Along with the reduction of enhancement and payable tax credit HMRC now require certain companies to inform them that they intend to make a research and development claim. In addition from the 1st August 2023, HMRC require all Companies making an R&D claim to provide additional information via their web portal, as well as make a claim through the usual CT600, and CT600L if making a claim for a repayment.

Notify HMRC that you intend to make an R&D claim.

You now need to let HMRC know if you want to make and R&D claim if your accounting period period starts after 1st April 2023 and any of the following apply:

- You have not claimed R&D before

- Your last claim was made 3 years before the last date of the Claim Notification Period

- You have claimed for the previous tax year, but have not submitted that claim before the last day of the Claim Notification Period.

What is the Claim Notification Period for Research and Development?

You must notify HMRC within 6 Months of the end of your accounting period that the claim relates to.

Additional Information Form

From 1st August 2023, all companies wishing to make a research and development claim must complete an additional information form on HMRC's website. This is for all companies, not only those wanting to make a claim for a tax credit, but those who are claiming for tax relief as well. This is a change from HMRC's previous tightening up of compliance for Research and Development, previously all their measures, including the implementation of the CT600 L, had been aimed at Companies making a claim for a tax credit. The form must be completed before you submit your R&D claim in your CT600 corporation tax return.

What information must be included in the additional information form?

You will need the company UTR, also the employers PAYE reference (only previously required for tax credits) and VAT registration number as well as the business type - usually taken from the SIC code registered at Companies House. The SIC code and VAT number are both new requirements.

You will also need to include the accounting start and end date and the contact details, in case HMRC want to contact you about your claim.

Project Details

For your research and development project you must give the following additional information:

1. What is the main field of science or technology

You will need to provide a brief description of the science or technology filed that the project relates to. HMRC provides the following guidance:

"Science is the systemic study of the nature and behaviour of the physical and material universe"

and

"Technology is the practical application of scientific principles or knowledge"

From 1st April 2023 mathematical advances are treated as science.

2. Describe the baseline level of science or technology the company plans to advance.

A description of what existed previously in the intended research and development area. This description was already included in HMRC's requirements to prove that R&D has taken place, so is an existing requirement

3. What advances in the scientific or technological knowledge did the company want to achieve.

This is a description of what you wanted to achieve -the objectives of the project. It can be an advance in knowledge or capabilities in science or knowledge. However, it would be seen as an advancement in the field by a competent professional who is working in that field.

4. The scientific or technical uncertainties that the Company faced

A description of the uncertainties that the company faces and hopes to overcome in the project.

5. How did the project seek to overcome these uncertainties

This is the methodology that the company used to overcome the uncertainties.

6. Which relief you are claiming

Include details of your qualifying expenditure on R&D and the type of tax relief you are claiming.

Qualifying expenditure can include for SME's

- Consumable items

- externally provided workers

- participants in clinical trials

- software

- staff

- subcontractors

- For accounting periods starting after 1st April 23, cloud computing costs and data license costs can also be included

- qualifying indirect costs.

Once your additional information form has been submitted you can then complete your CT600 corporation tax return in the normal way and make the R&D claim, and complete the CT600 L if making a claim for a R&D tax credit.

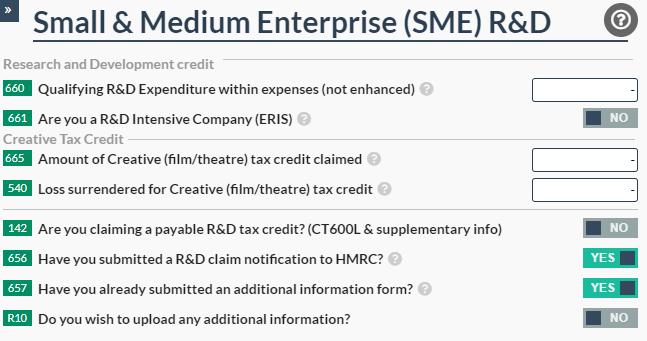

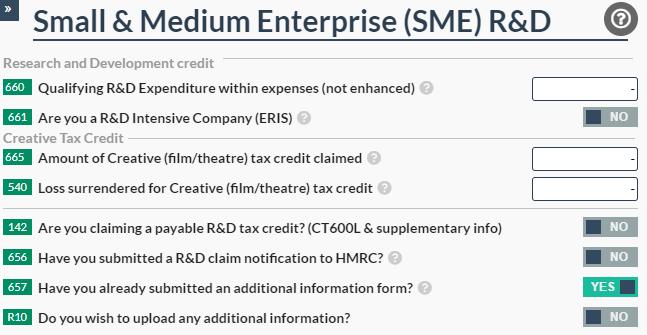

To complete this on your Easy Digital account, please navigate to 'R&D Expenditure' on your CT600 return and change boxes 656 and 657 to YES if you are completing an R&D claim for the first time. Please note, you must submit your form which tells HMRC you will be claiming R&D prior to submitting your CT600.

If you are not submitting for your first time, you only need to switch box 657 to YES.

Please go to HMRC's website to get started on your additional information form for research and development