which have to

be taken into account.

In the first place let’s explore what a chargeable asset is. A corporation’s chargeable assets usually are comprised of tangible fixed assets. For example:

a) Buildings

b) Land

c) Plant and machinery - such as computers, tools, office furniture

d) Shares

However, there are fixed assets which are exempt from Capital gains tax, for instance:

a) Motor cars

b) Items of tangible movable property (also called 'chattels') worth £6,000 or less. For example: jewellery, antiques, books, drawings, vintage cars.

c) Items with predictable useful life of no more than 50 years (called 'wasting chattels'). For instance: vintage motor-cycles.

d) Gilt-edged securities and qualifying corporate bonds.

e) A gift of a chargeable asset to a charity.

The chargeable gain figure for a period is calculated with

regards to the disposal value and the acquisition price of an asset. If a gain

arises, and there are losses to offset against, those are subtracted.

If an allowable capital loss arises, and there are no gains, then this loss is carried forward to future accounting periods. It is important to know that capital losses are treated differently from trading losses, therefore those cannot be offset against trading income.

Now let’s discuss how you can account for chargeable gains and capital losses in Easy Digital software.

Firstly, you will have to create a CT600 template in your

account, and to do so please click on the ‘Add filing’ blue button on the top

right of your screen and select the CT600 option (if you do not have your full

set of accounts in IXBRL format required by HMRC, then please select an option

with accounts).

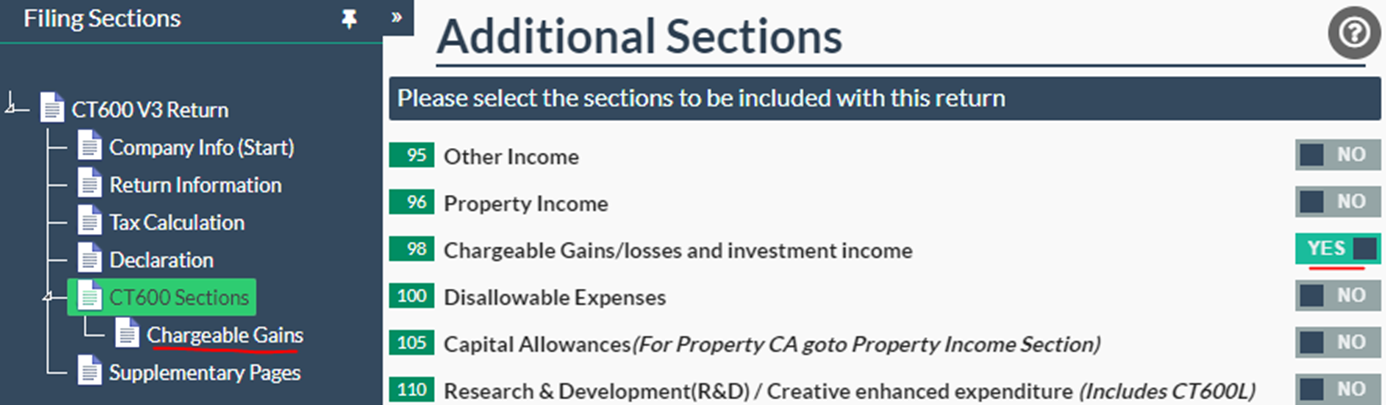

Once the filing has been created in your account you can click on it to open. There you will be able to see a number of sections on the left panel of the screen. The section you should click on next is ‘CT600 Sections’ where are all additional sections. Box 98 is ‘Chargeable Gains/losses and investment income’ and you have to switch it to ‘yes’. A new section will appear on the left - ‘Chargeable gains’

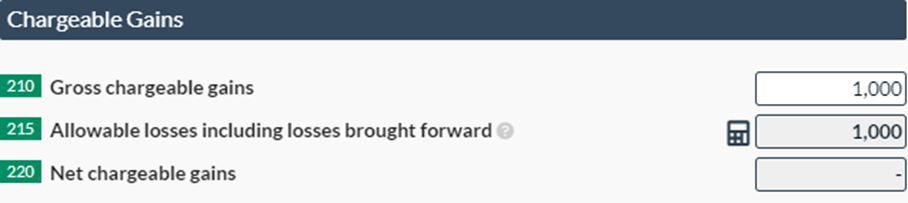

Let’s go through an example: Gross chargeable gain is £1,000

The Gross chargeable gains have to be inputted in CT600 box 210 - as shown below:

You will notice that CT600 box 220 changes, according to boxes 210 and 215.

If you have allowable capital losses/allowable losses that occurred in the

period or losses brought forward from previous periods – you have to

click on the calculator next to CT600 box 215 in order to disclose them. Please

note that these should be capital losses, not trading losses.

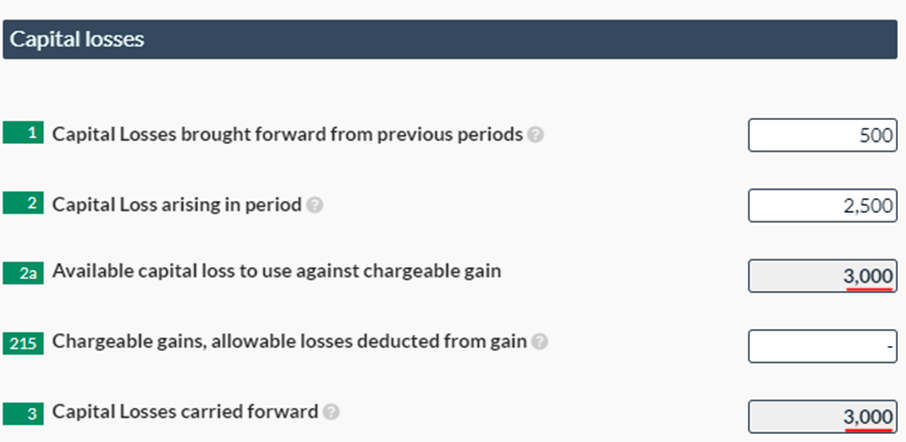

Capital losses section opens when you click on the calculator:

Box 1 – enter the value of allowable losses brought forward from

previous periods (if none leave blank).

Box 2 – enter the value of allowable losses in the period (if

none leave blank).

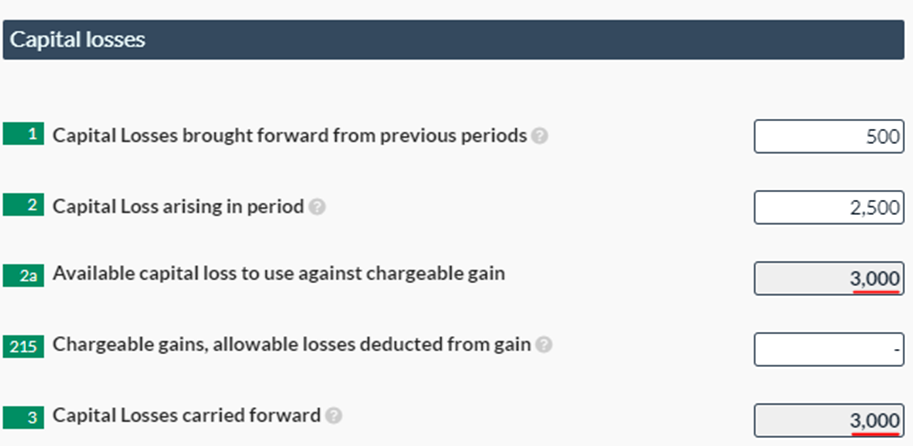

Let’s see an example again:

Box 1 Capital losses/allowable losses brought forward to be £500

Box 2 Capital losses/allowable losses arising in the period to be £2,500

You will notice that the value in box 2a is the sum of boxes 1 and 2:

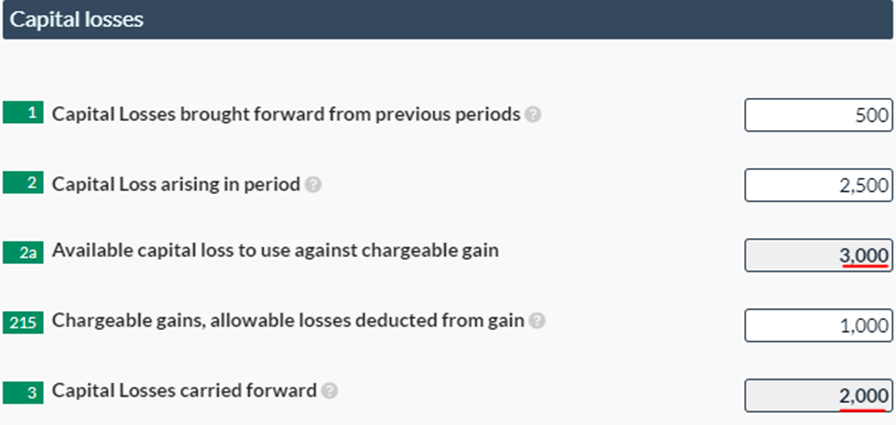

If you have a chargeable gain in the period and you want

offset it against capital losses, then enter the figure in box 215

(Please note that allowable losses must be less than or equal to the gross

chargeable gain).

Continued from the examples above: Gross chargeable gain is

£1,000 (box 210)

Capital losses available to use against chargeable gain

£3,000 (box 2a)

Let’s input our chargeable gain £1,000 in box 215

You will see that as you are using £1,000 of capital loss to

offset against a gain, £2,000 of capital losses will be carried forward to

future periods (£3,000 - £1,000) – this is the figure in box 3.

Therefore, our Chargeable gain section will look like this, with the allowable losses deducted from the gain:

Please note that as there is no chargeable gain arising, therefore the main Tax calculation page will be blank.

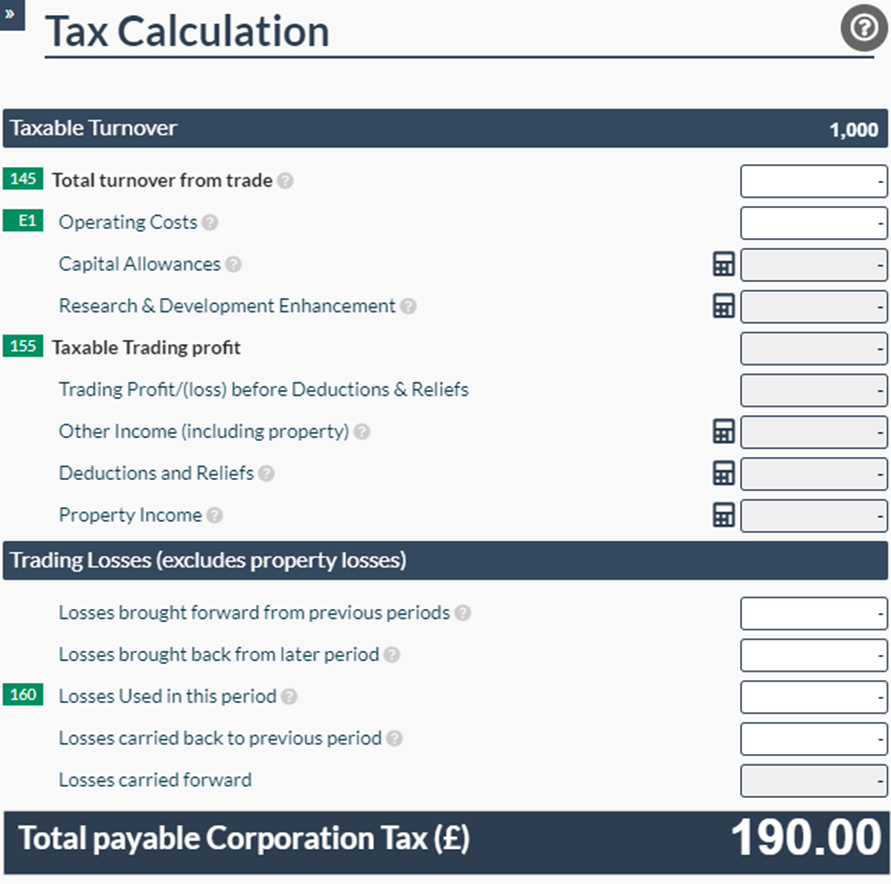

In another case, if a chargeable gain arises you will see

that the total tax due for the period will be shown on the main Tax Calculation

page.

Chargeable gain of £1,000 – then corporation tax is charged

at 19% and tax is £190.

Please note that only the taxable turnover and tax due will be present on the main Tax calculation page: