You may have heard after the budget back in March 2023, that there were some changes to the R&D tax credit for small businesses, we will discuss these changes here and how they will affect any small business carrying out research and development activities. These changes come after the addition of the CT600L form in 2021 and the restriction of the amount of R&D tax credit payable, relating to PAYE contributions back in April 2022.

Changes to Research and Development 2023.

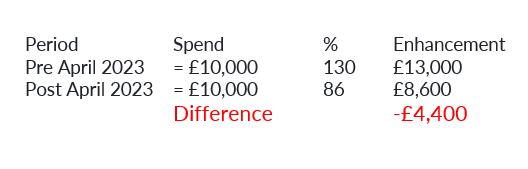

Since 1st April 2023, for SME's any expenditure spent on research and development, the enhancement has been reduced from 130% to 86%. This is a significant reduction. Pre April 2021, this means if your Company had spent £10,000 on Research and Development, you were eligible to claim an additional 130% enhancement, from April 2023 this will be reduced to 86%.

Therefore, if you have a tax period that falls both into the pre April 2023 reduction in R&D enhancement and post this date, our software will apportion the number of days in each period and the spend across that period. You will then receive an enhancement for the amount of spend that falls in each period. This is irrespective of whether the whole spend fell pre April 2023 or post April 2023.

The amount shown in the CT600L and box 660 of the CT600 form will reflect the total amount of enhancement. In your computations that accompany the CT600, you will see a breakdown of how this amount has been calculated.

The effect of the reduction in enhancement, will not only mean more tax to pay, if your company was profitable, as the enhancement will be less to offset against any profit but mean less companies will qualify for a payable tax credit.

Claiming a Tax Credit For Loss Making Companies.

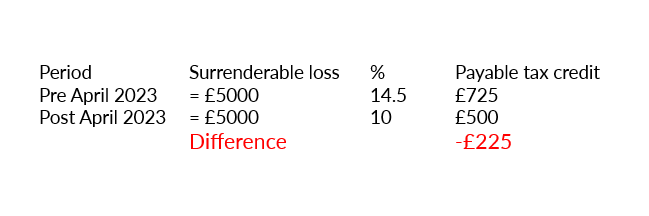

On top of the reduction for the enhancement for R&D expenditure, the percentage for the amount of tax credit payable has also been reduced, adding another blow to SME's. Previously tax credits were calculated at 14.5% of surrenderable loss. This has now been reduced to 10%.

Surrenderable loss is calculated by taking all your income for the period minus all your expenses including the actual spend on R&D. To this the enhanced credit is added. If after this your company is loss making, you then have a surrenderable loss (don't worry we calculate this for you).

If you have a large spend and loss, the effect will be significant.

HMRC have said that for Companies that are Research and Development intensive, they will keep the 14.5% tax credit rate. At this point in time there is little information about what constitutes a Research and Development intensive company or how to claim the 14.5%. HMRC will be issuing further guidelines on both.

Is Claiming a Tax Credit the Best Option?

This really depends on the situation of your business, however, bearing in mind the recent increases for corporation tax for profits over £50,000, if you are likely to be profitable in future periods, then the tax advantage could be significant when you compare a 10% tax credit with a reduction in corporation tax credit of up to 25%.

To find out more about completing your R&D claim, please see our article on Claiming research and development.