Company Tax Preparation Service

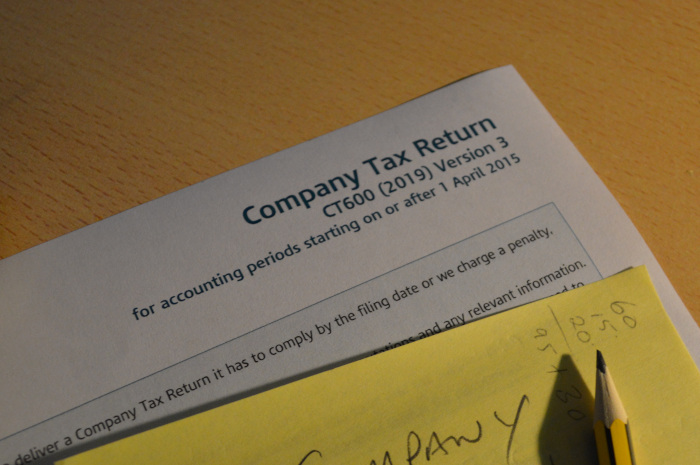

CT600 online tax filing preparation service for micro businesses who need to file their CT600 and iXBRL accounts to HMRC & Companies House.

Our premier micro managed filing service takes all the stress away, you simply provide your trading figures and we do the rest. We prepare a CT600 and computations, a set of iXBRL accounts inline with FRS105, the micro company regime for HMRC and Companies House all for £379 + VAT (£649 + VAT for Small Companies)

Premier Micro Managed Filings are for Micro companies (two of the following: Turnover below £1m; 10 employees or less; balance sheet total of £500K or less). Service does not include Research and development claims or directors loans.

Premier Small Managed filing for small companies (two of the following: Turnover below £15m; 50 employees or less; balance sheet total of £7.5m or less). Service does not include Research and development claims or directors loans (CT600A).

How does it work?

A quick and simple Managed Filings service

We create your tax return and

Company Accounts

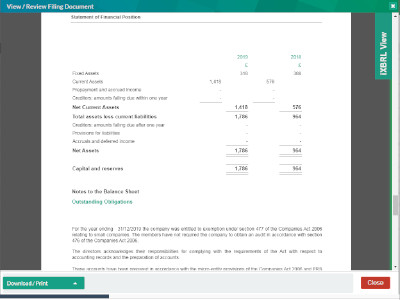

We create IXBRL accounts and your Company Tax return.

We Submit to HMRC &

Companies House

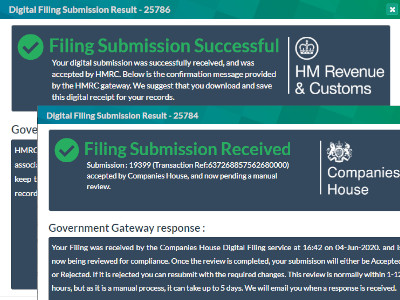

Once Successful you get HMRC Digital Receipt, and all filing documents.

Don't need our Managed Filings Service?

That's ok use our knowledge base to do them yourself

How To file a CT600 online

Step by Step guide for how to make a Corporation CT600 Tax Filing.

Extended year Company tax filing

Where your accounting period is greater than 12 months.