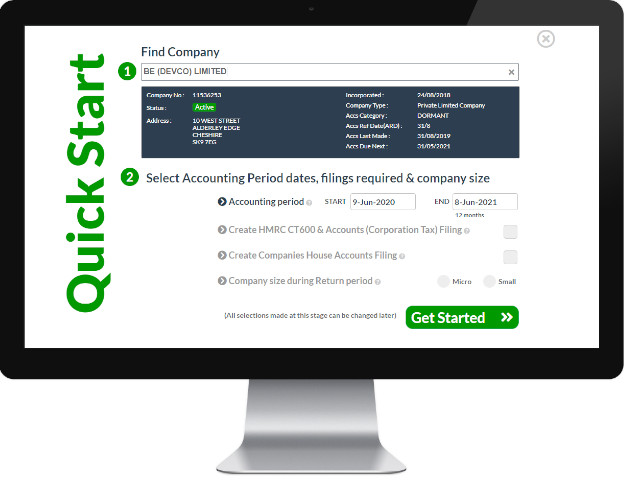

Step 1: Find Company to file for

Our easy to use cloud-based software means there is no software to install, you simply register and logon on and get started*.

First search for the limited Company you are making a corporation tax return for by using the Quick Start feature, search either by Company Name or Company Number.

Select which filings you require: either CT600 or iXBRL accounts or both - most companies require both.

Select whether your Company is a micro or small entity.

*You will need to registered with HMRC, if you are not already, to get a user name and password along with your company UTR

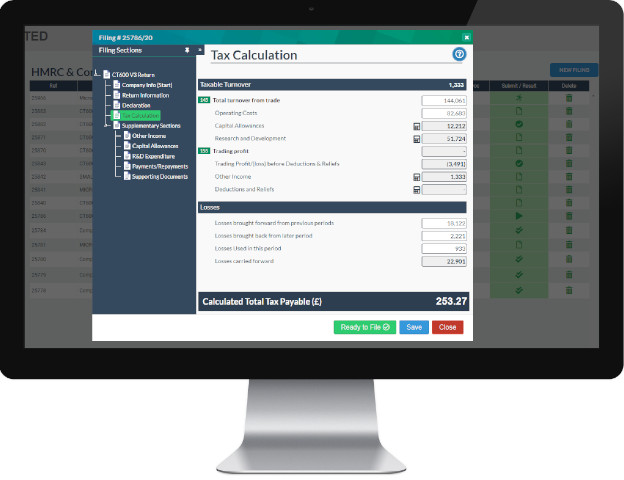

Step 2: Enter Turnover and expenses

Use our templates to complete your CT600 and iXBRL accounts. Our step by step process walks you through the different screens to help you fill in information about income, turnover, capital allowances, research and development and deductions and reliefs.

Our calculation engine, takes in all your CT600 return data and gives you a realtime corporation tax calculation.

If you are also creating iXBRL accounts, our user friendly templates will lead you through this process.

CT600 includes all sections including research and development/R&D tax credit, other income, property income, chargeable gains, capital allowances, losses and loans to participants.

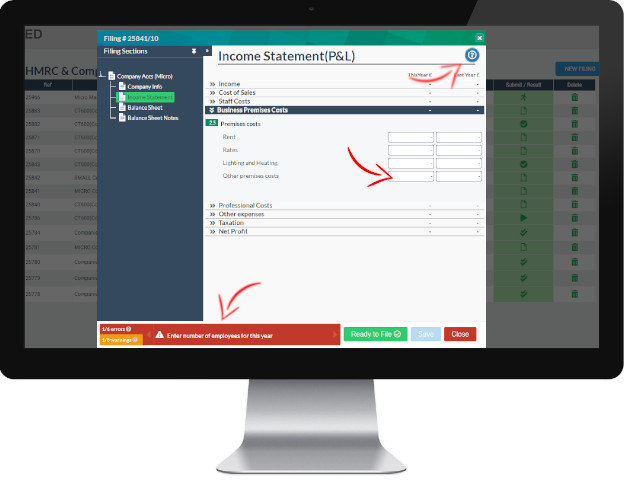

Step 3: Complete IXBRL accounts Template

Review your data, our inbuilt validator checks your information as you input your accounting data, to ensure your information is compliant with HMRC CT600 and accounts production rules.

Click on any errors to be directed to the area where any issues need to be addressed.

Review any warnings and either accept or amend your entries.

Our online help will give you extra information and point you to useful resources to help you along the way.

If you require extra help, contact us through our online messaging system.

Step 4: Review CT600 Computations and IXBRL Accounts

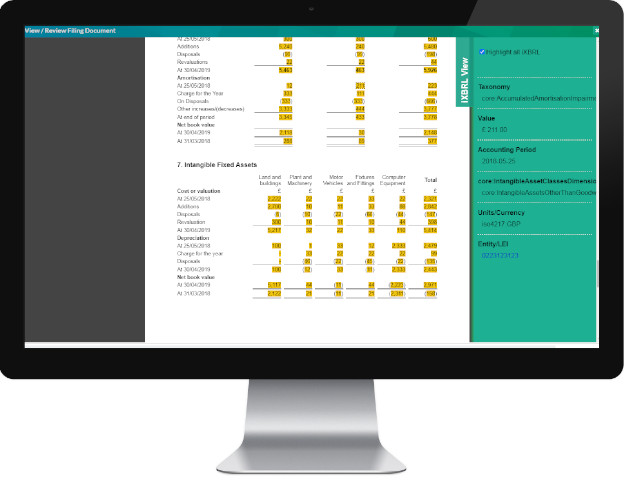

You are nearly there, now is the time to review your CT600 Corporation tax inputs. Click Ready to File and your accounts are instantly converted to iXBRL. No waiting!

Check through your accounts and click on our iXBRL viewer to see which of your fields are tagged.

Review your CT600, where your data is displayed in the CT600 form and in the associated iXBRL tagged computations.

Once you are happy with all your information, it's time to move on to submission.

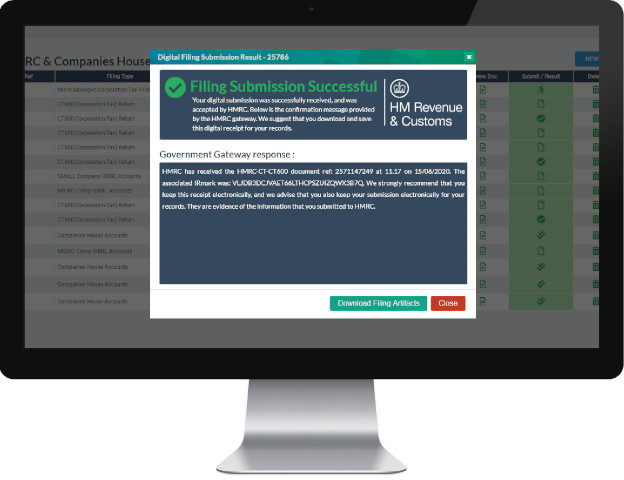

Step 5: Submit CT600 to HMRC

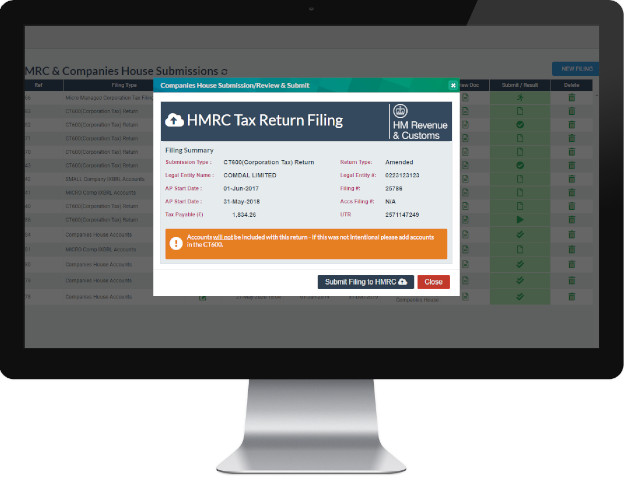

Now your CT600, tax computations and iXBRL accounts are ready to submit to HMRC.

If you have any supporting documentation, simply drag and drop to accompany your submission.

Click submit and we do the rest, your CT600, tax computations and accounts are sent directly to HMRC.

Step 6: Corporation Tax submission Done!

Once you have successfully submitted your return, download your CT600, tax calculation computations and accounts for your records. Your submission is complete!